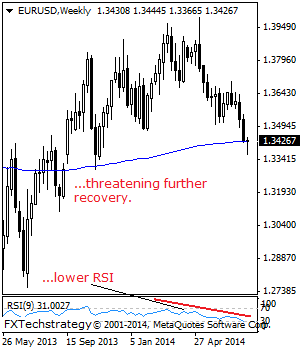

EURUSD: Prepares To Recover Higher.

EURUSD: With EUR halting its broader weakness to close flat the past week, it faces the risk of further recovery higher. If a follow-through higher on the back of its Friday gain occurs, further bullish offensive is likely in the new week. Support lies at the 1.3366 level where a break will expose the 1.3300 level. Below here will pave the way for a move lower towards the 1.3250 level. If this continues, expect further downside to occur towards the 1.3200 level. Its weekly RSI is bearish and pointing lower supporting this view. On the upside, resistance lies at the 1.3500 level, its psycho level followed by the 1.3550 level. Further out, resistance comes in at the 1.3600 level followed by the 1.3650 level. All in all, EUR remains biased to the downside in the medium term.

USDCHF: Further Pullback Risk Builds Up.

USDCHF: With corrective weakness triggered on the daily chart and a higher ,level rejection candle formed on the weekly chart, we expect price weakness in the days ahead. On the downside, support lies at the 0.9000 level with a break targeting the 0.8950 level. A cut through here will target the 0.8900 level where a violation will open the door for more weakness towards the 0.8842 level. On the upside, resistance resides at the 0.9100 level where a break will aim at the 0.9150 level. Further out, resistance resides at the 0.9200 level. A breather may occur here and turn the pair lower. All in all, the pair remains biased to the downside on pullback risks.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.