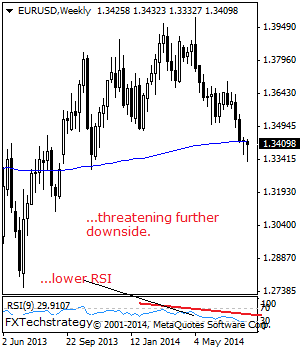

EURUSD: With EUR closing marginally lower with a rejection candle the past week, further corrective recovery is likely in the days ahead. On the upside, resistance lies at the 13450 level where a break will aim at the 1.3500 level, its psycho level followed by the 1.3550 level. Further out, resistance comes in at the 1.3600 level followed by the 1.3650 level. Support lies at the 1.3366 level where a break will expose the 1.3300 level. Below here will pave the way for a move lower towards the 1.3250 level. If this continues, expect further downside to occur towards the 1.3200 level. Its weekly RSI is bearish and pointing lower supporting this view. All in all, EUR remains biased to the downside in the medium term.

USDCHF: Sets Up For Corrective Pullback

USDCHF: With USDCHF failing at the 0.9114 level and closing lower on a rejection candle formation, it faces downside risk in the new week. On the downside, support lies at the 0.9000 level with a break targeting the 0.8950 level. A cut through here will target the 0.8950 level where a violation will open the door for more weakness towards the 0.8900 level and then the 0.8842 level. Its weekly RSI is bearish and pointing lower suggesting further downside. On the upside, resistance resides at the 0.9114 level where a break will aim at the 0.9150 level. Further out, resistance resides at the 0.9200 level. A breather may occur here and turn the pair lower. All in all, the pair remains biased to the downside on pullback risks

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.