EUR/USD

The EUR/USD continued to decline down to 1.2828 in the past week, however it has also been a little above the 1.2990 level. That is why we can expect a rebound from wave A during this week. If EMA (50) is breached, we can expect a growth of EUR/USD up to wave D. If the macroeconomic news are positive, we can expect a stagnation of EUR/USD around wave A.

GBP/USD

Towards the end of last week the British Pound has adjusted its previous growth from wave B to wave A. This week we are expecting an imitation of the growth line above EMA (50) and growth between waves B and C. If the triangular level and wave A is breached, then we can expect a declining adjustment up to wave D.

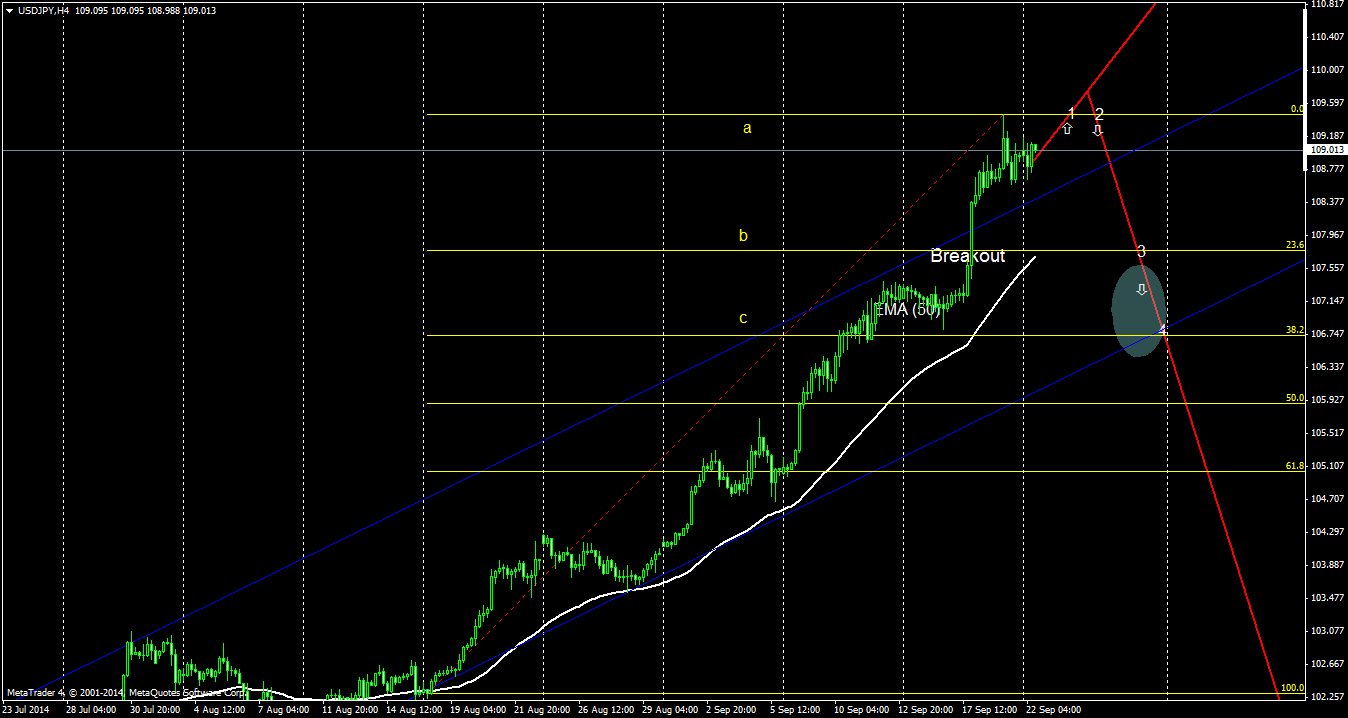

USD/JPY

Due to positive news from the American labor market the USD/JPY has grown and wave B was surpassed up to wave A. There is evidence of slight resistance forming close to wave A. If this resistance holds, then we can expect the USD/JPY to get back to the long-term growing channel and EMA (50) value. Consecutively if EMA(50) is breached, then we can expect a declining trend up to wave C.

GOLD

Gold has continued its decline towards wave A in the past week. It is currently floating below the EMA (50). This week we can expect an adjustment towards wave C. The long-term prediction is one of steady decline, and if wave A is breached we can expect a fall below 1200USD.

By utilizing this website, you agree to be bound by these terms and conditions. This is a legal agreement (“Agreement”) between you and Leconte, sro.. (“Gurulines”) for use of the website, data, Gurulines electronic trading platform, and products and services which you selected or initiated, which may include the Gurulines trading platform and third party signal providers (“Products and Services”). If you do not agree with the terms of this Agreement, do not use this website or any of the Products and Services.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.