Fundamental Forecast for Yen: Neutral

US Dollar/Japanese Yen exchange rate very sensitive to US Treasury Yields

Weekly Volume Report: USDJPY volume profile looks encouraging for bulls

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

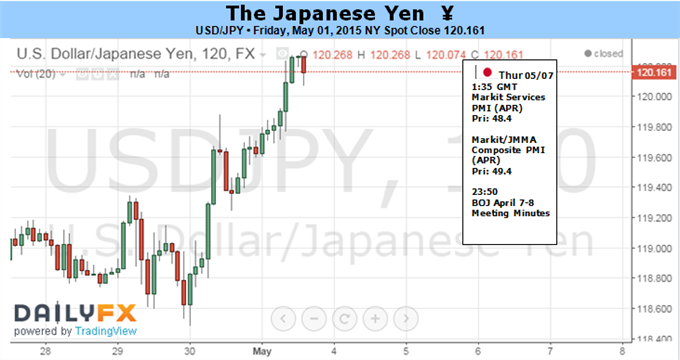

The Japanese Yen finished the week notably lower versus the US Dollar but stuck to its long-standing trading range. A big week for FX markets ahead might be enough to finally force a break in the slow-moving US Dollar/Japanese Yen exchange rate.

A sharp US Dollar rally pushed the USD/JPY to fresh 8-year highs through March and yet the pair has consolidated ever since. It has been a virtual stalemate for the Dollar and the Yen as both the US Federal Reserve and Bank of Japan have given relatively little reason to force a fundamental shift for either currency. And indeed this past week’s uneventful monetary policy decisions from both the Fed and BoJ maintained the status quo.

Any surprises in the upcoming US Nonfarm Payrolls report could nonetheless tip the scales and force major US Dollar volatility, while monetary policy meeting minutes from the Bank of Japan might spark noteworthy moves in the Yen. The US labor market report is often one of the biggest market-movers not only for the US Dollar and domestic financial markets but global counterparts as well. The interest rate-sensitive Japanese Yen will almost certainly react to any surprises.

Current consensus forecasts predict that the US economy added 225k jobs in April after a disappointing March result. Recent US Dollar weakness suggests few expect a material improvement in US economic data, and a worse-than-expected print could force the Greenback even lower.

The Bank of Japan Meeting Minutes due just a day before are less likely to force major moves in the Yen. Yet it remains important to monitor the central bank’s rhetoric in regards to future monetary policy moves. BoJ Governoor Kuroda sounded a surprisingly neutral tone at a recent press conference as officials show no real willingness to ease monetary policy despite notable disappointments in economic data. Pressure is building on the BoJ to ease further as recent inflation figures showed a sharp pullback in year-over-year Tokyo CPI growth. And though this may not be enough to force the Bank of Japan’s hand in itself, it remains of clear interest to monitor officials’ next moves.

It’s shaping up to be a fairly important week for the Dollar versus the Yen, and any major surprises could finally be enough to force the USD/JPY out of its narrow trading range.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.