Fundamental Forecast for Yen: Neutral

GBPJPY Reversal Setup- Short Scalps Eye 182

USD/JPY Risks Further Losses Despite Slowing Japan Consumer Price Index (CPI).

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

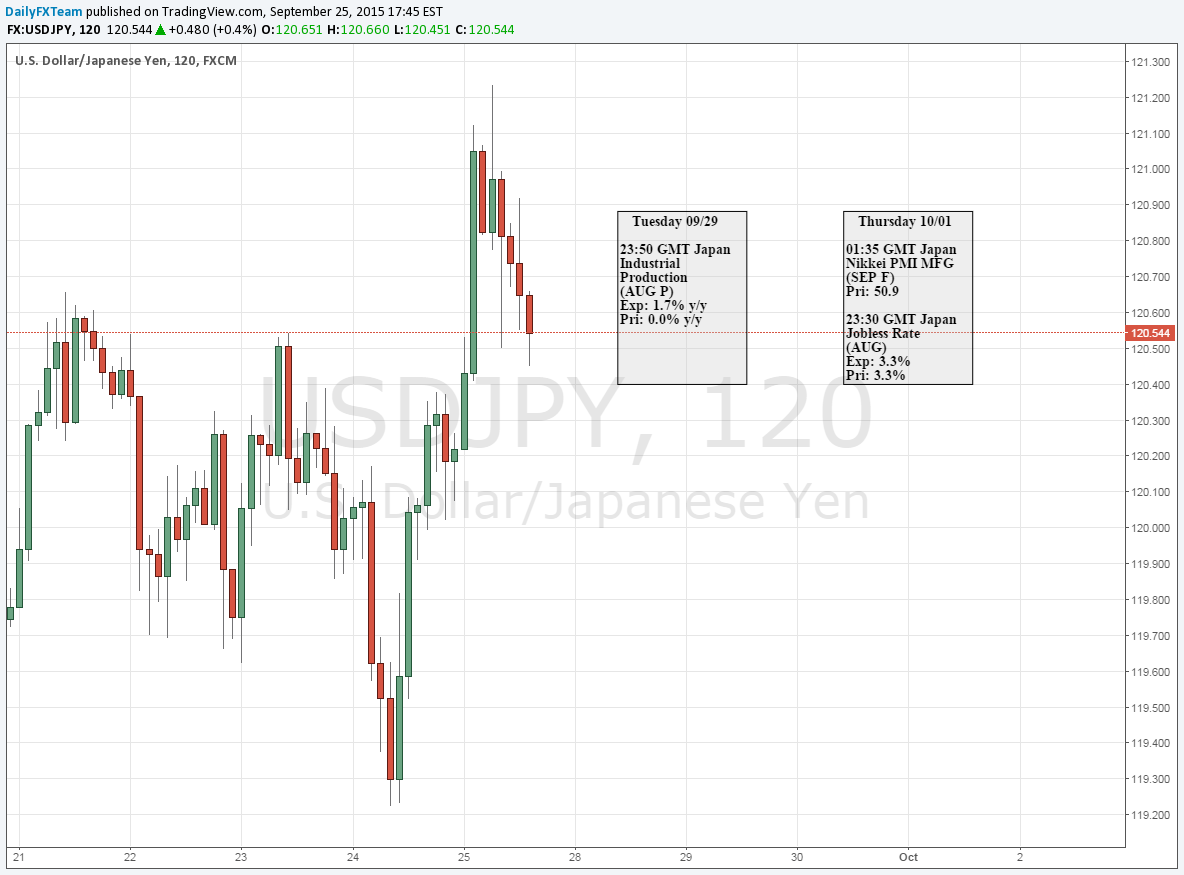

The long-term outlook for USD/JPY remains bullish amid the deviating paths for monetary policy, but the range-bound price action in the exchange rate may unravel in the days ahead as market participants continue to treat the Japanese Yen as a ‘funding-currency.’

Even though the Fed remains ‘data dependent,’ the recent rhetoric from Chair Janet Yellen suggest that the committee remains on course to raise the benchmark in 2015 as the central bank head pledges to normalize policy in a ‘timely fashion.’ As a result, the key data prints coming out next week may boost expectations for a rate-hike later this year as the economic docket is anticipated to show faster wage/price growth accompanied by another 200K expansion in U.S. Non-Farm Payrolls (NFP). Indeed, signs of a stronger recovery may encourage a larger dissent at the Fed’s October 28 interest rate decision especially as the region approaches full-employment.

In contrast, a down tick in Japan’s Tankan surveys may put increased pressure on the Bank of Japan (BoJ) to further embark on its easing cycle as it undermines the central bank’s scope to achieve the 2% target for inflation over the policy horizon. With the BoJ scheduled to announce two separate interest rate decisions in October, the softening outlook for global growth accompanied by the ongoing weakness in oil prices may become a growing concern for the central bank, and a greater willingness to boost the qualitative/quantitative easing (QQE) program is likely to produce headwinds for the Japanese Yen amid the deviating paths for monetary policy.

Moreover, market sentiment may continue to play a key role in dictating price ahead of the key interest rate decisions as global investors treat the Japanese Yen as a ‘funding-currency,’ and shifts in risk trends may largely accompany turns in USD/JPY as market participants weigh the outlook for monetary policy. Until then, the near-term consolidation in the dollar-yen may persist going into the end of September as the pair largely retains the opening range from the beginning of the month.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.