EUR/USD

Pushing higher.

EUR/USD is moving along the direction implied by the upside trend-line. Support can be found at 1.1087 (03/09/2015 low). Stronger support lies at 1.1017 (18/08/2015 low). Hourly resistance can be found at 1.1330 (21/09/2015 high).

In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We remain in a downside momentum.

GBP/USD

Moving sideways.

GBP/USD is still trading between the 50% and the 61.8% Fibonacci retracement. Hourly support can be found at 1.5087 (05/05/2015 low). Stronger support can be found at 1.4960 (23/04/2015 low). Hourly resistance can be found at 1.5659 (27/08/2015 high).

In the longer term, the technical structure looks like a recovery. Strong support is given by the long-term rising trend-line. A key support can be found at 1.4566 (13/04/2015 low).

USD/JPY

Fading momentum.

USD/JPY is still moving sideways. The pair is still moving around the 200-day moving average. Hourly support is given at 118.61 (04/09/2015 low). Stronger support can be found at 116.18 (24/08/2015 low). Hourly resistance can be found at 121.75 (28/08/2015 high).

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF

Riding the upside trend-line.

USD/CHF is still holding below resistance at 0.9844 (25/09/2015 low). The technical structure still shows an upside momentum. We remain bullish in the medium-term.

In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).

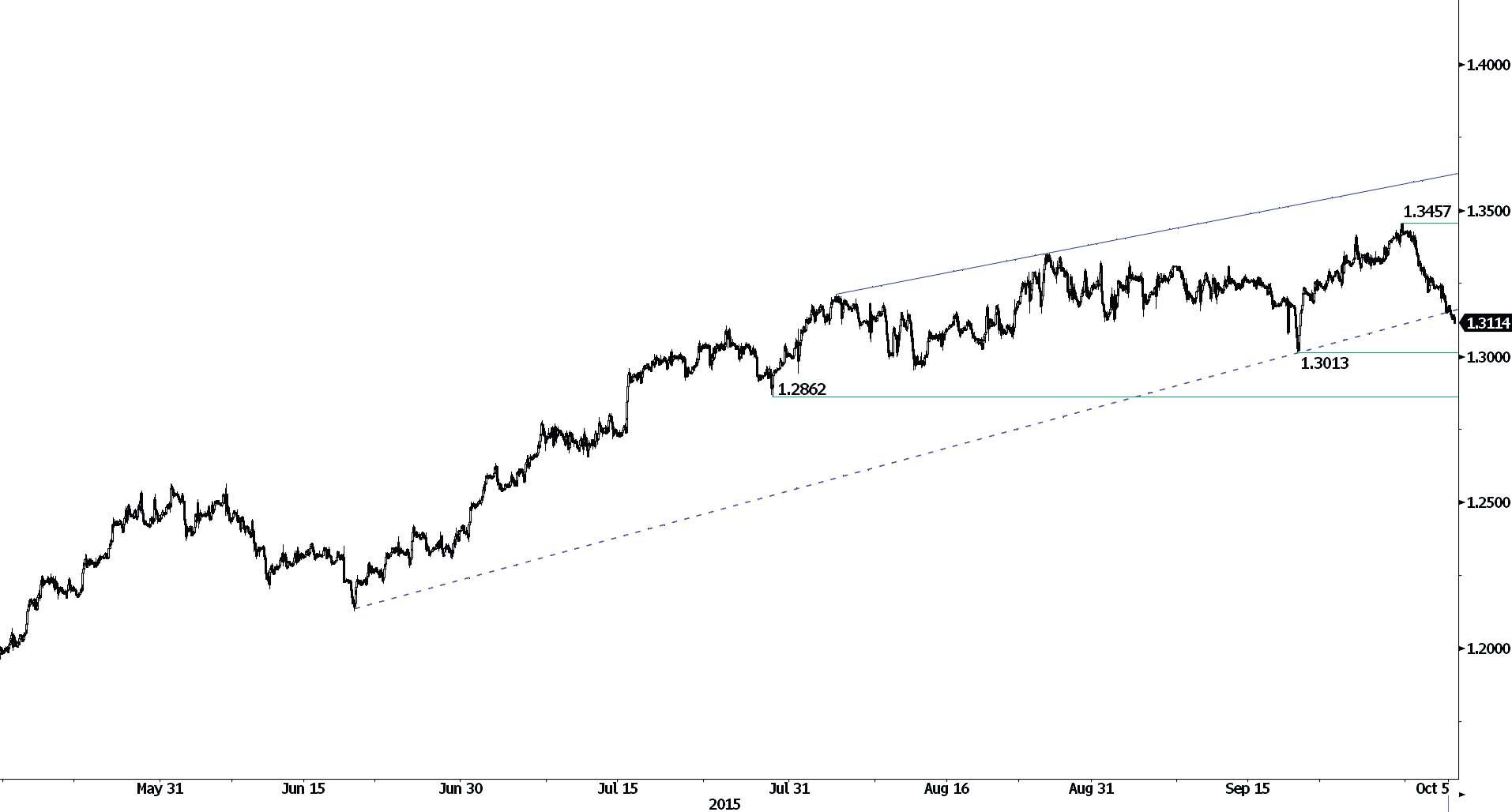

USD/CAD

Bearish momentum growing.

USD/CAD has now entered in a bearish momentum. The pair was showing signs of shortterm exhaustion after its overextended rise. Therefore, the short-term technical structure is negative Expected test of the support at 1.3013 (18/09/2015 low).

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Support can be found at 1.1731 (06/01/2015 low).

AUD/USD

Gaining upside traction.

AUD/USD is pushing higher. Even if the technical structure still favours further weakness, the pair is likely to keep moving slightly higher. Hourly resistance can be found at 0.7280 (18/09/2015 high). Hourly support lies at 0.6893 (04/09/2015 low).

In the long-term, there is no sign to suggest the end of the current downtrend. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

GBP/JPY

Failed to challenge support at 180.24.

GBP/JPY is bouncing back. Hourly support can be found at 180.24 (04/09/2015 low). We think that the bearish momentum is now growing. Expected reversal is still likely to challenge psychological resistance at 190.00.

In the long-term, the lack of any medium-term bearish reversal pattern favours a bullish bias. The successful test of the strong support at 175.51 (03/02/2015 low) signals persistent buying interest. Key resistances stand at 197.45 (26/09/2008 high). A major support area can be found between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low).

EUR/JPY

Moving sideways.

EUR/JPY is moving in either direction between 133.58 and 135.34 (Fibo 50% and 38.2% retracement). Hourly resistance is located at 137.45 (17/09/2015 high). Expected increase of the pair.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Riding the short-term upside trend-line.

EUR/GBP is consolidating after breaking hourly resistance at 0.7422 (24/08/2015 low). Hourly support lies at 0.7196 (22/09/2015 low). Expected bullish move before entering into another downside move.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

EUR/CHF

Downside momentum continues.

EUR/CHF is showing further signs of bearish pressure. The pair is still holding below 1.1000. Hourly support can be found at 1.0823 (22/09/2015 low). Expected growing downside momentum.

The EUR/CHF is digesting its 15 January sharp decline. A key resistance stands at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

GOLD

Trading in range.

Gold is still trading sideways. In the mediumterm there is still no clear momentum. Hourly resistance is given at 1168 (24/08/2015 low). Hourly support can be found at 1093 (12/08/2015 low). Stronger support can be found at 1077 (24/07/2015 low).

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. Although the key support at 1132 (07/11/2014 low) has been broken, a break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Challenging resistance at 15.43.

Silver is trading in a range between hourly support at 13.98 (24/07/2015 low) at resistance is given at 16.53 (04/06/2015 high). Expected growing upside momentum.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. The strong support at 14.66 (05/02/2010 low) has been broken and prices have then consolidated. A key resistance stands at 18.89 (16/09/2014 high).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.