Fundamental Forecast for Euro: Neutral

USD/JPY Confluence Could Provide Support Near 120

Using FX Sentiment & Volume Analysis to Spot USDJPY Trend Resumption

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

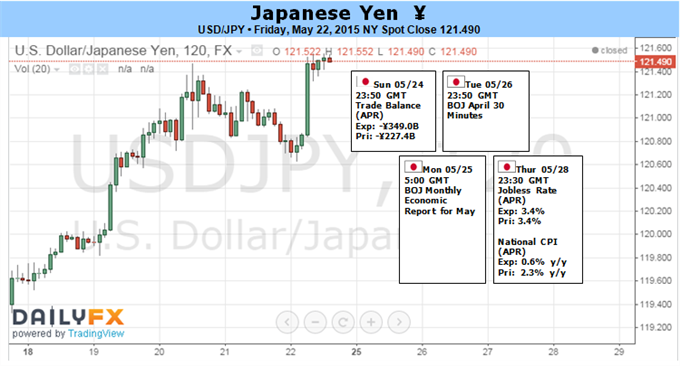

The near-term breakout in USD/JPY raises the risk for a run at the 2015 high (122.01), but the fundamental developments coming out of the world’s largest economy may undermine the bullish outlook surrounding the exchange rate should we see a growing number of Fed officials show a greater willingness to further delay the normalization cycle.

Speculation surrounding the Fed policy outlook may play an increased role in driving dollar-yen volatility as the Bank of Japan (BoJ) preserves a wait-and-see approach, and another series of dismal U.S. data prints may drag on interest expectations as the Federal Open Market Committee (FOMC) Minutes show a greater willingness to retain the zero-interest rate policy (ZIRP) beyond mid-2015. The preliminary 1Q U.S. Gross Domestic Product (GDP) report will be in focus going into the last full-week of May, and the updated print may dampen the appeal of the greenback as market participants anticipate a 0.9% contraction in the growth rate versus an initial forecast for a 0.2% expansion.

A marked downward revision in 1Q GDP may encourage the Fed to retain the ZIRP for an extended period of time, and we may see a growing number of central bank officials adopt a more dovish tone should the weakness from the beginning of the year carry into coming quarters. With FOMC voting-members Stanley Fischer, Jeffrey Lacker and John Williams scheduled to speak next week, the fresh batch of rhetoric may ultimately spur a near-term pullback in USD/JPY should the policymakers talk down bets for a September rate hike.

Nevertheless, the technical outlook highlights the risk for a test of the 2015 high as USD/JPY breaks out of the near-term range, and a more bullish formation may take shape in the days ahead should the U.S. developments highlight an improved outlook for the U.S. economy and beat market expectations.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to holds above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.