Fundamental Forecast for Pound: Neutral

- EURUSD back above $1.2500 but EURCHF has started to probe the Sf1.2000 floor.

- Futures speculators reduced Euro shorts for the first time since late-September.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

With risk appetite bolstered after the Bank of Japan’s latest round of easing, investors continued to shift capital into higher yielding assets this past week, and it translated into the Euro rallying against the lower yielding currencies while shedding some against the commodity bloc. EURJPY continued to impress, gaining another +2.00% to close at ¥145.66, and EURUSD was able to climb to a close of $1.2525 – after seeing prices below $1.2400 on Friday morning.

Much of the Euro’s stability against the British Pound, the Japanese Yen, and the US Dollar in recent days is due to the fact that Euro-Zone economic data hasn’t been so poor in recent weeks – we wouldn’t say ‘better,’ but rather ‘less worse,’ if you will. The Citi Economic Surprise Index, a proxy for economic data momentum, closed the week at -26.4, having recovered more than halfway from the yearly low of -57.3 set on October 14.

A closer look at this past week’s GDP data highlights why some of the figures are only ‘less worse.’ Q3’14 French GDP beat expectations at +0.3% q/q versus +0.1% q/q expected. However, the bulk of gains came from increased government spending (France needs to reduce its deficit, not add to it) and inventory growth. Inventory growth without matched consumption is essentially borrowing against future production: if inventories are stocked longer, it means that prices need to be cut to stoke demand or there is excess supply. Needless to say, France’s Q3 GDP figure was hollow at best.

Inflation expectations also remain an issue, which is why the Euro hasn’t been able to mount a full-scale recovery so far. The 5Y5Y inflation swaps, ECB President Draghi’s purported favorite market-measure of inflation, fell to a yearly closing low of 1.602%, but still have the yearly intraday low of 1.541% set on October 14. The breakdown of the October CPI report is important to note. Per the most recent headline HICP reading of +0.38% y/y, the energy subcomponent was -1.97%; headline HICP ex-energy would be +2.35% y/y. Prolonged weaker energy prices are a big reason why inflation continues to run below the ECB’s projections.

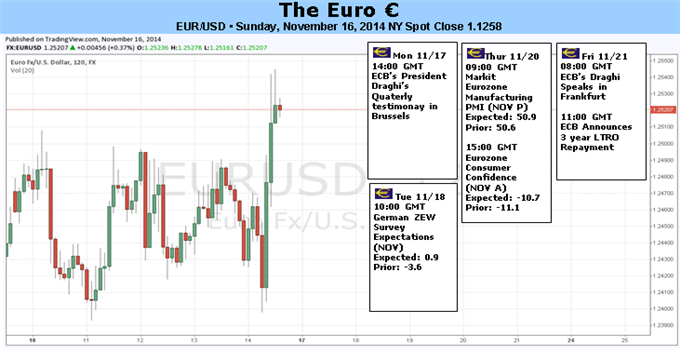

Looking to the week ahead, we’ll probably see more data that’s coming in a bit better than it was relative to a few months ago, but only being of the ‘not so bad’ variety. The German ZEW survey for November, particularly the Expectations sub-index, should be watched closely: it has collapsed spectacularly over the past year, from +62.0 in December 2013, to -3.6 in October. We’re interested because after 10 consecutive months of decline, the sub-index is expected to return into positive territory at +0.5.

Thursday’s November PMI data from across the region caps what is a week of minimal event risk for the Euro. The theme of reprieve is apparent in these data, too: the German readings are expected to edge a bit more positive in growth territory above the October readings, while the French figures are expected to improve but remain in contraction territory.

Positioning in the weeks ahead is key. Speculators/non-commercials reduced their extreme net-short Euro position for the first time in nearly two-months, having added to shorts every week since September 30. Down from 179.0K net-short contracts for the week ended November 11, the 163.9K net-short contracts remains a large, veritable source of tinder for the Euro to burn on a short covering rally.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.