Editor’s Note: This will be our last commentary of the year. Our next publication will be the outlook for 2015, out the first week of January. We wish you the very best for the holiday season and a happy new year.

I recently revisited the economic projections we made last January, as part of my performance appraisal. I dread the experience, as it tends to highlight my frailty as a forecaster.

This year wasn’t too bad, though. Allowing for the polar vortex, we got U.S. growth just about right. We had been skeptical about Europe, and thought that China would moderate. Our call on how the Federal Reserve would progress was spot on.

However, a number of things that transpired during 2014 caught us quite by surprise. Here is our roster of the most unexpected events and trends of the year.

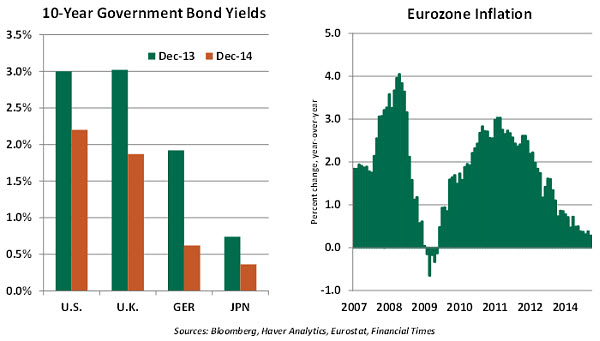

- Shrinking world interest rates. Just when you thought they couldn’t go any lower, long-term interest rates set new bottoms. The 10-year U.S. Treasury yield stands about 100 basis points below the consensus forecast of 12 months ago, and German government bond yields are negative all the way out to four years. All of this is due largely to …

- Lowflation. We expected eurozone inflation to remain subdued through 2014 – but not to drop from 0.85% at the end of 2013 to just 0.30% by November. The deflationary pressures currently hitting the eurozone are coming from multiple sources – lack of consumer demand, contracting credit and ongoing fiscal austerity.

As the euro weakens against other currencies, Europe may export some of its disinflation to other markets. British inflation has fallen from 3% in the middle of 2013 to 1% today, and U.S. inflation is well below target.

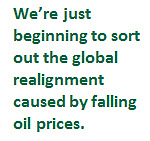

- Plummeting energy prices. A confluence of events – slower growth in China and the eurozone, rising oil production in the United States and OPEC’s recent decision to not cut production have sent the price per barrel of oil to four-year lows with no floor in sight. Markets have conceded that $100 oil is not returning any time soon, and discussion has turned toward whether the benefits accruing to importers can balance the strain felt by oil-producing countries.

It may take some time to sort out all of the ripple effects as they work through income statements for governments and households. Certain amounts of borrowing in the public and private sectors were underwritten with a much higher oil price in mind. As we head into the new year, this is the single biggest issue to watch.

It may take some time to sort out all of the ripple effects as they work through income statements for governments and households. Certain amounts of borrowing in the public and private sectors were underwritten with a much higher oil price in mind. As we head into the new year, this is the single biggest issue to watch.

- Russia: From Sochi to Sanctions. It took only days for the good feeling generated by the Winter Olympics to fade. The annexation of Crimea, military support for Ukrainian separatists and the accidental downing of a civilian airliner all cast Russia in a dark light. Vladimir Putin’s course is troubling and not likely to change even in the face of sanctions, a contracting economy and the worst performing emerging market currency this year. Putin’s approval ratings are still sky-high and the public is willing to weather the storm for now. How long this will last is anyone’s guess.

- Brazil’s soccer crash. Despite construction anxieties in the months leading up to the World Cup, none of the new facilities collapsed. That was left to the Brazilian national team.

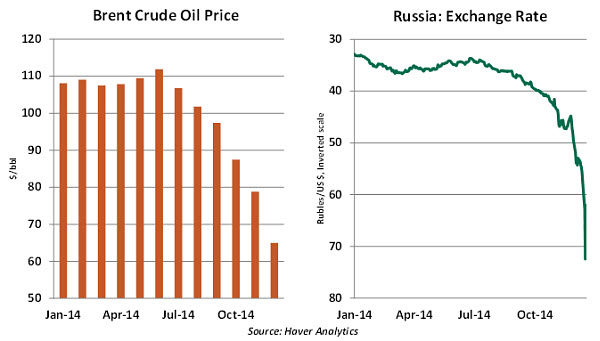

- Falling unemployment in the United States and the United Kingdom. The jobless rates in the United States and the United Kingdom are both 1.2 percentage points lower than they were a year ago. This performance has exceeded the expectations of even the most optimistic forecasters. Labor force participation has been solid in both countries, despite the advancing retirement of the post-war generation.

This positions the Federal Reserve and the Bank of England to contemplate interest rate increases in the new year, which will have to be carefully communicated and executed to preserve market stability.

- Renewed emerging market uncertainty. The year began well, with elections in India ushering in more business-friendly candidates and key reforms passed in Mexico; mid-year elections in Indonesia also offered hope to investors. Emerging markets once again attracted a lot of favorable attention from investors.

However, highlights from the second half of the year included Argentine default, a disappointing election result in Brazil, and the ruble’s free fall. Countries that export energy and other raw materials have been challenged by falling prices. While Australia, for example, has economic diversity and solid policy to withstand the correction, smaller producers may not.

With the Federal Reserve and the Bank of England poised to raise rates, we could see portfolio outflows from emerging markets, adding to the financial pressure. All of this could destabilize countries that have insufficient reserves or poor policy combinations. Those with smaller fiscal burdens, less commodity-export dependence, and more progress on structural reforms will fare better.

With the Federal Reserve and the Bank of England poised to raise rates, we could see portfolio outflows from emerging markets, adding to the financial pressure. All of this could destabilize countries that have insufficient reserves or poor policy combinations. Those with smaller fiscal burdens, less commodity-export dependence, and more progress on structural reforms will fare better.

- No U.S. government shutdowns. After a 2013 filled with interruptions of service and threatened bond defaults, the U.S. Congress made it through the year without creating chaos. Of course, they didn’t create much legislation, either.

- Faltering Abenomics. Japan entered the year with a lot of momentum and high expectations, but the bold plan to re-energize the Japanese economy endured a few blows this year. The economy’s prolonged negative reaction to the consumption tax increase in April has been surprising. The solid economic recovery expected in the third quarter proved elusive, with the economy instead falling into a technical recession.

The structural arrow of Abenomics included very few awe inspiring measures. Corporate governance reforms failed to garner the hoped-for support from the Diet, and other initiatives received scant consideration. This led Prime Minister Shinzo Abe to call new elections despite holding a supermajority in parliament. His victory could provide just enough momentum to jump start his namesake economic agenda.

- China’s great leap sideways. Despite an undershooting of the annual growth target, a series of debt defaults and plenty of troubling economic indicators, China made it through 2014 without a significant crisis.

This is not to say the trend is positive – growth for 2014 will be the slowest in 23 years. Furthermore, policymakers are still hesitant to acknowledge that years of excessive investment, overcapacity, and soaring real estate prices have created imbalances that are in dire need of correction. If surviving 2014 without a crisis came as a surprise to some, completing 2015 without incident might potentially be more impressive.

This is not to say the trend is positive – growth for 2014 will be the slowest in 23 years. Furthermore, policymakers are still hesitant to acknowledge that years of excessive investment, overcapacity, and soaring real estate prices have created imbalances that are in dire need of correction. If surviving 2014 without a crisis came as a surprise to some, completing 2015 without incident might potentially be more impressive.

- Bitcoin mania. In retrospect, there was far too much attention devoted to this virtual currency, which ended up being subject to the same kind of fraud that has afflicted more traditional modes of exchange for centuries. Not everything belongs in "the cloud."

I’m sure that there are many surprises in store for us next year. We’ll look forward to covering them for you.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.