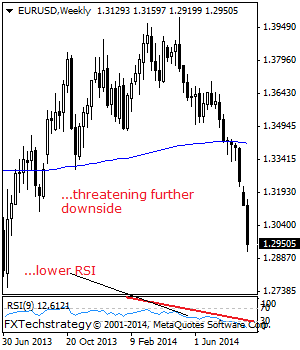

EURUSD - With a sharp sell off occurring the past week, further bearishness is envisaged. We may see corrective recovery in the new week. Support lies at the 1.2900 level where a break will expose the 1.2850 level. Below here will pave the way for a move lower towards the 1.2800 level. If this continues, expect further downside to occur towards the 1.2750 level. On the upside, resistance lies at the 1.3000 level where a break will aim at the 1.3050 level, its psycho level followed by the 1.3100 level. Further out, resistance comes in at the 1.3150 level. All in all, EUR remains biased to the downside in the medium term.

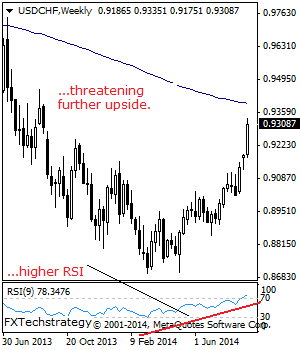

USDCHF: Rallies, Set To Extend Strength

USDCHF - With a sharp rally seeing USDCHF closing higher the past week, further bullishness is envisaged in the new week. On the upside, resistance resides at the 0.9350 level where a break will aim at the 0.9400 level. Further out, resistance comes in at the 0.9450 level. A breather may occur here and turn the pair lower but if taken out the 0.9500 level will be aimed at. On the downside, support lies at the 0.9250 level with a break targeting the 0.9200 level and then the 0.9150 level. Further down, support comes in at the 0.9100 level. A cut through here will target the 0.9050 level. All in all, the pair remains biased to the upside in the medium term.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.