Fundamental Forecast for Pound: Neutral

- The Euro’s performance has been broadly mixed the past month, but there are selective opportunities both long and short.

- EURUSD may be setting a higher low as the economic data drought ended with surprise German, EZ PMIs.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

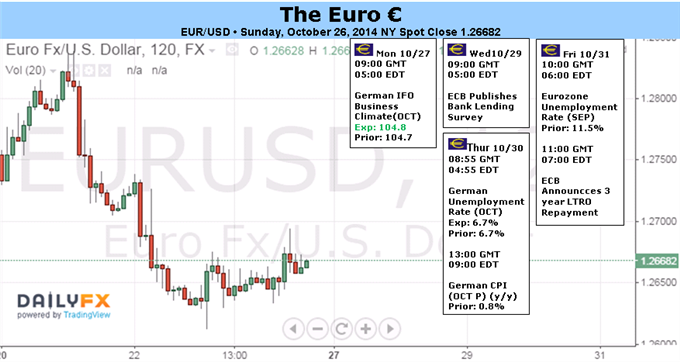

The Euro continued its process of stabilization for the third consecutive week, although a slightly more negative tone was apparent in the run up to the release of the European Central Bank’s asset quality review (AQR, stress tests) The 18-member currency posted gains against only two of the major currencies covered by DailyFX Research, with EURUSD falling by -0.71% to $1.2671. A culmination of factors over the last few days and weeks may be gathering for Euro strength in the near-term

Aided by much better than expected preliminary October German and Euro-Zone PMI data, gauges tracking Euro-Zone economic momentum have turned sharply higher from their lowest levels of the year. While the yearly low was set on October 14 at -57.3, the Citi Economic Surprise Index shot up to -36.8 by the end of this past week. Relatively speaking, data has been less disappointing and even positive in select cases.

Following the small improvement in data momentum, medium-term inflation expectations rebounded slightly this week as well. The 5Y5Y breakeven inflation swap, the European Central Bank’s preferred market measure of medium-term inflation expectations, edged higher from 1.779% to 1.791% - not a terrific rebound, but still moving in the direction the ECB’s policy is hoping for. The yearly low was set on October 15 at 1.541%.

These improving economic data trends are now bolstered by what should be considered a better than expected round of stress test results. The AQR was released on Sunday at 12 CET, and showed that while 25 Euro-Zone banks failed the tests totaling €24.2B in capital shortfall, 12 banks have already raised enough capital to cover their respective shortfalls.

The total shortfall after the 12 banks raised capital fell to €9.5B – a much more manageable figure. Various banks’ estimates pegged the cumulative shortfall from anywhere to low tens of billions to as high as €100B.

If there was ever a chance for the Euro to take advantage of near-term conditions, the moment may be ripe for the elusive Euro short covering rally. The fuel here, of course, is the stretched futures market positioning. Non-commercials/specs held 159.4K net-short contracts for the week ended October 21, an increase from the 155.3K net-short contracts held a week earlier.

Outside of the very immediate time horizon, the outlook is still fairly bearish: sovereign QE is still widely expected from the ECB next year while other major central banks (BoE, Fed) winddown their expansive stimulus policies. – CV

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.