Daily Forecast - 26 August 2016

EURGBP Spot

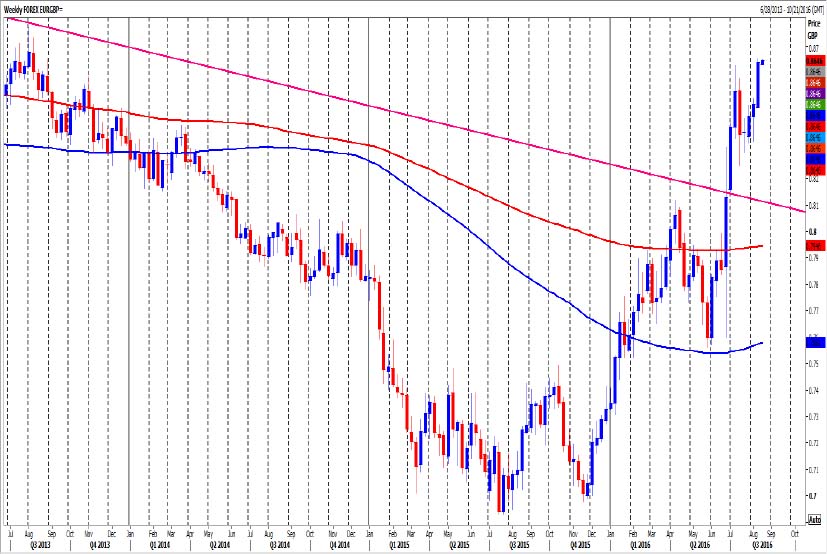

EURGBP topped exactly at strong resistance at 8570/80 as predicted & is headed back to the 8540/30 level. This is only minor support so further losses are possible & target a buying opportunity at 8490/85, with stops below 8470. A break lower however is a sell signal targeting 8460 & good support at 8430/25 with a low for the day expected if we reach this far.

Strong resistance at 8570/80 is the best chance of a high for the day again today, but shorts need stops above 8595. Holding above 8585 is a buy signal targeting 8615 then resistance at 8630/35.

AUDUSD Spot

AUD/USD outlook negative but same levels apply for today with hardly any movement this week unfortunately. First support again at 7590/85. A break below here is more likely & is seen as a sell signal targeting 7550/45 but strong support at 7525/21 could hold the downside so we are profit taking on all remaining shorts on the approach to this area. HOWEVER longs are a little risky...if you try for a quick bounce, use a stop below 7490.

Resistance at 7630/35. Try shorts with stops above 7660. An unexpected break higher targets only minor resistance at 7685/90 then trend line resistance at 7720/25.

USDJPY Spot

USD/JPY first support at 100.30/25 held perfectly yesterday, but below here targets 9999/95. Further losses today could retest the August low at 99.55/53. A break lower in the bear trend cannot be ruled out & could target important June lows at 99.12/08. Buying here on the hope of a double bottom is too risky. A break below 9890 targets 9850/46 then 9810/05.

Holding above first support at 100.25/30 targets quite strong resistance at 100.71/74. If a break higher is seen look for 101.10/15, perhaps as far as a selling opportunity at 101.40/45. Shorts need stops above 101.80.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.