What’s on our mind

- general credit market news

Risk sentiment was back on last week as the market was gearing up for the upcoming ECB announcement later this week. Despite somewhat volatile equity markets, credit markets remained fairly calm and the European IG index itraxx main was 6bp tighter w/w while the HY index (iTraxx crossover) was about 40bp tighter w/w.

We saw larger primary activity compared to the previous week. The market improved in both volumes and diversity of issuance as both core, periphery and non-European issuers entered the market.

European Court of Justice Advocate-General, Pedro Cruz Villalón, announced his opinion last week on the European Central Bank's OMT programme ahead of a ruling expected later this year by the court. Mr. Villalón found the ECB’s bond-purchase programme to be compatible "in principle" with European law, thereby contradicting the German Constitutional Court’s legal challenge and giving Draghi the green light ahead of this week’s expected QE announcement.

Due to expected portfolio rebalancing effects, we anticipate that the ECB’s announcement later this week will have a positive effect on corporate credit spreads going forward, even if the ECB decides only to include SSAs in the purchase programme to begin with.

Close of relative trade (‘Buy’ Stena 2020, ‘Sell’ Stena 2019)

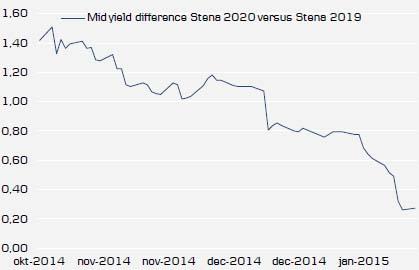

The yield differential is no longer ‘very’ attractive between Stena 2020 and Stena 2019. Yield pickup between the bonds has narrowed to some 0.55% p.a. (compared with a start yield differential of 1.4% p.a. when the trade was suggested on 24 October 2014).

Following healthy relative performance since initiation in October 2014, we close out and take profit on our earlier trade idea (buy Stena 2020, sell Stena 2019).

Fundamentally, we like Stena and currently view the company as a ‘BB’ credit with moderately improving credit metrics short term (<2016) but flat to declining credit metrics longer term (>2016). Following the close of the trade, we keep our absolute ‘Buy’ recommendation on the Stena bonds/CDS

(see valuation chart later in this presentation).

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.