Another interesting week lies ahead of us and as we have heard in the press, these are times of “unprecedented uncertainty”, which require us to pay close attention to the current environment and clearly understand what is driving prices.

Among the major themes of interest this week, the FOMC policy is heading towards an interest rate hike in its December meeting which is an important catalyst for the USD to move higher. Concurrently the ECB is expected to extent its current QE program or introduce further accommodative measures in December thus, weakening the Euro. Japan’s inflation expectations have not changed, and in China, if the economic conditions further deteriorate, they may have to consider further stimulus of the economy, which in turn affects all global financial markets. It is inflation and interest rates that determines monetary policy and ultimately drives prices.

Every week, we take a fresh look at the current sentiment and also we identify which macro theme is gaining more attention by the market participants. Besides paying attention to economic developments and a change in fundamentals, we also keep an eye on potential “black swan” events, which are difficult to predict and estimate the full impact they might have in the markets. For example, while we can estimate the impact of the rising USD in commodity prices, because of the FED’s policy, and in particular in Crude oil prices there are other events that can completely change the outlook and the direction of prices. For example, a cut in production to support prices, an unforeseen geopolitical event or even the deficit in the Saudi’s Arabia balance sheets, can combine together to present a serious event. We also have the US presidential elections looming and a migrant crisis in Europe that some think could even lead to the collapse of theEurozone as we know it. All these issues contain the potential to cause powerful impacts that is difficult to predict this is why we must pay attention to the news flow and how that impacts and changes the fundamentals.

This week specifically we are focused once again on the divergent, monetary policies of the ECB andthe FED and whilst we note the strong divergence between them, we have to remember that the Chinese economic situation is very relevant, as we do not know how they will react to the decisions made by the two major central banks and that will factor greatly in market sentiment.

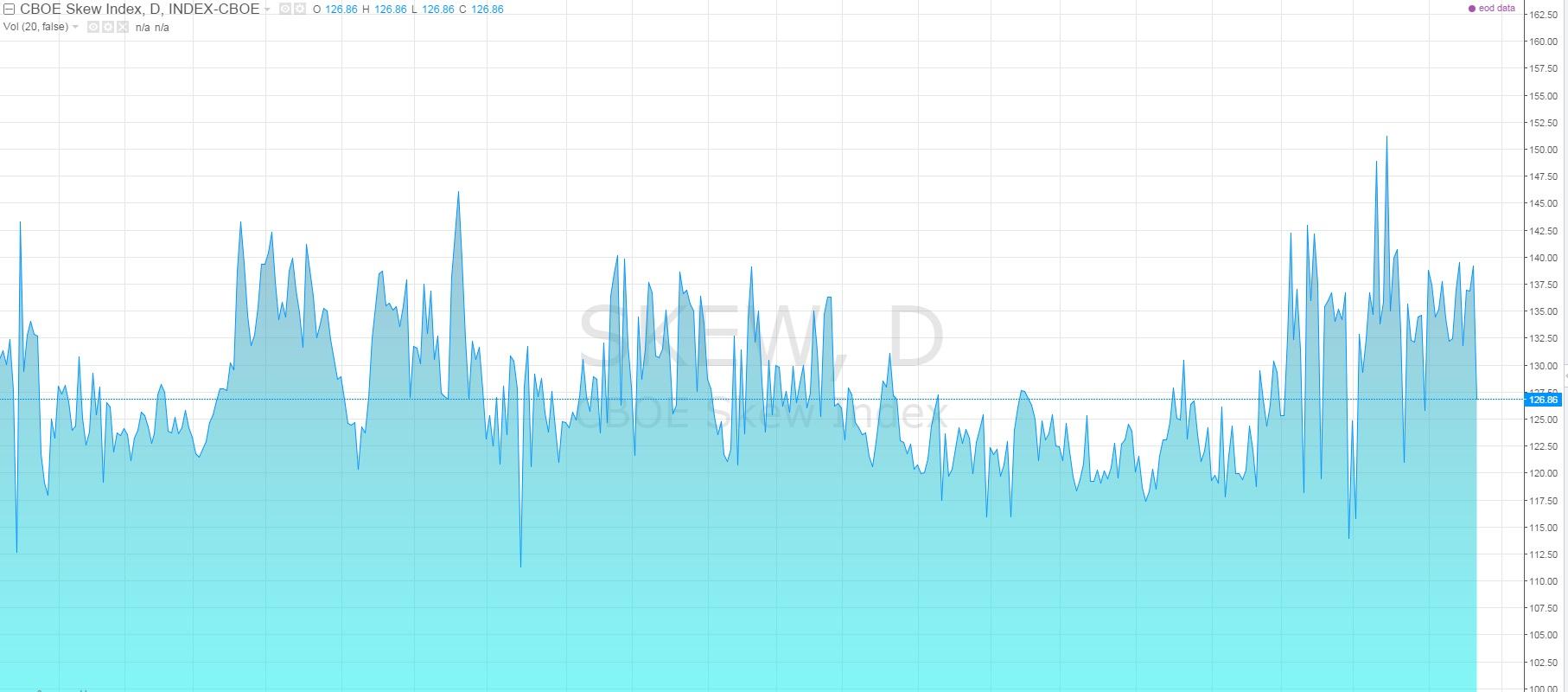

As we approach the end of the year there are indications that the environment could become more unstable and one of the charts that we should pay attention to is the CBOE’s SKEW Index.

This is a volatility index based on the SP 500 equity index that measures “outlier” risks, otherwise known as “tail risk” and it shows the price of SP500 tail risk based on out-of-the-money SP500 options. The tail risk is defined as the risk of outlier returns, two of more standard deviations away from the mean. The index records readings between 100 and 150, where 100 is normal distribution and moves higher towards 150 indicate the probability is increasing for an outlier event.

This is the SKEW index chart from last week.

The reason for the elevate dmoves up recently are due to the uncertainty in the market about monetar ypolicy, which makes prediction difficult. The strength of the USD is currently dictated by FED’s policy and the future pace of the hiking cycle. Last week’s FOMC minutes revealed the intention to raise but in the same document there was mention of accommodation should global events justify it. These are contradictory statements and little wonder uncertainty is increasing.

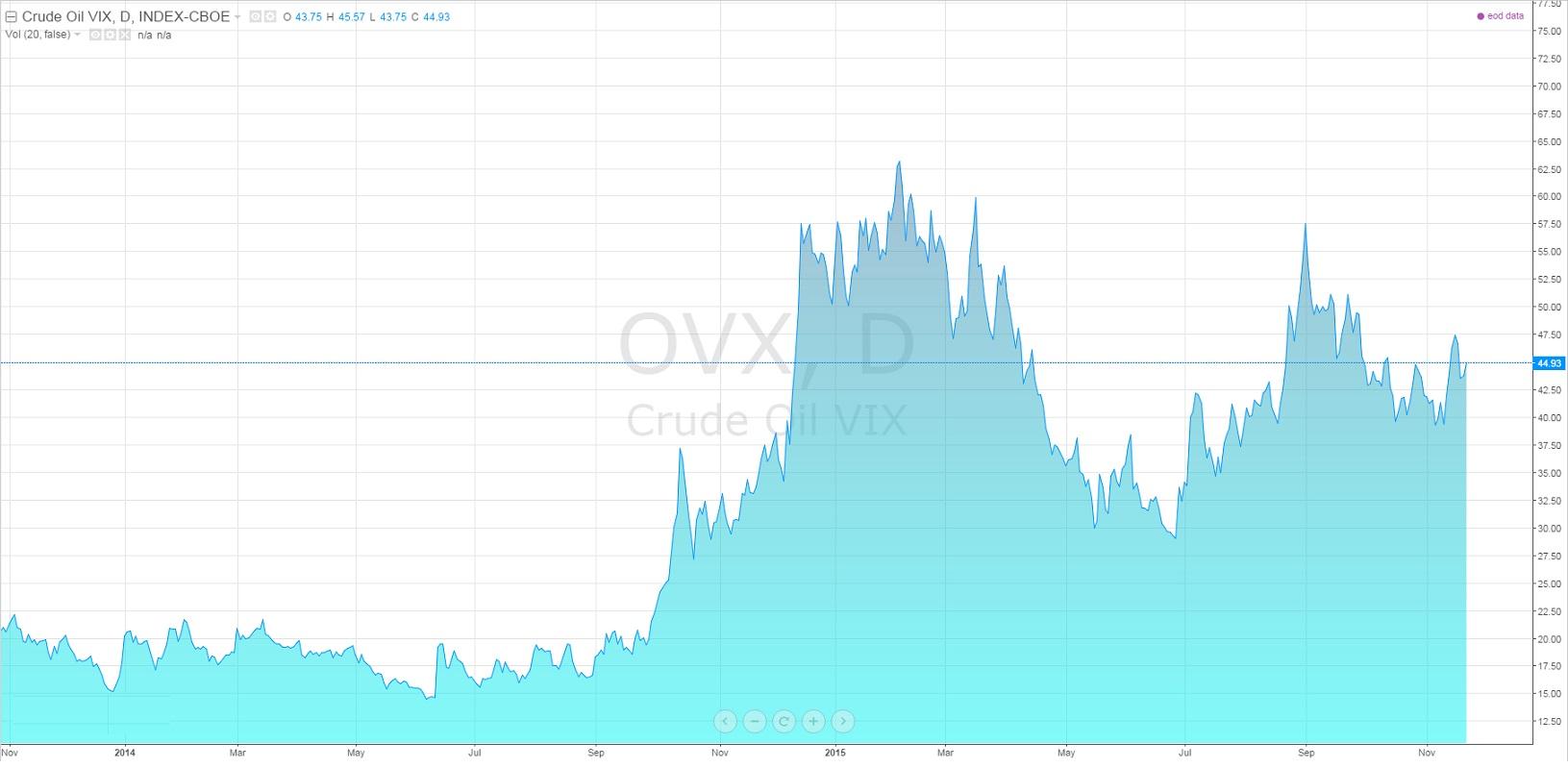

Crude Oil VIX

Another chart showing volatility increasing in crude oil. Last year both monetary policy and strong trends kept the volatility low but that moved higher as the Fed started to discuss major policy changes.

Equities VIX

Volatility has calmed since last week following the mention of accommodation by the FOMC and the prospectof a very “gradual” pace in the hikes.

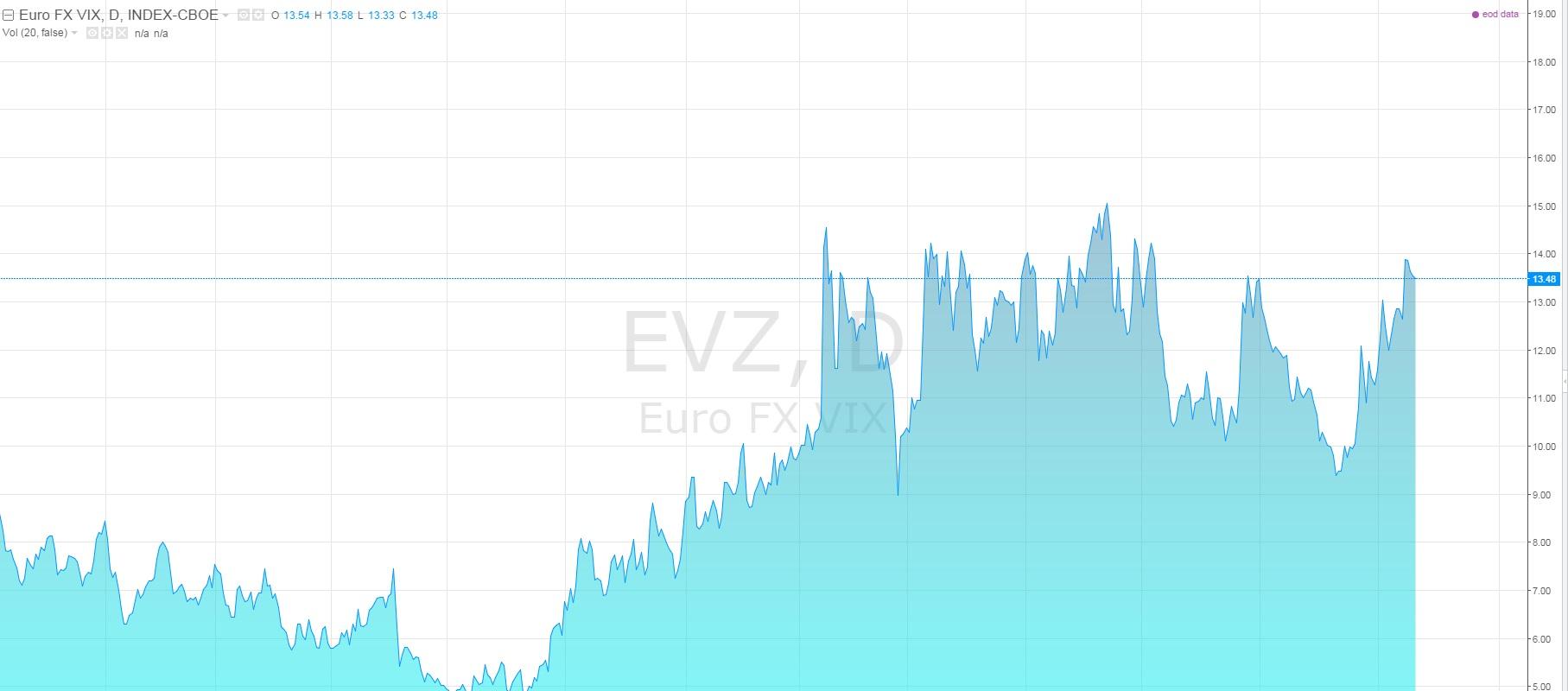

EURO FX Volatility

Volatility here has moved to its highs again due to the prevailing uncertainty not only about inflation expectations and monetary policies but also Chinese issues and world politics. It is not all just about the FED. Sentiment shows itself to be nervous in this environment and there is great concern over the future. We are unable to predict what the two major central banks will do or how China will deal with it. As stated earlier this is indeed unprecedented uncertainty.

Our research demands usto be specific so the following charts can be used to understand the current environment and identify the current regime we are in.

EEM-FXI

EEM is an emerging market's equity index and we like to pay attention as emerging markets are expected to suffer due to higher USD prices and a drop in commodities. Is a significant down move and collapse of fundamentals in these markets going to scare off the FED and make them more “gentle” with the hiking? The mere mention of the word ‘accommodation’ by the FOMC caused this index to rise as did the FXI.

The FXI is a Chinese Equity Index ETF. They are both, however in a down trend and with resistance now overhead. Any particular hawkishness by the FED will cause weakness, so this should be monitored to see if the correction continues. These markets are particularly correlated with the USD, so it is useful to pay attention so we can understand what is currently driving prices and what the current regime is.

MSWORLD (EXCL US)

If we pay attention atthis Global equity markets index excluding the US, we can see we currently have a bearish outlook as we have a series of lower highs and lower lows. It is useful to pay attention to intermarket relationships as this will help us understand whether we are in a risk-on or risk-off regime.

CEW

CEW is an emerging market’s currency fund and is currently moving a bit higher but this seems to be a corrective move within a bigger down trend. This index assists us in measuring the strength and sentiment of the USD against emerging market’scurrencies.

Specific Markets and Opportunities

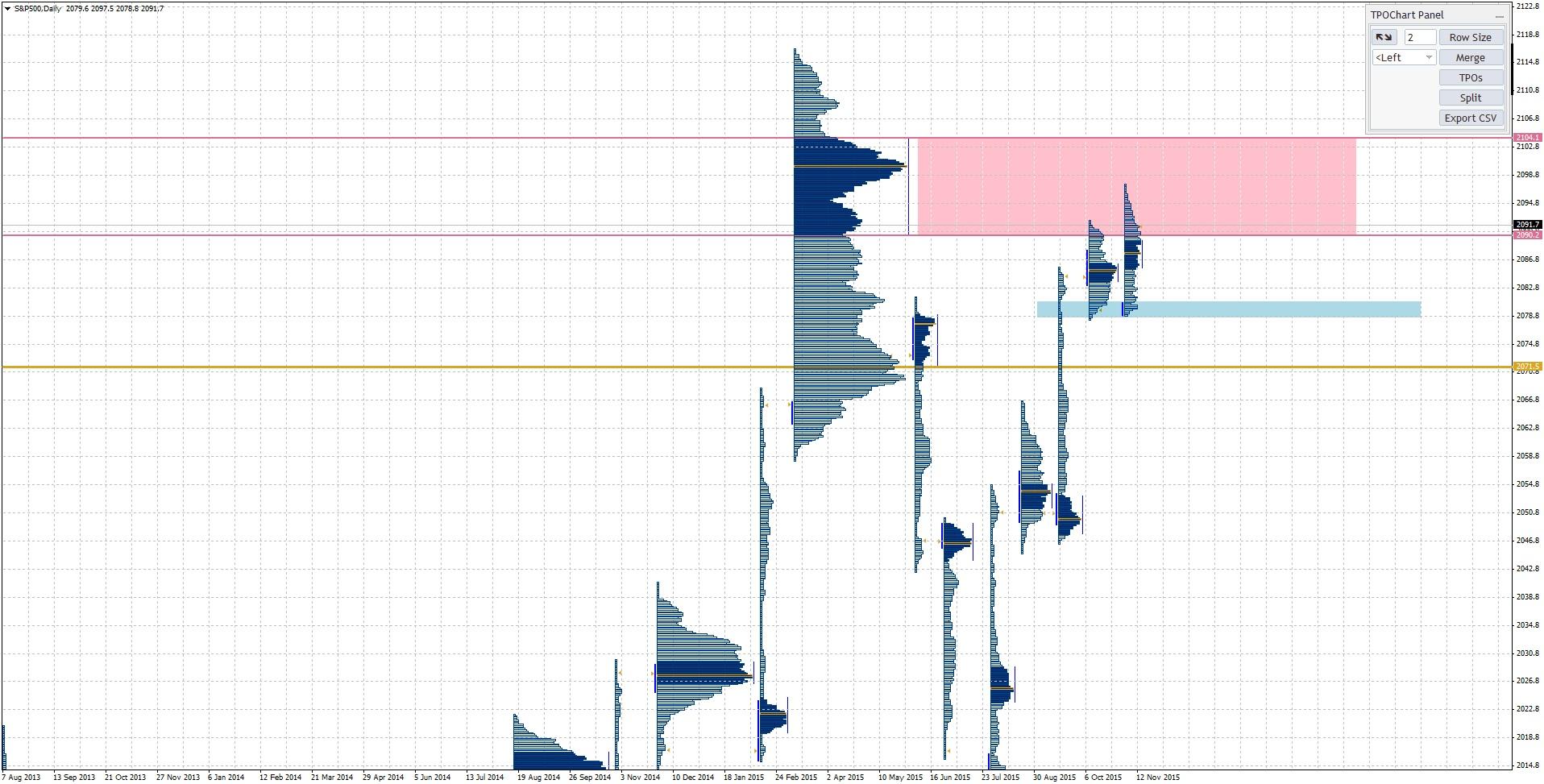

SP500

The index moved higherlast week, whilst strong, does have significant resistance above. Higher US rates may bring the end of the rally. The market remains balanced in auction market theory terms, so we will be looking to sell near resistance at the highs or if we are more conservative to wait for a break lower outside the current range. It is not wise to guess where the market is going, the best approach isto identify the optimum risk reward potential.

On the market profile chart we clearly see the Value Area where the volumes are concentrated, using a 30day value setting. The best place to do business is at the highs of this value area or a clean break of the 2070 support. The lack of trend is an indication that neither buyers nor sellers are in control and it maybe that the break out from the present balance and determination of direction will occur with the upcoming OPEC meeting in Vienna, the Fed and the ECB decisions in December.

DAX

Markets are expecting further easing from Mr. Draghi and that is driving European equities higher. This scenario could become invalid by a potential crisis in China and emerging markets so as always we need to understand the inter-market relationships to assess the risk-on, risk-off environment.

++20_11_2015_20151123132001.jpg)

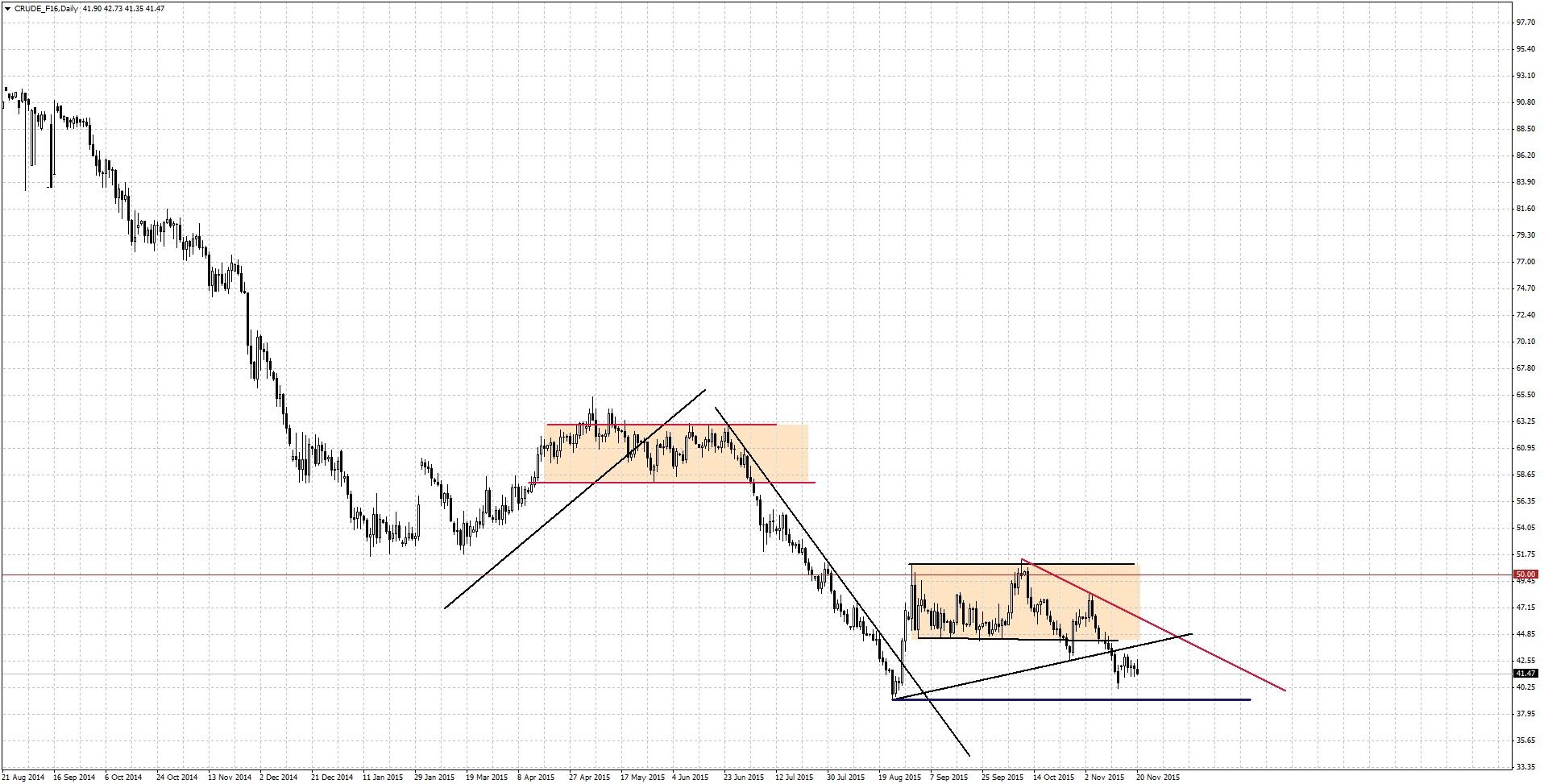

CrudeOil

In balance in a traditional tri-angle pattern and could test the lows. This obviously can be changed by the OPEC meeting which could cause a sharp move in either direction.There is a possibility that Saudi Arabia will have a change of mind because of the big pressure in their balance sheets and Bank of America actually has described any potential actions by the Saudi government as their number 1 black swan event for 2016, so please pay attention for any developments regarding this story.

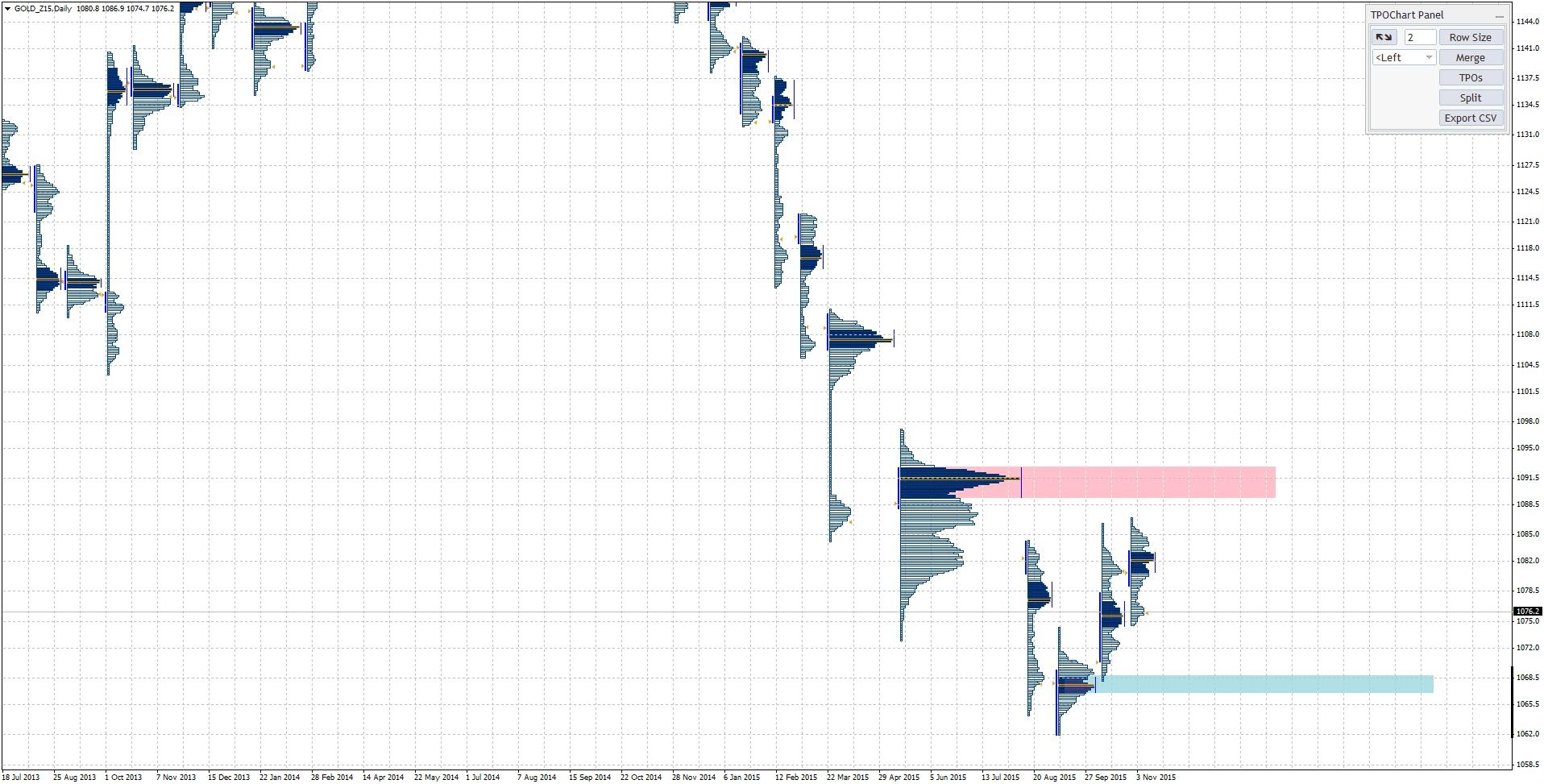

Gold

Shown here on a market profile chart. A positive change in US core inflation could bring a move higher. But we will be looking to buy above the 1094 high volume node.

GDX

A mining index at all-time lows, but the pattern shows there are some buyers. If inflation indeed rises in the US this can become a high probability trade.

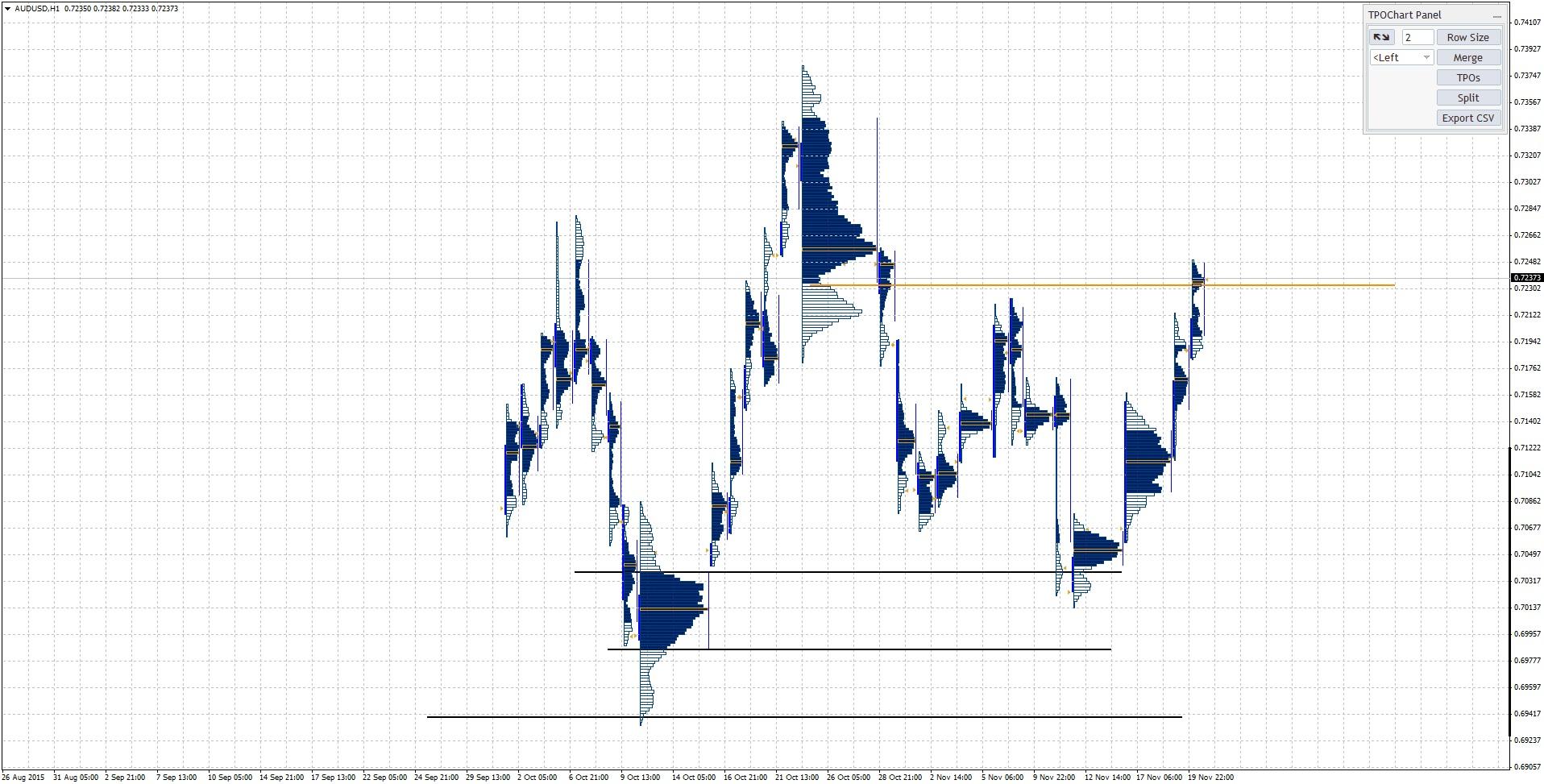

AUDUSD

This is a big balance with three higher highs and a small uptrend within the balance. If commodities improve this could be a buy in the right areas. The US rates will impact this and may cause choppiness which will mean we have no edge. We need to see it stay above the red line on the chart with targets to the trend line.

The market profile shows where we can do business and the support at the bottom of the value area which we can monitor. A potential change in direction in Crude, can also cause the AUD to move higher. The timing is not yet perfect but it is on the watchlist with an eye on commodities to see if they can rise.

EURAUD

ECB expectations of further QE and accommodation are pushing this currency lower. A weakening of commodities will work against this so again essential to watch them. We are looking for a close below the trend line and acceptance there which can lead to the bottom of the pattern.

EURNZD

We have similar reason sas the EURAUD above to believe that the EURNZD will move lower. We are looking for a move outside the range to the downside.

GBPAUD

This pattern is not mature yet, we will have to be a little more patient but a breakout outside the range can provide a good opportunity. This pattern can provide a significant move.

Looking at the economic calendar, it will be important to pay attention this week to the US PCE core data and Oil inventories on Wednesday. USE PCE Core is the most favorite measure of inflation for the FED and it can add or remove strength to the various scenarios about the future monetary policy. A weak reading could mean amore dovish policy, a more gradual path for interest rates while, a stronger reading could reaffirm the even stronger dollar scenario, with more hikes in 2016.

In this uncertain environment our approach should be a conservative one but we look forward to the possibility of some bigger moves and the formation of new and potentially strong trends after the three big meeting that December will bring.

Thank you!

Fotis Papatheofanous, MBA.

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.