I have to digest a great deal of written material to keep up with the global economy. When I have free time to read, I often choose to decompress by enjoying the cartoons in “The Authoritative Calvin and Hobbes Treasury” or the food pictures in Bon Appétit. I know that sounds shallow, but it helps keep me sane.

During this summer’s vacation, I found middle ground by working through two very interesting books that provide some perspective on the modern practice of economics: "The Signal and the Noise” by Nate Silver, and “Thinking, Fast and Slow” by Daniel Kahneman. Both look critically at the strengths and weaknesses of the way we view behavior, models and markets.

Silver’s book looks at the application (or misapplication) of statistical methods in meteorology, geology, epidemiology, sports, politics and finance. Geometric increases in the availability of data and the speed with which it can be analyzed have expanded the use of models in many fields. In some cases, this approach has yielded important new insights (the “signal”). In others, the outcomes are misleading or incorrect (the “noise”). Our challenge is to separate the two.

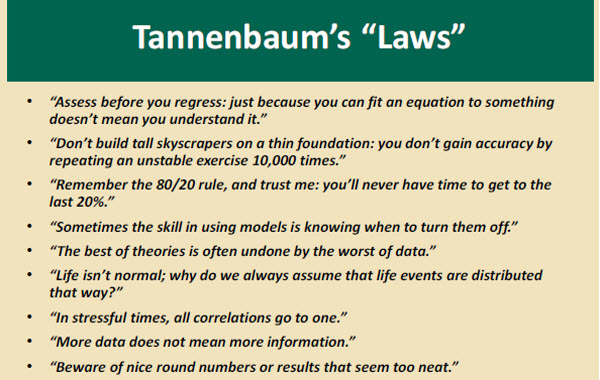

Having built models and managed modelers for more than 30 years, I find that Silver’s themes resonate with me. Visitors to my office will find the following manifesto posted on the door:

We sometimes tend to give too much respect to outcomes that emerge from complicated algorithms. Sometimes this is because we have a natural aversion to engaging with complex computations. (More on this later.) Yet very basic problems often trip up complex models.

Data can be incomplete or misleading. We have many examples of this in macroeconomics, where the accuracy of raw information is never absolute. Statisticians sometimes improperly extrapolate results for small samples to make broad conclusions. Investment managers can have a strong year, or even several, but this does not necessarily mean that their results are due to skill as opposed to chance.  Consumers must understand the limitations of the data and model output they consume as well as the perspective of their creators. We should understand that there is error around estimates and account for the degree of this dispersion when using the results. There is still an important role for studied intuition in decision-making, and blending this properly with quantitative approaches is our collective challenge.

Consumers must understand the limitations of the data and model output they consume as well as the perspective of their creators. We should understand that there is error around estimates and account for the degree of this dispersion when using the results. There is still an important role for studied intuition in decision-making, and blending this properly with quantitative approaches is our collective challenge.

Silver, the founder of www.fivethirtyeight.com, continues to press the envelope of data mining by applying it to an ever-expanding universe. Visitors to the site will find provocative work… which should nonetheless be consumed with caution.

Daniel Kahneman won the 2002 Nobel Prize in Economics despite being trained as a psychologist. Along with others, he founded the school of behavioral economics that was the subject of some scorn before finally gaining wide acceptance. The reason for this is that Kahneman’s work questioned the most fundamental assumptions of economics: that people behave in a rational, calculated manner.

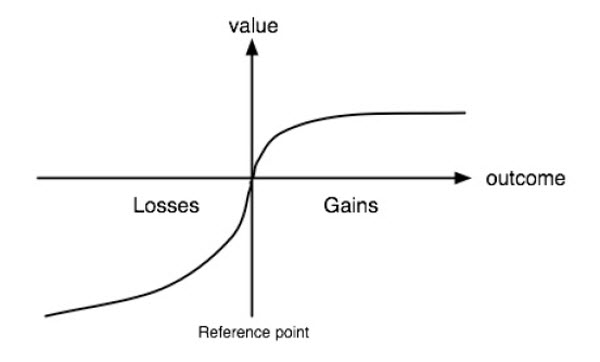

“Thinking, Fast and Slow” explores the way in which individuals and groups make choices. Kahneman’s most impactful work has focused on “prospect theory.” Readers who have taken economics will remember “indifference curves” mapping a series of price/quantity combinations that provide the consumer with the same level of “utility.” Kahneman’s work found that indifference curves are kinked and can vary based on the starting point. In the world of finance, this is demonstrated by the fact that investors derive more pain from losses than pleasure from gains.

Kahneman describes a series of other human tendencies that have a significant impact on our judgment. Among them:

- Confirmation bias – We give more weight to information that corroborates what we already believe and tend to discount contradictory evidence.

- Halo effect – We ascribe broad positive and negative attributes to something on the basis of very limited impressions. Examples would be thinking a company is a good investment because their logo is handsome or favoring a political candidate who dresses well.

- Substitution – We often avoid doing difficult mental calculations by reverting to a simpler problem that we think is similar. This is called a heuristic process, and it often produces poor results. Profiling, which uses observable physical attributes (e.g., beady eyes) to infer difficult-to-observe character qualities (e.g., trustworthiness) is one especially pernicious example of this.

All these shortcomings may sound like character flaws, but psychologists think that the way in which our brains are wired may lead us to these behaviors. Complicated calculation creates stress, and so our bodies might steer us toward simpler modes of analysis. Yet whether innate or acquired, we must allow for our imperfections if we are to understanding how equilibrium is reached in markets.

All these shortcomings may sound like character flaws, but psychologists think that the way in which our brains are wired may lead us to these behaviors. Complicated calculation creates stress, and so our bodies might steer us toward simpler modes of analysis. Yet whether innate or acquired, we must allow for our imperfections if we are to understanding how equilibrium is reached in markets.

I realize that both my summer reading tomes have been out for a while, but better late than never. And I also realize that these themes must sound overly heavy to those who like to spend their leisure time with something lighter. To reconcile the two, you might enjoy Calvin and Hobbes’ take on capitalism.

Enjoy the balance of your summer.

Treading Water

The second quarter provided a welcome rebound in the United States, with the annual pace of economic growth rising to 4.0%. But the trend in eurozone moved in the opposite direction, deepening the sense of malaise on the Continent.

The level of real gross domestic product (GDP) was essentially flat across the 18 members of the eurozone for the April–June period. There were some encouraging results in countries that had struggled during the first quarter; the Netherlands, Spain, and Portugal recorded decent progress. But the three largest economies in the area all struggled. Aggregate GDP for the eurozone has yet to regain the level recorded before the global financial crisis.

The German economy, which accounts for nearly a third of eurozone GDP, contracted by 0.2% in the second quarter. This outcome did not come as a complete surprise, given that a mild winter in that country allowed for stronger-than-expected growth in the first quarter. But tepid recent readings on German manufacturing and business confidence, along with the impact of sanctions imposed against Russia, do not bode well for the balance of the year. If the eurozone sees its main engine of growth falter, then the effort to prevent deepening disinflation will become even more challenging.

Growth in France is flat, and Italy has fallen back into recession. Both countries will now struggle to meet the deficit targets that had been set for them, and both are calling on the European Central Bank (ECB) to intensify its stimulus program. Yet neither of these two countries has had much success in implementing the structural reform of trade and labor practices that many identify as central to economic progress. Sluggish economic growth and the absence of reform will not help accelerate the decline in eurozone unemployment, which has come down only fractionally since peaking early last year. Improvement in youth unemployment, which remains over 40% in Italy and over 50% in Spain, is clearly being hindered by lingering rigidity in labor markets.

Yet neither of these two countries has had much success in implementing the structural reform of trade and labor practices that many identify as central to economic progress. Sluggish economic growth and the absence of reform will not help accelerate the decline in eurozone unemployment, which has come down only fractionally since peaking early last year. Improvement in youth unemployment, which remains over 40% in Italy and over 50% in Spain, is clearly being hindered by lingering rigidity in labor markets.

The household deleveraging that was necessitated by the Great Recession is well along in the United States and the United Kingdom, but it hasn’t really begun in the eurozone. Disinflation makes the real value of the debt higher – and harder to pay off.

And sluggish growth will also be unhelpful to the health of eurozone banks, which are still being very cautious about lending as they conserve scarce liquidity and capital. The ECB’s asset quality review/stress test will be completed in October, and that will be a critical moment for Europe’s financial system. If carried off well, the results could be a springboard to improved credit flows and confidence.

Despite the disappointing news, we do not expect the ECB to make a near-term change in policy. The new round of long-term refinancing operations is set to begin next month and is designed to promote credit extension and economic growth. While work continues on a more traditional quantitative easing program, significant political and logistical barriers remain. If there is a silver lining in this week’s news, it’s that the willingness of Germany to support further central bank action may have increased.

But patience may be wearing thin: eurozone equity markets have corrected by about 10% since the beginning of the summer. Policy-makers in the region would be advised to stop pointing fingers at one another and start pointing the way to better economic results.

Macroprudential Policy Is Working

Can central banks take some steam out of asset markets at risk for overheating? Is “Too Big to Fail” too big a problem to solve? A couple of recent stories that you might have missed offer some affirmative answers to these questions.

Goldman Sachs recently announced that it was recasting its prime brokerage business, where it offers support to hedge funds. Fees are being raised, and some clients are being asked to take their business elsewhere. This comes as part of an effort to sustain profitability amid increasing operational and compliance costs.  Nonbank financial institutions like hedge funds are often key players in asset markets, and some think their activities drive prices to points that stretch linkages with fundamentals. Since the Federal Reserve does not regulate them, they were thought to be outside the reach of supervisors intent on reducing risks to financial stability. But hedge funds rely on depositories to clear their trades, provide access to the payments system and supply financing. New regulations have made it more expensive for banks to provide these things. So, indirectly, prudential measures may be curbing market enthusiasm.

Nonbank financial institutions like hedge funds are often key players in asset markets, and some think their activities drive prices to points that stretch linkages with fundamentals. Since the Federal Reserve does not regulate them, they were thought to be outside the reach of supervisors intent on reducing risks to financial stability. But hedge funds rely on depositories to clear their trades, provide access to the payments system and supply financing. New regulations have made it more expensive for banks to provide these things. So, indirectly, prudential measures may be curbing market enthusiasm.

It was also announced that the Fed has asked a number of large banks to re-write their recovery and resolution (R&R) plans. These plans, required by the Dodd-Frank act, call for the biggest banks to imagine their potential demise and create a road map for coping with it. The hope is that should trouble ever arise, these contingency plans would obviate the need for a bailout.

Few think that we’ll reach this goal anytime soon. As shown in the chart above, the number of bank subsidiaries has mushroomed during recent decades, motivated by tax and regulatory considerations. The process of writing R&R plans has forced big banks to account for all their disparate operations and potentially consider simplifying them. A smaller organization is easier to resolve, and the Fed may continue to press on the R&R process to move firms in this direction.

Supervisors have encountered skepticism when they’ve touted the use of “macroprudential tools” to achieve the goal of financial stability. But in subtle ways, these strategies are having an important impact on the banking industry.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.