The first quarter of 2016 proved to be a very tough environment for hedge funds and professional traders.

A quite well known analyst was making the analogy that the first quarter’s trading regime, looked like a blind squirrel looking for a nut in the dark! It was very difficult to find a decent momentum trade and even if you did, it has been very difficult to ride that trend. Another Bloomberg article mentioned the“unprecedented uncertainty” that exists in the markets and the increasing confusion amongst investors.

Despite the current conditions, we should focus on the underlying fundamentals that are driving prices as this will assist usto uncover opportunities moving forward, in the financial markets.

Let’s go back at the beginning of the year and examine the behavior of major assets since then.

In January 2016, due to prospects of higher interest rates in the US, the economic crisis in China and Emerging Markets, as well as global growth concerns, global equities moved sharply lower, in some cases below -10% in a matter of days, while both the USD and the JPY were the top performers.

Fast forward 3 months and what do we notice now? Commodities, global equities, emerging markets, high yield bonds are all top performers while the UUP (the US Dollar Index ETF) is down -5.97%!

You can see that the change in rhetoric by the US FED around the end of January as they become much more accommodative, helped China and Emerging Markets avoid a catastrophe. In December 2015, the FED was very hawkish, suggesting that there are going to be probably 4 rate hikes in 2016. But after they witnessed the impact that such a decision would have in other economies, they changed their tune and have become much more “softer”, paying more attention to international conditions. Nowadays, we argue about two hikes in 2016 or one or even none at all! Hence the weakness in USD and the “dovish” language of the FED has helped commodities, EMs and global equities to rally from the bottom that was established in early February 2016.

But the important question in trading and investments is not only to understand what happened in the past but what happens next! Is the current regime likely to continue?

I don’t think so. I will explain the reason and also show you the opportunities and risks that lie ahead.

We are not at the same point on the business cycle that we used to be, when the central banks first decided to inject money in the economy and stimulate the environment. Quantitative Easing doesn’t work and hasn’t worked for any economy so far.

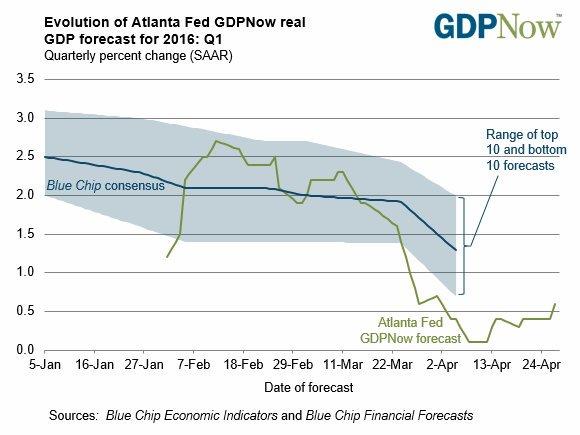

I have one simple question regarding the FED,“where is the growth?” They are trying to attract our attention to the only economic indicator that shows signs of improvement and that is unemployment but growth has been very anemic, as you can see below.

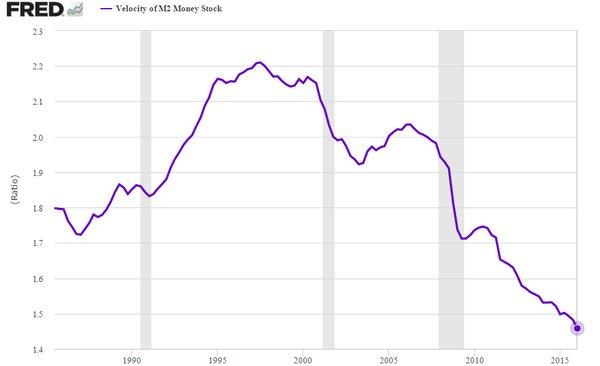

What disturbs and actually worries me is that the velocity of Money (M2) has reached a new low indicating that there is simply no growth in the economy.

Even the FED publicly acknoledges this situation both at home and abroad and has decided to be much more accomodative, they have lost credibility and it’s very doubtfull whether a new QE would help.

In this enviroment there also are other very significant catalysts that can heavily contribute to a major crisis. We are paying great attention to developments in these macro themes outlined below, as they have the capability to ignite the next big move. I am just going to list them below, without going into much details:

- Chinese debt situation – Corporate defaults

- Emerging Markets Economic Status

- Eurozone– Japan Deflation

- Globalgrowth concerns

- Commodities Crash

A simple reading of some of the world’s biggest financial media like Bloomberg or CNBC, will reveal to you how popular these themes are among investors and how significantly they affect sentiment in the markets.

Based on this outlook, let’s identify some high probability opportunities and risks that lie ahead for this coming week but also for the medium term.

YOU NEED TO HEDGE YOUR RISK or ANY EXPOSURE YOU MIGHT HAVE. Be very selective in your trades from now on, lock in some profits in your portfolio if you have any, cut your exposure or buy some insurance to protect your wealth in case of negative developments. In this environment my mentality is to preserve capital and be protected against any potential risk event.

Firstly, I have the impression that the“agreement” at the last G20 meeting that was taken among members, not to engage in a competitive devaluation currency war will not hold for long and it is possible that either Japan or China will fire the first “shots”.

The BoJ has been unsuccessfully trying to reflate the economy but they cannot succeed in their efforts, if the currency stays too strong. A very strong JPY is hurting their efforts and the more the Yen strengthens and moves in the 100-105 zone, the more changes we have for an intervention by the BoJ.

Take a look at the following chart that shows the performance of some major equity indices since the start of 2016.

As we explained before, due to the drop of theUSD and the accommodative FED, this helped Emerging Markets Assets and global equities but the last decision by the BoJ NOT to act has confused markets significantly and Nikkei is one of the worst performing indices, dropping sharply the last few days. Despite the negative interest rates by the BoJ, the JPY is outperforming other assets, followed by the Emerging Markets Index ETF.

In this environment I don’t want to be too exposed in riskier assets, as we could have important risk aversion themes dominating sentiment.

I have a small SHORT exposure to the FSTE100 as you can see on the market profile chart below:

I took a small short, risking no more than 0.5%of the total account, at 6321, as the buyers failed to hold the price higher and there were also important risk events going on.

On Friday the 29th of April, I alsoshorted the DAX, again risking no more than 0.5%, due to global developments, corporate earnings and negative sentiment. I took the short at 10228, as we were consolidating outside the Value Area, as indicated by the Profile charts:

My goal in these equity trades is to earn around 3-4 times my risk.

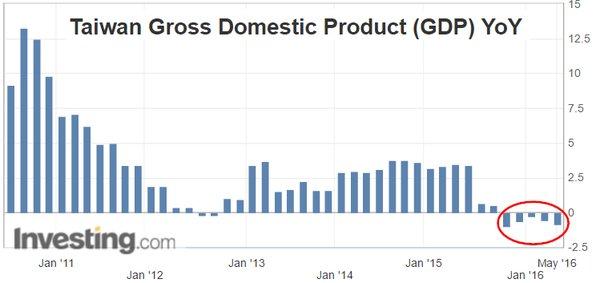

When it comes to the Forex markets, my focus ison Taiwan as their economy is shrinking. Please have a look at the GDP growth chart below.

Therefore, I am paying to attention to go long the USD against the TWD if we move above the trend line around 32.40 as indicated on the chart below.

Next, I am looking to potentially go long the USD against the Brazilian Real, if we form a base and find support around 3.2000.

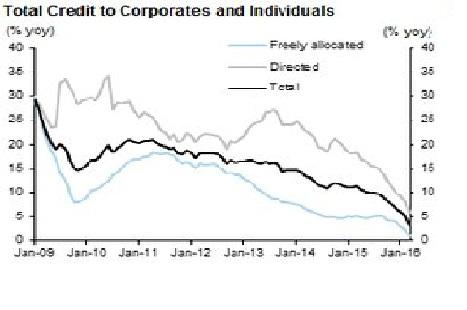

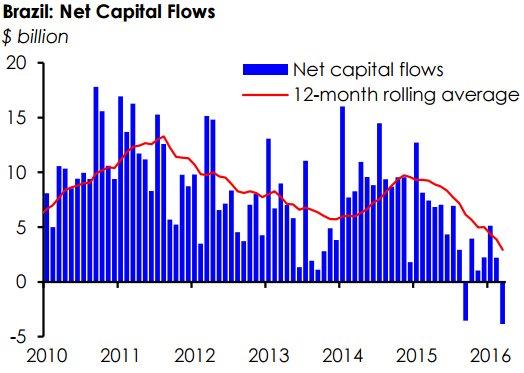

We acknowledge the USD is currently moving lower due to the softer FED but take a good look at Brazil’s economy. Credit conditions are getting worse and worse while there are even capital OUTFLOWS away from Brazil:

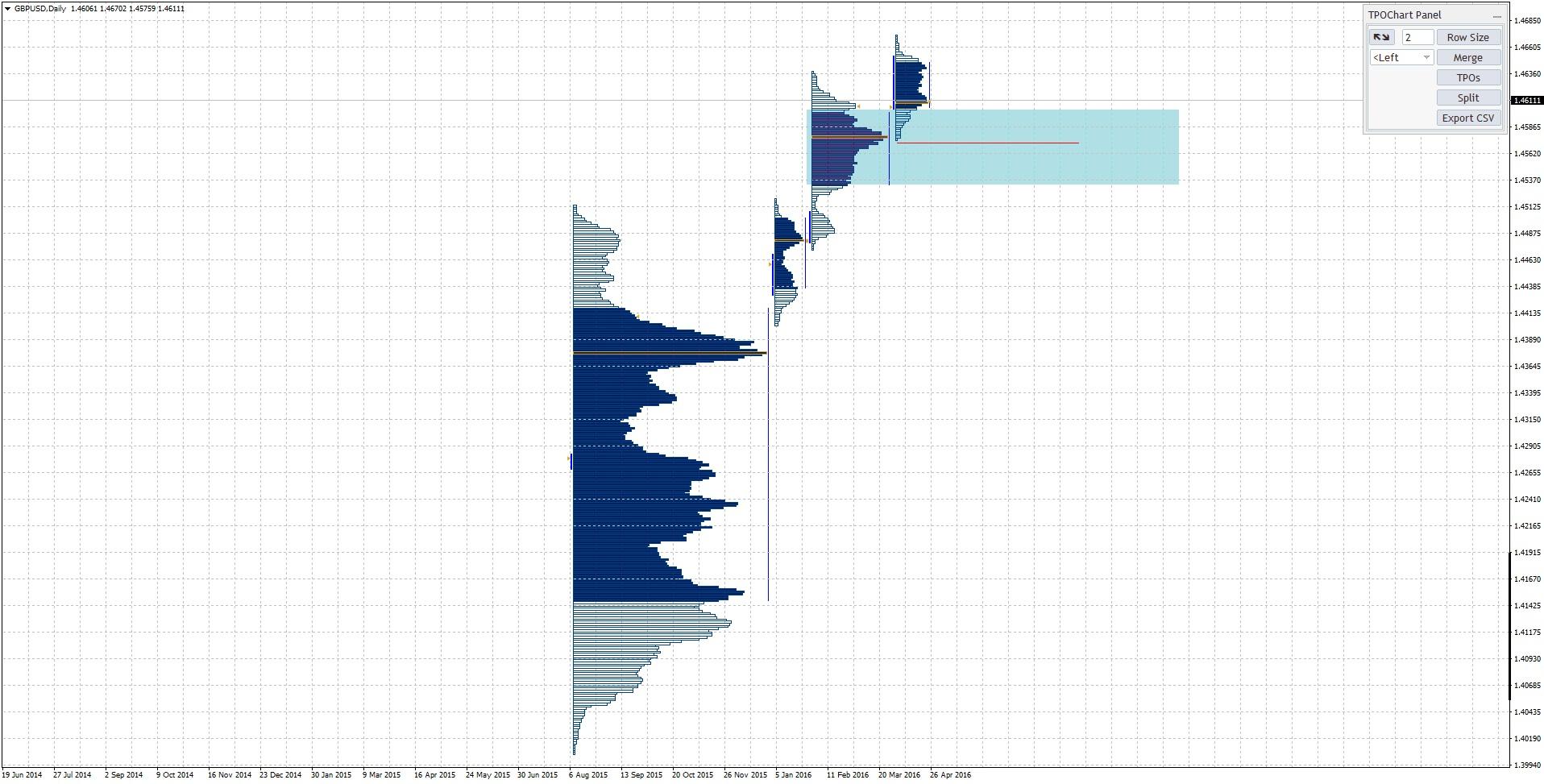

In Europe, ahead of June’s Brexit referendum I have GBPUSD on my watch list, for a potential move below the Value Area as indicated by the blue rectangle below:

I am also keeping an eye on GBPJPY, since we had a strong move lower and I am now looking for the formation of a smaller balance and continuation of the current trend. But there must be some further horizontal action and absorption of the buyers before we decide to pull the trigger on this trade.

Take also a look at the overall EmergingMarkets ETF:

You can see that technically, we have broken outside the large triangle to the downside, come back up, test previous lows that act as resistance. EM’s equities will probably struggle in this area.

I am also concerned about EM Bonds, as well as EM High Yield Bonds. Let’s take a look at the charts:

Due to the more dovish conditions, not only by the FED but from other central banks as well, yields in emerging markets have moved lower, allowing bond prices to move higher but we are now reaching an area that both technically and fundamentally cannot justify lower yields.

Given the weak global growth, strong deflation, emerging markets turmoil, credit conditions and other geopolitical factors, we need to pay great attention to the EM Bonds markets, as it is very likely that they will be the first casualties of a risk aversion theme.

In conclusion, in the medium to longer term we focus on the macro theme of lower yields in developed markets and potentially important macro catalysts coming from EM markets and China.

We hold positions in cash and in conservative bond portfolios aimed to preserve capital while we take small speculative positions, based on shorter term developments to enhance our performance. We have small, speculative positions in European equities, and potentially looking to go long USDBRL and USDTWD at the right time. We keep an eye on Commodities and we are looking for a potential top in Crude that will allow us to SELL EEM and EM Bonds.

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.