Fundamental Forecast for Pound: Neutral

British Pound: Swaps Show Weakest BoE Rate Forecast in 6 Months

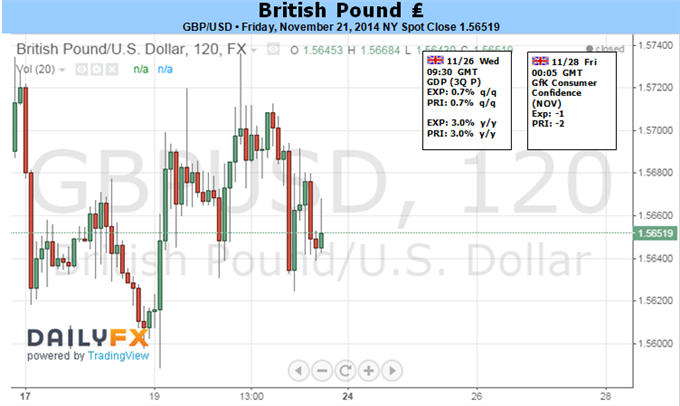

GBP/USD Outside Day Reversal; Bigger Resistance Slightly Higher

For Real-Time SSI Updates and Potential Trade Setups on the British Pound.

GBP/USD may face a more meaningful rebound in the week ahead as the Bank of England (BoE) highlights the risk of overshooting the 2% target for inflation, while the Federal Reserve remains reluctant to move away from its zero-interest rate policy (ZIRP).

With the BoE scheduled to testify in front of the Parliament’s Treasury Select Committee next week, the fresh batch of central bank rhetoric may heighten the appeal of the British Pound should Governor Mark Carney continue to prepare U.K. households and businesses for higher borrowing costs. Even though the BoE Minutes showed another 7-2 spit at the November 6 meeting, it appears as though there’s a greater dissent within the Monetary Policy Committee (MPC) as the faster-than-expected erosion of economic slack raises the risk for above-target inflation. In turn, we may see a growing number of BoE officials scale back their dovish tone for monetary policy, while the Fed may further delay its normalization cycle amid the subdued outlook for U.S. inflation.

The preliminary 3Q U.S. Gross Domestic Product (GDP) report may serve as another fundamental catalyst to drive GBP/USD higher as market participants anticipate a downward revision in the growth rate, while the core Personal Consumption Expenditure, the Fed’s preferred gauge for inflation, is expected to grow an annualized 1.4% after expanding 2.0% during the three-months through June. As a result, central bank Chair Janet Yellen may largely endorse a more neutral tone for monetary policy going into the end of the year, and 2015 rotation for the Federal Open Market Committee (FOMC) may further dampen the appeal of the U.S. dollar as central bank hawks Richard Fisher and Charles Plosser lose their vote.

With that said, GBP/USD may make a larger attempt to break out of the narrow range on the back of hawkish BoE commentary along with a series of dismal U.S. data, and we would also like to see a topside break in the Relative Strength Index (RSI) as the oscillator retains the downward momentum carried over from the previous month.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.