EUR/USD Technical analysis Dec 22nd - Dec 26th

EUR/USD started the week with relative bullish bias as a follow-up of the previous week. Despite making its first weekly higher high after four weeks, the market bias were changed thereafter the FOMC meeting minutes and the press conference on Wednesday. The pair made its weekly high on Tuesday at 1.2569 just on the 50 day SMA and closed the daily candle above its monthly pivot point but below the 50 day SMA. On Wednesday, the US FED chairwoman Jannet Yellen took on stage with increased monetary divergence signals hinting possible rate hikes in April 2015 putting the Euro under pressure.

Despite last week’s bearish push with the Russian economic crisis and increased monetary divergence signals, EUR/USD failed to break below its 1.22 psychological level, finding its weekly support 30 pips above the 1.2200 level.

On the daily chart, the price structure still remains lower peaks (if Tuesday’s high would be excluded) and lower troughs. Current rate remains below all three of our moving averages; 20, 50 and the 100-day moving averages, and once again back within boundaries of the bearish channel which has been almost intact for the last 10 weeks. The overall bearish price action can be concluded as intact with further bearish targets remaining towards 1.2100 support zone and the anticipated 1.2000 psychological barrier.

Expectations for the upcoming week (Dec 22nd - Dec 26th):

From smaller 4 hour time frame point of view, we can see further continuous bearish trend. All three of the SMAs are sloping down and 20SMA just crossed below the 100SMA indicating strengthening bearish bias.

On Daily time frame all three of our MAs are sloping downwards, RSI is pushing towards its 30 bullish territories, MACD still in its bearish zone.

Although, for the upcoming week strong volatility is not expected, as long as the rate stays below 1.2300 resistance level preferences are based on further bearish bias. Especially the final Q3 US GDP reading could potentially push furthermore bulls into the USD rally pushing EUR/USD towards 1.20 zone.

Resistance levels: 1.2370 (R1), 1.2300 (R2) 1.2469 (MPP) and 1. 2525 (R3)

Support levels: 1.2200 (S1), 1.2115 (S2) and 1.2020 (S3)

GBP/USD Technical analysis Dec 22nd - Dec 26th

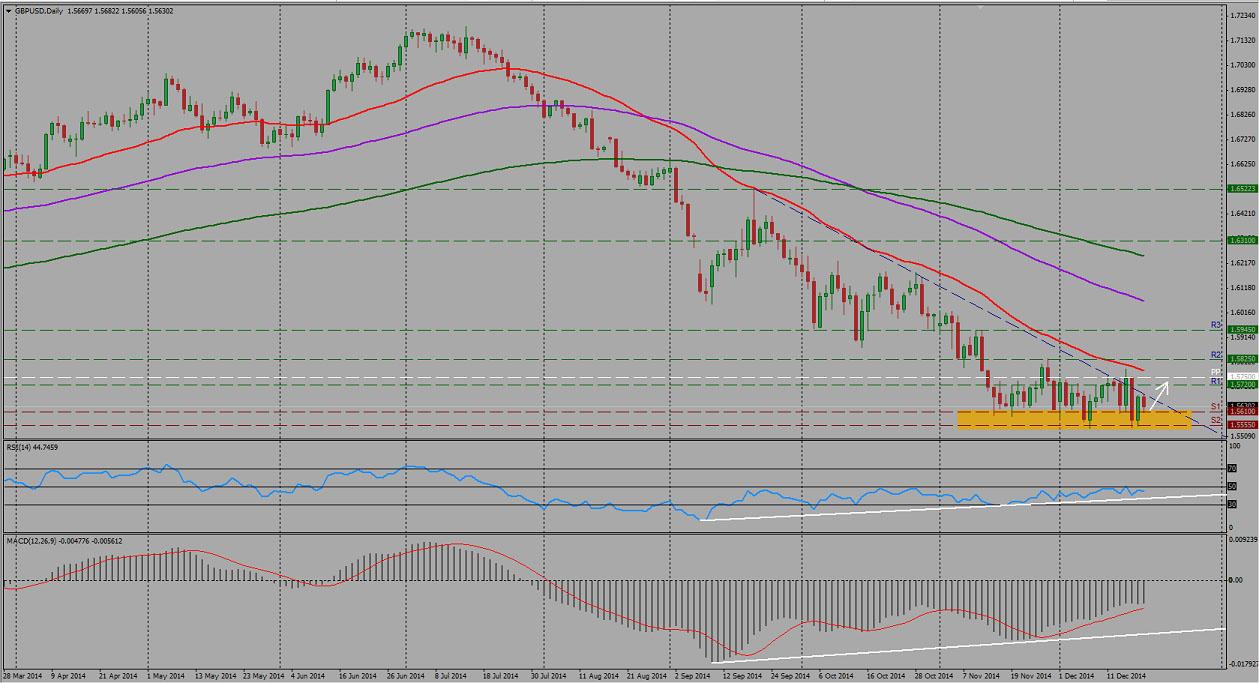

Despite making weekly higher high and higher low, GBP/USD could not sustain its bullishness last week bouncing off falling trend line.

The week started for the pair relatively neutral, on Tuesday we had the weekly high of 1.5786 and closed the daily candle above the falling trend line, however the bulls could not keep up the momentum for the following days. Just like in every other USD pair, GBP/USD trend was halted by the FOMC meeting minutes, pushing the pair off the monthly pivot point by 200 pips on Wednesday.

From relatively broader picture, we can conclude that the pair has been trading within a narrow channel, sideways between 1.5555 and 1.5775 levels for the last 5 weeks. Despite the previous week’s bullish attempt the price action development still stays as neutral with bearish preferences.

Expectations for the upcoming week (Dec 22nd - Dec 26th):

At the time of analysis the pair is trading just below its monthly pivot point of 1.5750 as well as its weekly trend line.

Both on 4 hour and daily time frames all three of our MAs are sloping downwards. Meanwhile both RSI and MACD on daily timeframe are indicating bullish divergence which is an indication of falling bearish momentum in the market.

Considering the falling momentum in bearish power and the festive period we could expect to see an upward correction wave towards 1.5880 zone before the bears take the power againsellers prevail again.

Resistance levels: 1.5720 (R1), 1.5750 (MPP), 1.5825(R2), and 1.5945(R3)

Support levels: 1.5610(S1), 1.5555(S2) and 1.5400 (S3)

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.