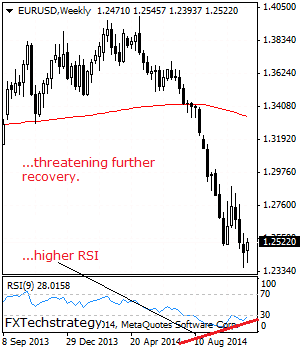

EURUSD: With EUR halting its decline and turning higher at the end of the week, further strength is envisaged in the new. However, EUR will have to break and hold below the 1.2393 level to resume its weakness. On the other hand, support lies at the 1.2300 level where a break will expose the 1.2250 level. Below here will pave the way for a move lower towards the 1.2200 level. On the upside, resistance lies at the 1.2600 level where a break will aim at the 1.2650 level, its psycho level followed by the 1.2700 level. Further out, resistance comes in at the 1.2750 level. All in all, EUR remains biased to the downside in the medium term.

USDCHF: Closes Lower On Corrective Pullback.

USDCHF: Having triggered a corrective weakness the past week, further downside is likely in the new week. On the upside, resistance resides at the 0.9700 level where a break will aim at the 0.9750 level. Further out, resistance resides at the 0.9800 level. A breather may occur here and turn the pair lower. On the downside, support lies at the 0.9550 level with a break targeting the 0.9500 level and then the 0.9450 level. Further down, support comes in at the 0.9400 level. All in all, the pair remains biased to the downside on correction.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.