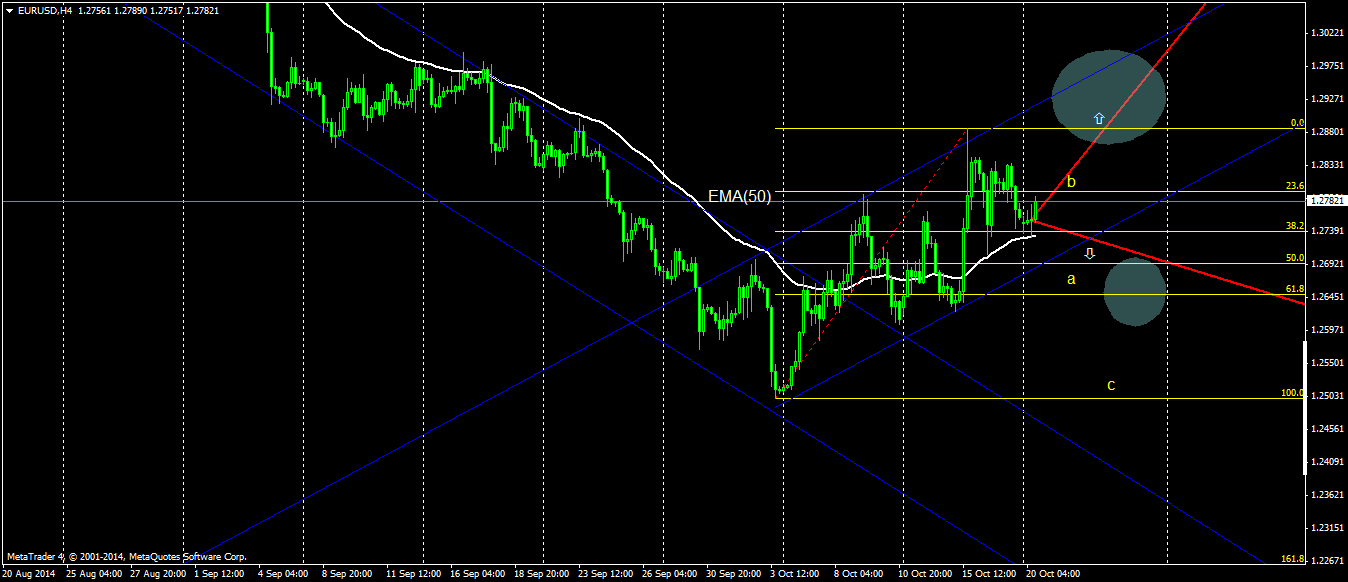

The EUR/USD currency pair has corrected its previous decline during last week and reached the level of 1.2886 and it ended the week on 1.2759. Last week the German government has significantly decreased its predictions about the growth of German economy for both this and the next year. The US economy has continued its month and a half long growth and its increase was visible in most regions of the USA. Furthermore last week the number of applications for social support due to unemployment in the US has declined to its lowest level in the past 14 years. In September the industrial production has experienced the highest growth since 2 years. Retail sales have dropped by 0.3% in comparison to the previous month.

EUR/USD

The EUR/USD currency pair has grown up to 1.2886 and finished the week at 1.2756. In the short-run we expect a neutral development of EUR/USD. If the EUR/USD will remain in its growing trend then we can expect a long-term bullish trend with the possibility of growth to the psychological level of 1.3000. The nearest support can be found at 1.2700 and another at 1.2650. A clear fall below these levels would result in an interruption of the bullish scenario and could start a another bearish pressure towards 1.2580-1.2500.

GBP/USD

The GBP/USD currency pair has declined to 1.5870. The main bearish trend continues. The nearest support can be found at 1.6030 and a clear fall below this level would result in bearish trend and a decline below 1.6000. Then we could see another decline towards 1.5800-1.5700.

USD/JPY

The USD/JPY currency pair attempted to decline during the last week and reached 105.18 but it bounced of this level and finished of at 106.86. Short-term expectation is bullish with a possibility of growth towards 107.50. In case of a clear breach of this level, the bearish trend would be interrupted and we could experience a growth up to 108.00 or higher. The nearest support is found at 106.5. A clear fall below this level would drive the price into a neutral zone and we could experience an attempt at 105.5 or lower.

GOLD

In the last week gold has continued its expected correction and it has not dropped below the EMA(50) line. The gold is expected to grow up to 1250 where there is heavy resistance. This level should not be breached. We tend to incline towards a bearish trend and a fall of gold up to 1180 USD where we expect a strong support. If gold bounces of this level then a so called dual bottom will be created and we will experience a bounce back to growth.

By utilizing this website, you agree to be bound by these terms and conditions. This is a legal agreement (“Agreement”) between you and Leconte, sro.. (“Gurulines”) for use of the website, data, Gurulines electronic trading platform, and products and services which you selected or initiated, which may include the Gurulines trading platform and third party signal providers (“Products and Services”). If you do not agree with the terms of this Agreement, do not use this website or any of the Products and Services.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.