The Canadian dollar was almost unchanged last week, as USD/CAD closed the week at 1.3340. The upcoming week has just three events. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Federal Reserve minutes didn’t contain any surprises, as the guessing game continues regarding a rate hike in December. US Core Inflation met expectations, with a gain of 1.9%. Canadian Retail Sales beat the forecast at 0.3%, but Core Retail Sales missed the estimate with a poor reading of -0.5%.

Updates:

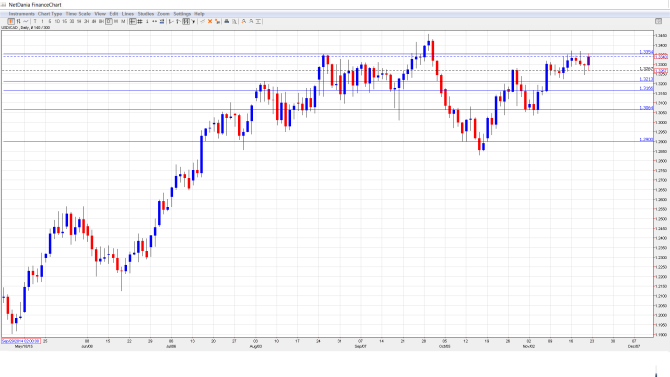

USD/CAD daily chart with support and resistance lines on it.

BOC Deputy Governor Lynn Patterson Speaks: Tuesday, 20:30. Patterson will speak at an event in Regina. A speech that is more hawkish than expected is bullish for the Canadian dollar.

Corporate Profits: Thursday, 13:30. Corporate Profits provides a snapshot of the strength of the business sector. The indicator posted a gain of 12.9% in Q3, after two straight declines.

RMPI: Friday, 13:30. The Raw Materials Price Index measures inflation in the manufacturing sector. The index posted a gain of 3.0% in September, easily beating the estimate of 1.2%. This marked the first gain since May. Will the index repeat with a gain in the October report?

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3318 and climbed to a high of 1.3371. The pair then reversed directions, dropping to a low of 1.3246, as support held firm at 1.3213. USD/CAD closed the week at 1.3340.

Technical lines, from top to bottom

We begin with resistance at 1.3759.

1.3587 was a cap in March 2004.

1.3443 has held firm since late September.

1.3353 was tested and remains a weak resistance line.

1.3213 held firm in support for a second straight week.

1.3165 is the next support line.

1.3063 is protecting the symbolic 1.30 line.

The very round line of 1.2900 is the final line of support for now.

I am bullish on USD/CAD

With speculation rising that the Fed could press the rate trigger in December, the US dollar is in an excellent position to post broad gains. Revisions to the Preliminary GDP will be released during the week, and a strong reading could bolster the US dollar.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.