Fundamental Forecast for Yen: Neutral

One-sided crowd sentiment gives us a modestly bearish USD/JPY trading bias

USD/JPY nonetheless likely to stick to recent trading ranges given Bank of Japan inaction

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

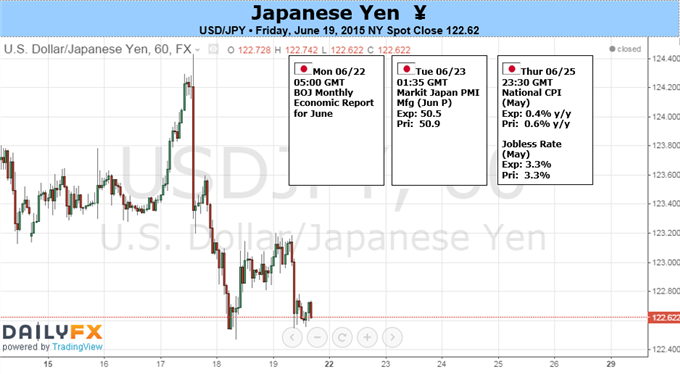

The Japanese Yen finished the week modestly higher versus the recently-downtrodden US Dollar, but the lack of a clear breakthrough from a highly-anticipated US Federal Reserve meeting and a lackluster Bank of Japan decision give few clues on next steps for the USD/JPY.

All eyes were on the US Federal Open Market Committee (FOMC) as investors looked to Fed guidance on its next interest rate moves, and relatively dovish official rhetoric and forecasts sparked a modest US Dollar sell-off across the board. Officials stopped short of giving clear indication on whether the FOMC would raise interest rates at its much-anticipated September meeting, however; the ambiguity gives relatively little reason to expect the US Dollar will continue sharply lower through the foreseeable future.

A mostly uneventful policy meeting from the Bank of Japan likewise gives little reason to believe that the USD/JPY will see major moves through the foreseeable future. The BoJ did announce it would improve the way in which it communicates policy decisions and economic forecasts in the future. At this stage there is little reason to believe the changes will have a meaningful impact on the Japanese Yen through the near-term.

A noteworthy drop in FX volatility prices suggests that the USD/JPY may continue to trade within its recent ¥122.50-124.50 range. The most important caveat is that a continued lack of progress in ongoing negotiations between Greece and its creditors raises the risks of significant market volatility. If Greece is unable to seek funding ahead of a key June 30 deadline it may in effect be forced out of the Euro Zone—an event that would likely send significant shockwaves through broader financial markets.

In times of market turmoil we have most often seen the Japanese Yen outperform its major counterparts, and we believe that similar episodes in the future would push the JPY higher across the board (USDJPY lower). Barring such an outcome, however, we see little reason to believe that the US Dollar will break substantially in either direction versus the recently slow-moving Japanese Yen.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.