Fundamental Forecast for Japanese Yen: Neutral

USDJPY test key highs, but limited trader conviction warns against chasing gains.

Mixed technical forecast for US Dollar raises risks of a short-term pullback

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

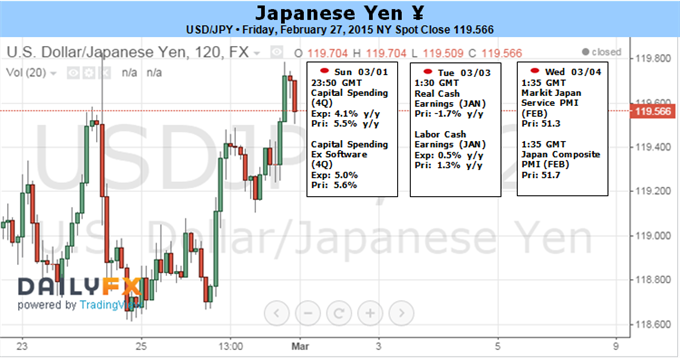

The Japanese Yen traded lower versus the US Dollar for the third week in four and left the USDJPY exchange rate near the key ¥120 level. Why might the week ahead finally bring a major breakout?

Traders have shown little interest in pushing the Yen beyond its narrow three-month trading range, but any significant surprises in upcoming US Personal Income/Spending and Nonfarm Payrolls labor data could change outlook for the otherwise-rangebound USD/JPY exchange rate. A fairly consistent rally from January lows near ¥116 suggests that the next major USDJPY move will be to the topside. Relatively low trader volumes in recent weeks nonetheless limits our enthusiasm for fresh USDJPY-long positions, however. We would ideally see a major shift in market conditions and trader attitudes to justify calling for a sustained break higher.

The key question remains unchanged: when will the US Federal Reserve begin raising interest rates? Yield-seeking investors have typically sold the Japanese Yen against higher-yielding currencies through normal rate environments. And indeed, the fact that the US Fed appears to be the only major central bank to act in 2015 has helped push the US Dollar to 8-year peaks versus the JPY.

Expectations can only take the Greenback so far, and eventually investors will need to see action. Consistent improvements in US Nonfarm Payrolls figures suggest the coming week’s result will further build the case for Fed rate hikes. Yet fundamental risks seem weighed to the downside as few predict that hiring matched the impressive pace seen through January’s report.

Technical forecasts paint a similarly mixed picture for the Dollar/Yen exchange rate, and indecision helps explain why recent CFTC Commitment of Traders data shows speculative JPY-short positions (USDJPY-longs) have fallen to their lowest since November, 2012.

It’s certainly possible that strong US economic data could force a larger break higher in the USDJPY. As far as probabilities go, however, we put relatively low odds on a sustained US Dollar move higher in the week ahead.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.