Understanding the major catalysts that are driving prices, is the first step in assessing market conditions, at the beginning of each trading week. This week we are looking again at the three main catalysts that are moving prices in the current period:

i) the situation in China and in particular the data released early Monday morning,

ii) the ECB later this week and

iii) the potential US tightening cycle is currently on hold but the speculation about the start of the tightening still continues.

During the summer period, speculation surrounding the US rate hike was the major theme affecting sentiment but, as we moved on concerns about the Chinese economy were developing and the markets began to consider the possibility of the return of strong deflationary trends globally or, whether we were simply looking at a small correction within the bigger economic cycles.

The consequences of these two very different outcomes affect all the inter-connected major asset classes such as, equities, oil, bonds and commodities.

The reality of the effect that the Chinese economy has on commodities and in turn how this impacts future inflationary trends around the globe cannot be underestimated, so little surprise that the market attention was focused firmly on the release of the Chinese GDP today and Industrial production as the trading week commenced.

GDP in fact recorded a slight improvement but the Industrial Production was significantly below its expected number with serious implications for the deflationary cycle. Later today, the RBA will release the minutes from their meetings and their opinion is of obvious importance, in assessing the likelihood of further easing from them in their November meeting.

The calendar this week contains also other critical events. GDT prices in New Zealand will throw some light on their economy and a major focal point on Wednesday will be the Bank of Canada. With their rate announcement and the tone and language of their statement, the market, whilst expecting rates to hold will be looking for clues as to how they perceive their future policy requirements, and whether current global circumstances require further accommodation.

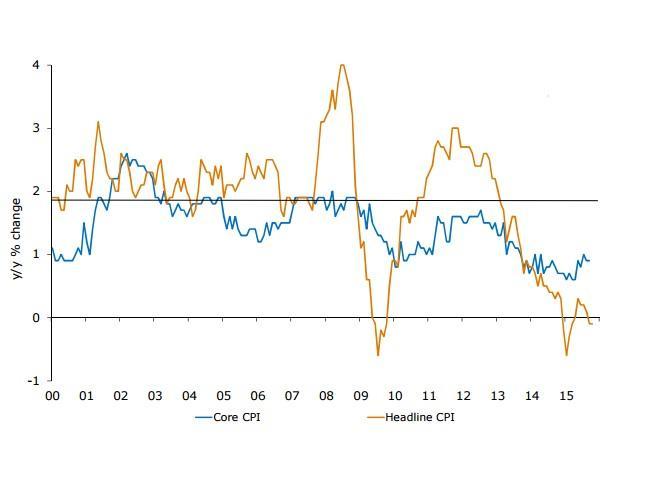

The all-important CPI and core CPI are also in the calendar for Canada on Friday.

The ECB rate and statement on Thursday could well be the event of the week. ECB member Nowotny, expressed a view last week that inflation targets had been missed perhaps warranting further QE measures but,later corrected his statement somewhat by suggesting that it may be too early as yet to execute any changes. It is certainly a move that the market is looking for and thus any clues, comments or tone from Draghi later this week will have its effect on sentiment.

Here again we look to see the view of the ECB as to their perception of the future path of monetary policy. Of course if Mr. Draghi remains silent the Euro will benefit. It should also be remembered that the following day, Friday, will bring the PMI numbers from the Eurozone’s two major countries, Germany and France with all that implies in the issue of future inflation.

Fundamental analysis of this nature will is vital in assessment s of probable impacts on sentiment and what to expect going forward.

Global Macro Developments;

Global Macro, is not just theoretical and understanding it in terms of forward projections is essential for under standing probabilities.Bloomberg last week highlighted the emerging markets’ economic situation and the recent wave of debt trimming. The carry trade has been popular since accommodative policy began, the borrowing of USD to invest in higher yielding currencies but in the current climate this has led to the inevitable unwinding. As expectations developed for the US to begin the rate hike cycle, many of these emerging economies will struggle to make payments.

Examples include corporations in South East Asia paying 3 billion more than they borrowed because of the USD appreciation. Economies can be destroyed in circumstances such as these!

This week specifically sees the Chinese state-owned steel company, Sino steel, in such a predicament, faced with honoring bond holder’s options to the tune of 350 million USD. They are expected to be able to meet their obligations but this is potentially a recurring problem a few months down the line. If the money cannot be found we could easily see a black swan event developing.

So this week we have seen an improvement in the Chinese GDP but the miss in Industrial Output is a problem which reveals a weakness deep in the Chinese economy and it will be a crucial factor in determining future sentiment. If demand drops for materials such as steel, the decline in commodities will follow.

How to Understand Events and Shifts in Sentiment:

The following charts should be monitored this week;CEW

An emerging market’s currencies fund. Too early to say if there was a trend change here. The softer tone from the US triggered the move and now we have to watch for a continuation or reversal.Images courtesy of Stockcharts

$MS WORLD

This was corrected from a major down trend and there were no breaks of the highs and the down trend remains intact. The effect of China is significant and can indicate the move back to risk-off.

EEM and FXI

As we moved into risk-on the emerging markets moved ahead modestly. In the FXI index , specifically China, the same advance was seen but with no trend change. We now have to observe how the Industrial production data will affect these.

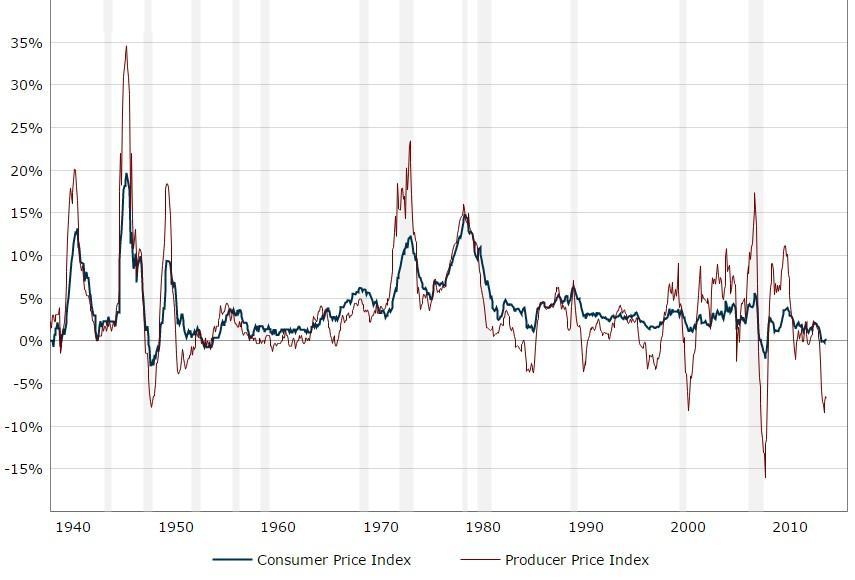

As to Economic indicators, we saw another improvement last week in the US Labor market but the problem there is the lack of traction on inflation. There is no inflation. The chart following shows CPI and PPI close to zero.

Image courtesy of Bloomberg

Simply put, the Fed are unable to touch rates while the Chinese economy is struggling and now that, we are aware that sentiment is vulnerable FOMC needs an improvement in international sentiment before considering any commencement of the tightening policy.

The same issue exists as we have seen in the Eurozone where headline inflation is below zero. Despite the vast amounts of money thrown into the economy there is still no inflation. We await Mr.Draghi.

The Opportunities

Last week we recommended selling Euro weakness and some profits were made. This week, with important data coming out of China and markets concerned with the decisions taken at Central Banks, we have to stay aware of the impact on sentiment and on commodities. Copper tested the top of its balance and is breaking the trend line to the downside, which of course is a negative for sentiment and may well lead us to a risk off environment later.

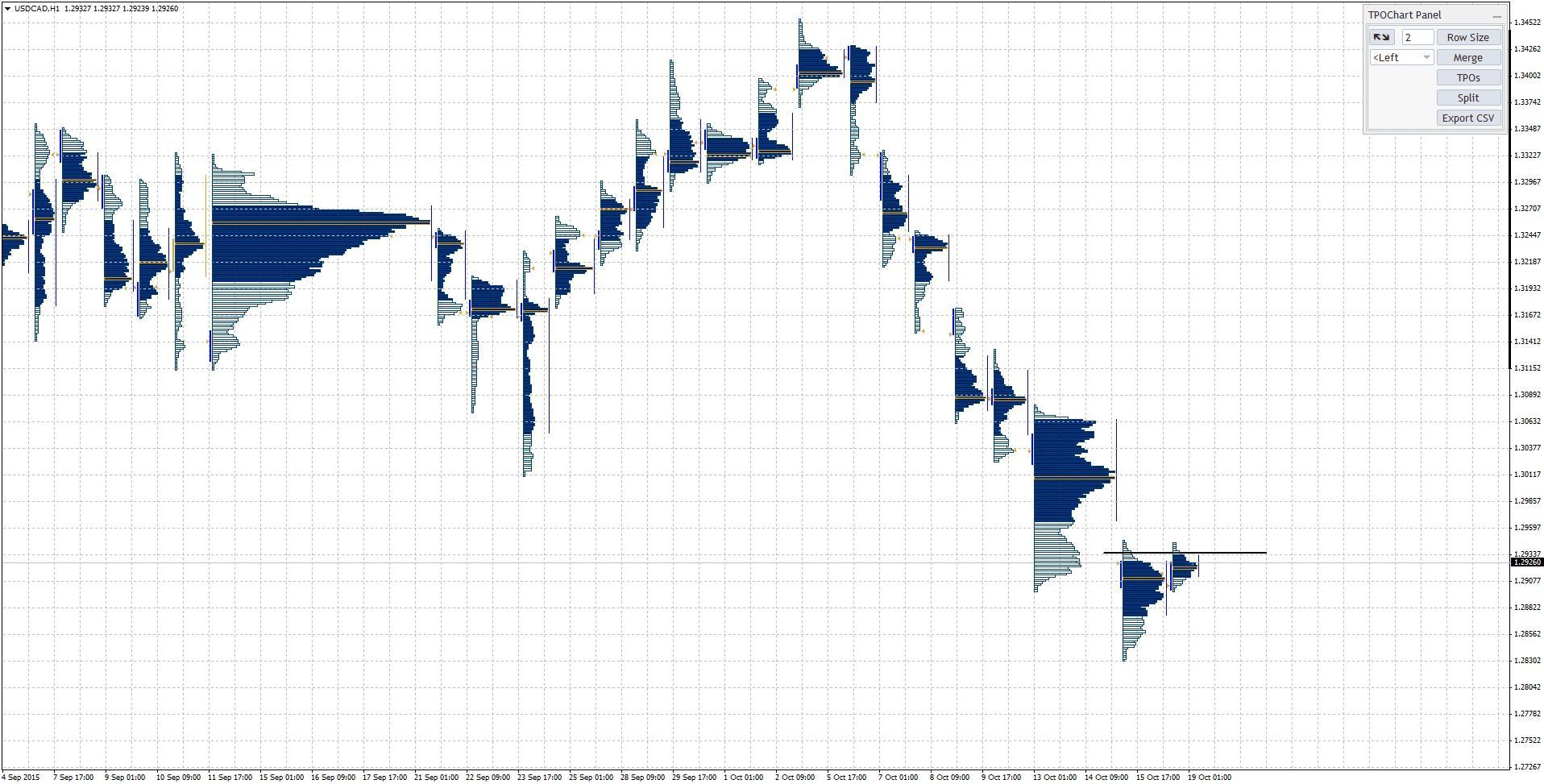

This week we favor going long the USD CAD above 1.2950 as we anticipate a more accommodative rhetoric from the BoC. Also the fact that Copper and Crude are moving lower due to the poor industrial output from China is not helping the CAD either.

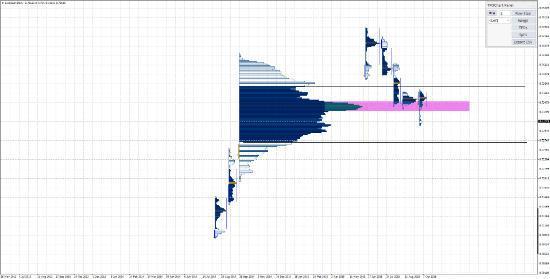

If you also look at the market profile chart, we are ready to break the Value Area High to the upside and test the High Volume Node of the larger balance higher.

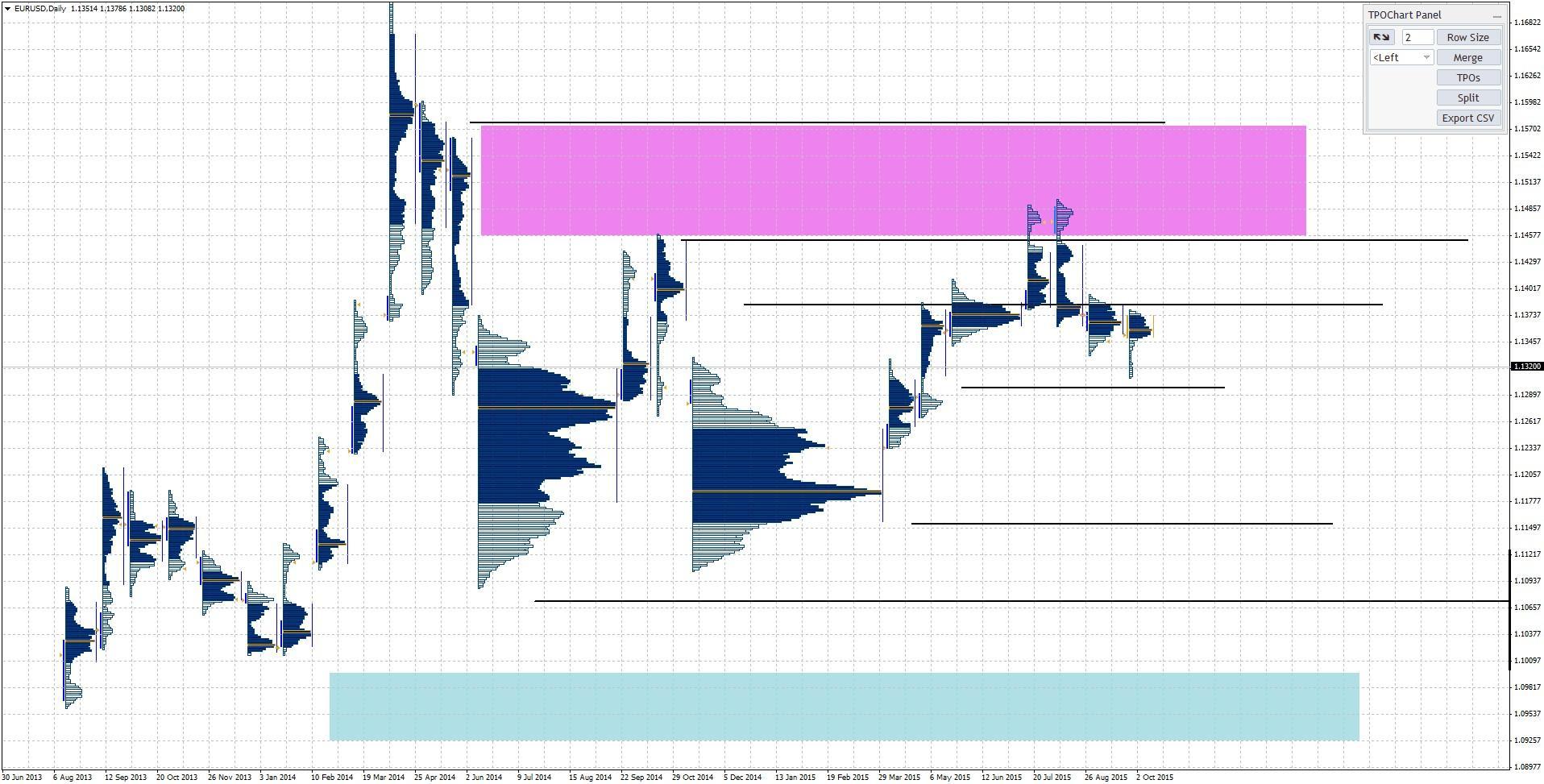

Last week, we also highlighted to our students that the EUR can face significant weakness in anticipation of extension of the QE by the ECB. We had identified the resistance area from before and we were taking shorts from the 1.143—1.1450 area.

Another trading idea we have highlighted is selling the EUR against the GBP and as you can see we are now breaking the upward trend line and this can be the beginning of a nice trend change.

Keep in mind which fundamental catalyst is driving this currency pair.Therefore, if we have a dovish tone and a suggestion that the QE will be extended in the Eurozone then the EUR can see significant weakness.

You can also see on the profile chart that we are breaking below the High Volume node of the larger balance and we are going most likely to test the bottom value area of that balance. Any moves and acceptance below 0.7270, could yield significant trends lower.

Thank you!

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.