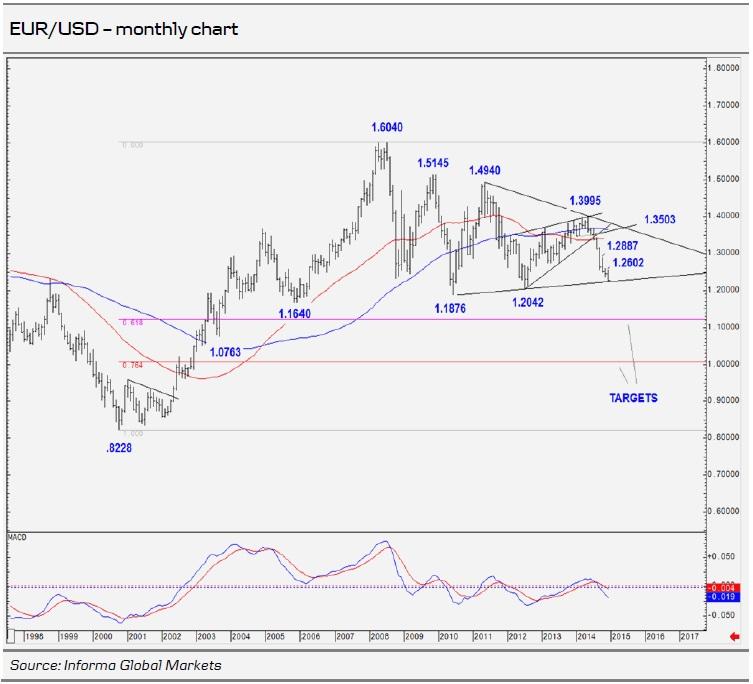

This week, we present one technical view: sub 1.2042 to confirm a complex top for 1.1212/1.0071.

EUR/USD – sub 1.2042 to confirm a complex top for 1.1212/1.0071

- Summary summary – technically, sub 1.2042 to confirm a complex top for 1.1212 and 1.0071. Resistance comes in at 1.2602/1.2887.

EUR/USD is pressuring critical support and the target region set earlier in the year, following the completion of a top area and major rising wedge.

MACD and Stochastic studies continue to point lower and a break under the 2012 low at 1.2042 would confirm a major multi-year complex top area. This signals/projects very significant downside over coming weeks and months. This also corresponds to projections we have made on the USD basket. Sub 1.2042 opens initial objectives/levels at 1.1876 and 1.1640. These mark the 2010 and 2005 lows. Further weakness is then anticipated to 1.1212, the 61.8% retracement level of the major .8228-1.6040 October 2000 to April 2008 cycle. The complex top area, however, indicates scope is likely, below here, towards the 76.4% retracement level at 1.0071.

To neutralise the current and immediate bear structure, recent lower ceilings at 1.2602 and 1.2887 must be reclaimed.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.