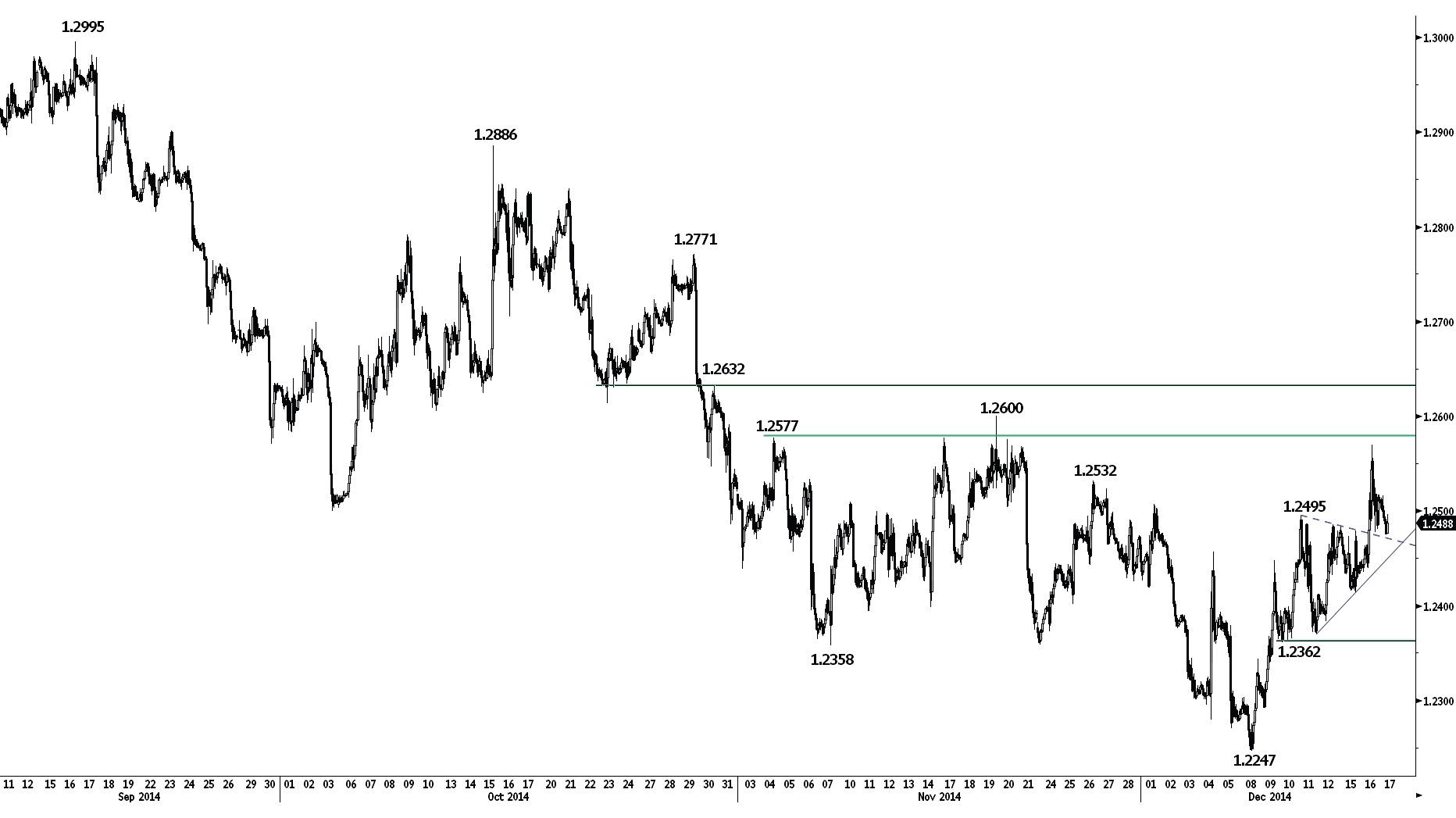

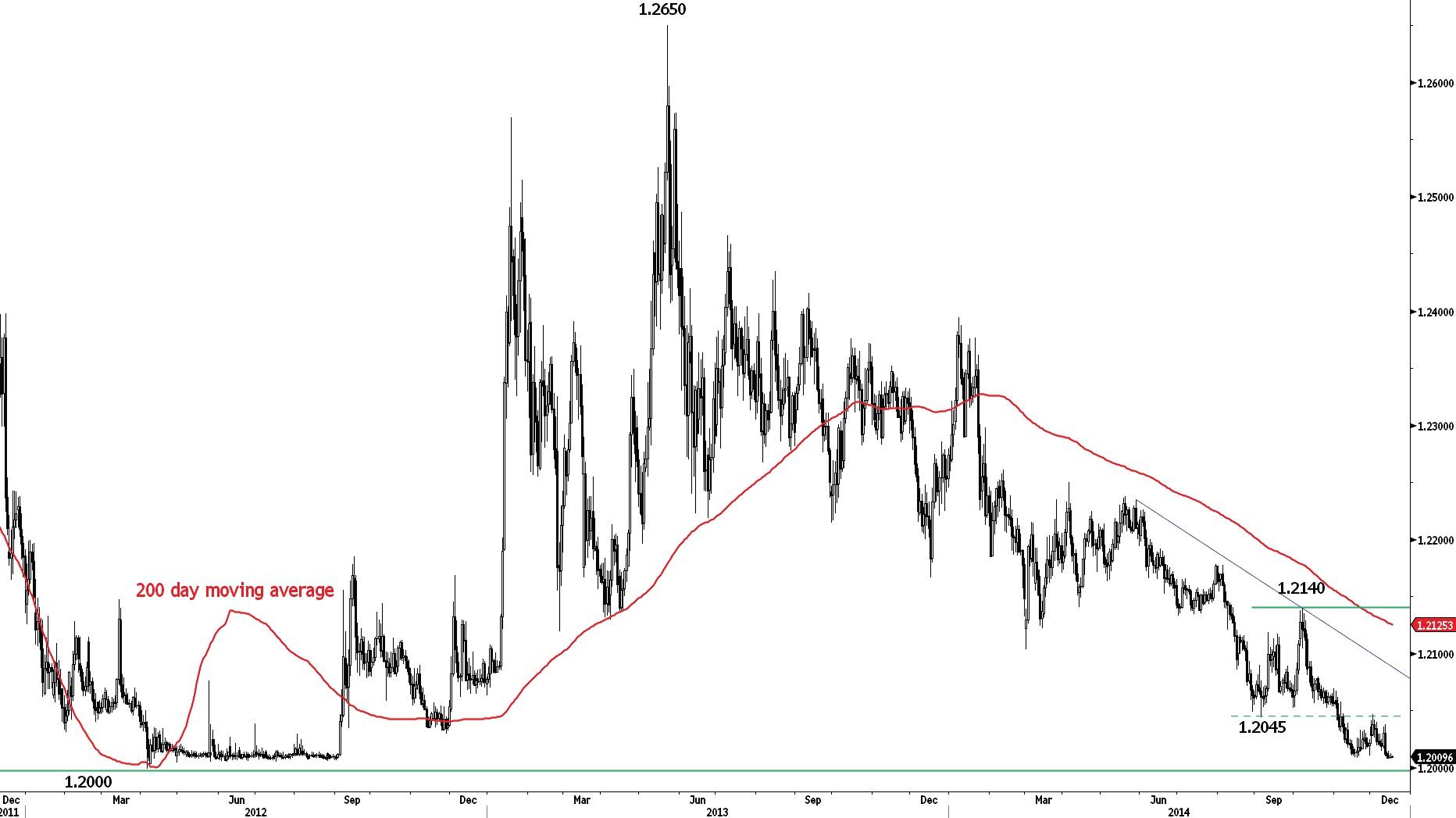

EUR/USD

The key resistance at 1.2577 is intact.

EUR/USD moved higher towards the key resistance area between 1.2577 and 1.2600 yesterday. The short-term upside potential is likely limited by these resistances. Hourly supports are given by the short-term rising trendline (around 1.2450) and 1.2415.

Tonight's FOMC meeting can add some shortterm volatility.

In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) calls for a decline towards the strong support at 1.2043 (24/07/2012 low). A key resistance stands at 1.2600 (19/11/2014 high).

Short 2 units at 1.2522, Obj: Close unit 1 at 1.2305, remaining at 1.2070., Stop: 1.2610 (Entered: 2014-12-16)

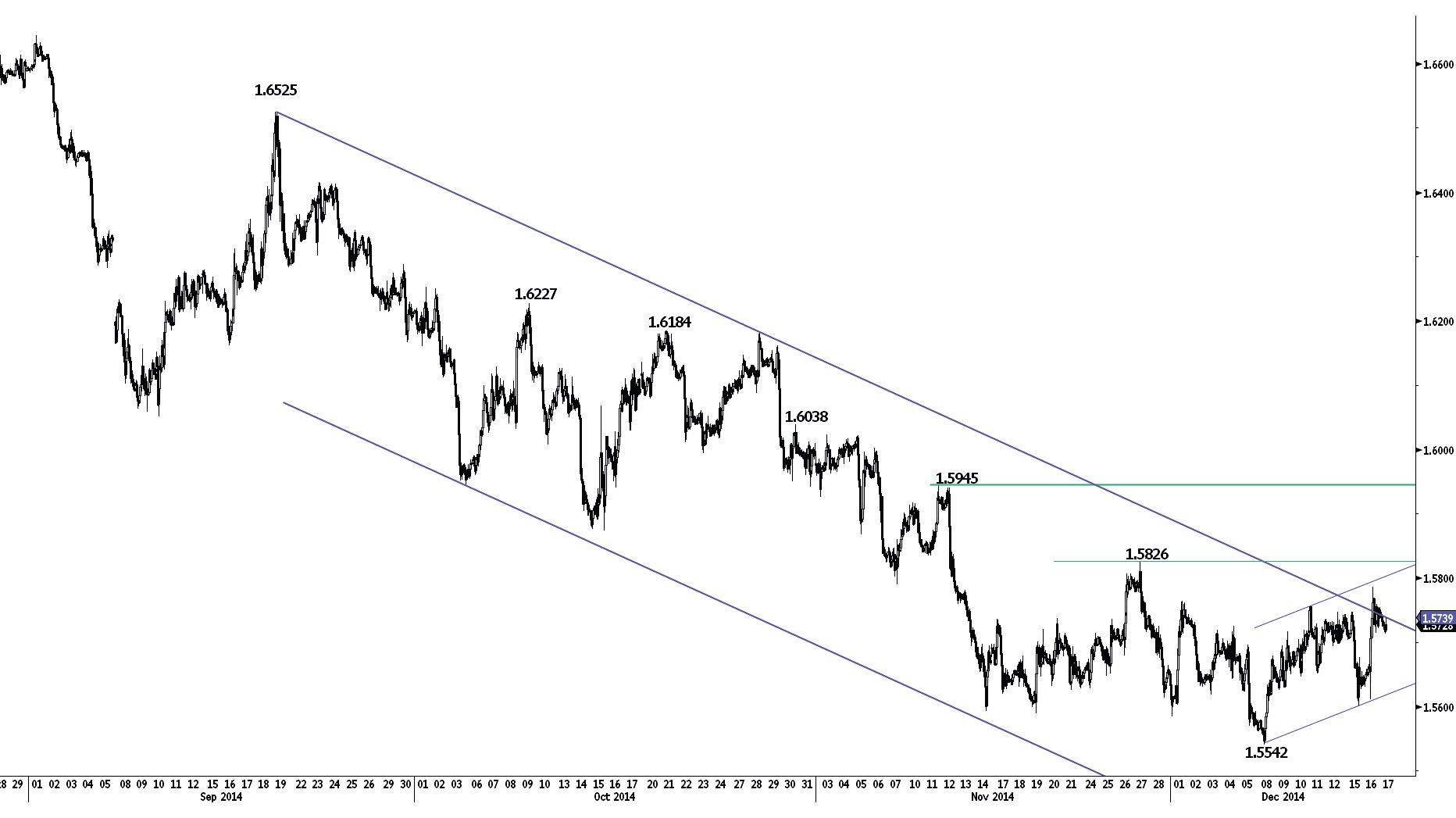

GBP/USD

Consolidating.

GBP/USD has temporary moved above the resistance implied by its declining channel. However, a break of the key horizontal resistance at 1.5826 is needed to significantly improve the medium-term technical structure. Hourly supports can now be found at 1.5677 (intraday high) and 1.5602 (15/12/2014 low).

In the longer term, the technical structure is negative as long as prices remain below the key resistance at 1.5945 (11/11/2014 high). A conservative downside risk is given by a test of the support at 1.5423 (14/08/2013 low). Another support can be found at 1.5102 (02/08/2013 low).

Await fresh signal.

USD/JPY

Successful test of the key support at 115.46.

USD/JPY has thus far successfully tested the key support at 115.46 (see also the 38.2% retracement). Hourly resistances can now be found at 118.01 (16/12/2014 high) and 119.09 (15/12/2014 high, see also the declining trendline).

A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Key supports to monitor for a medium-term consolidation stand at 115.46 (17/11/2014 low) and 113.17 (04/11/2014 low). Currently, there is no sign to suggest the end of the long-term bullish trend.

Await fresh signal.

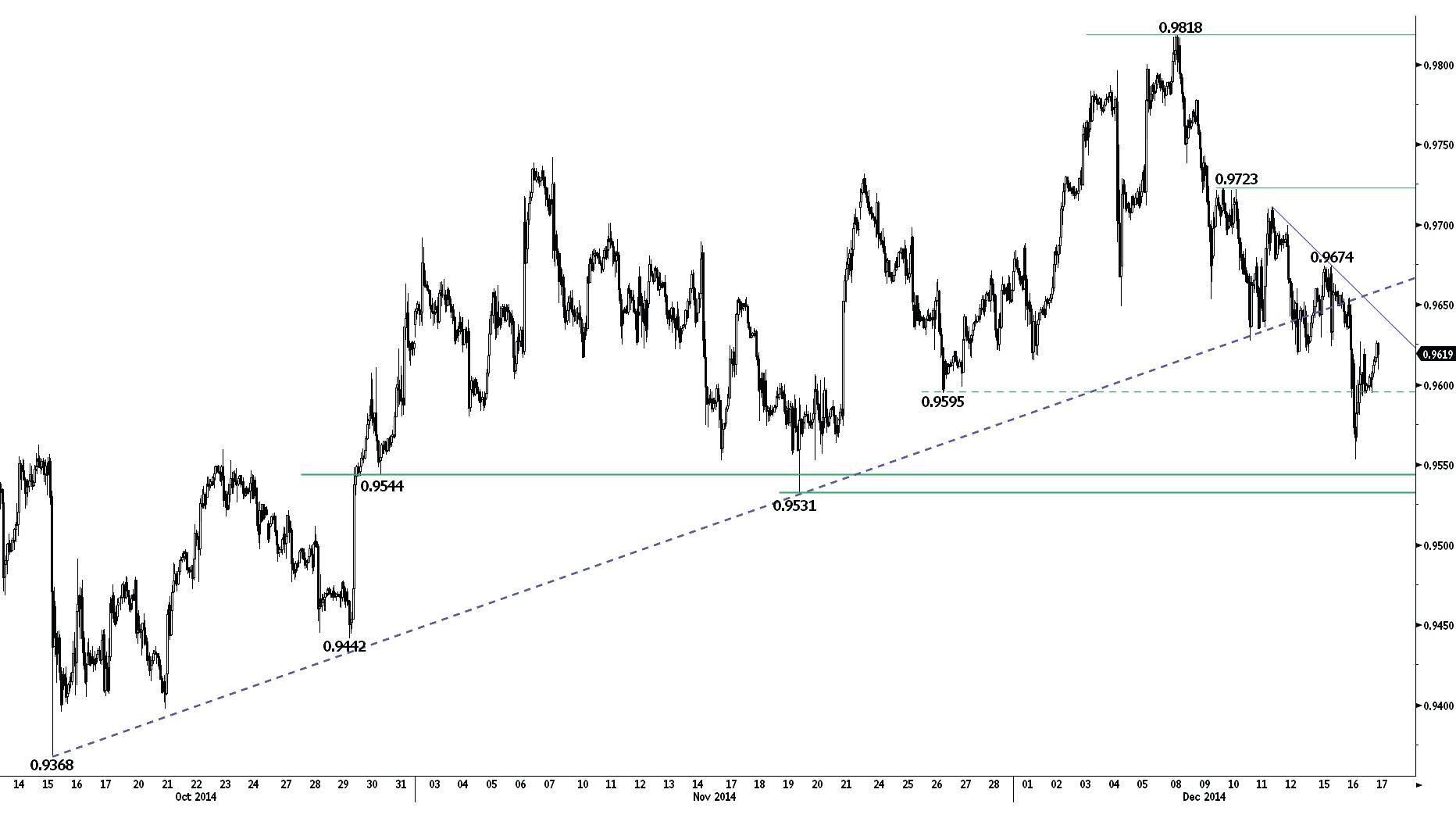

USD/CHF

Bouncing near the key support at 0.9544 and 0.9531.

USD/CHF is showing some buying interest near the key supports at 0.9544/0.9531. Hourly resistances can be found at 0.9654 (intraday high) and 0.9674, while a more significant resistance stands at 0.9723.

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. A major resistance area stands between 0.9972 (24/07/2012 high) and 1.0067 (01/12/2010 high). A key support can be found at 0.9531 (19/11/2014 low).

Await fresh signal.

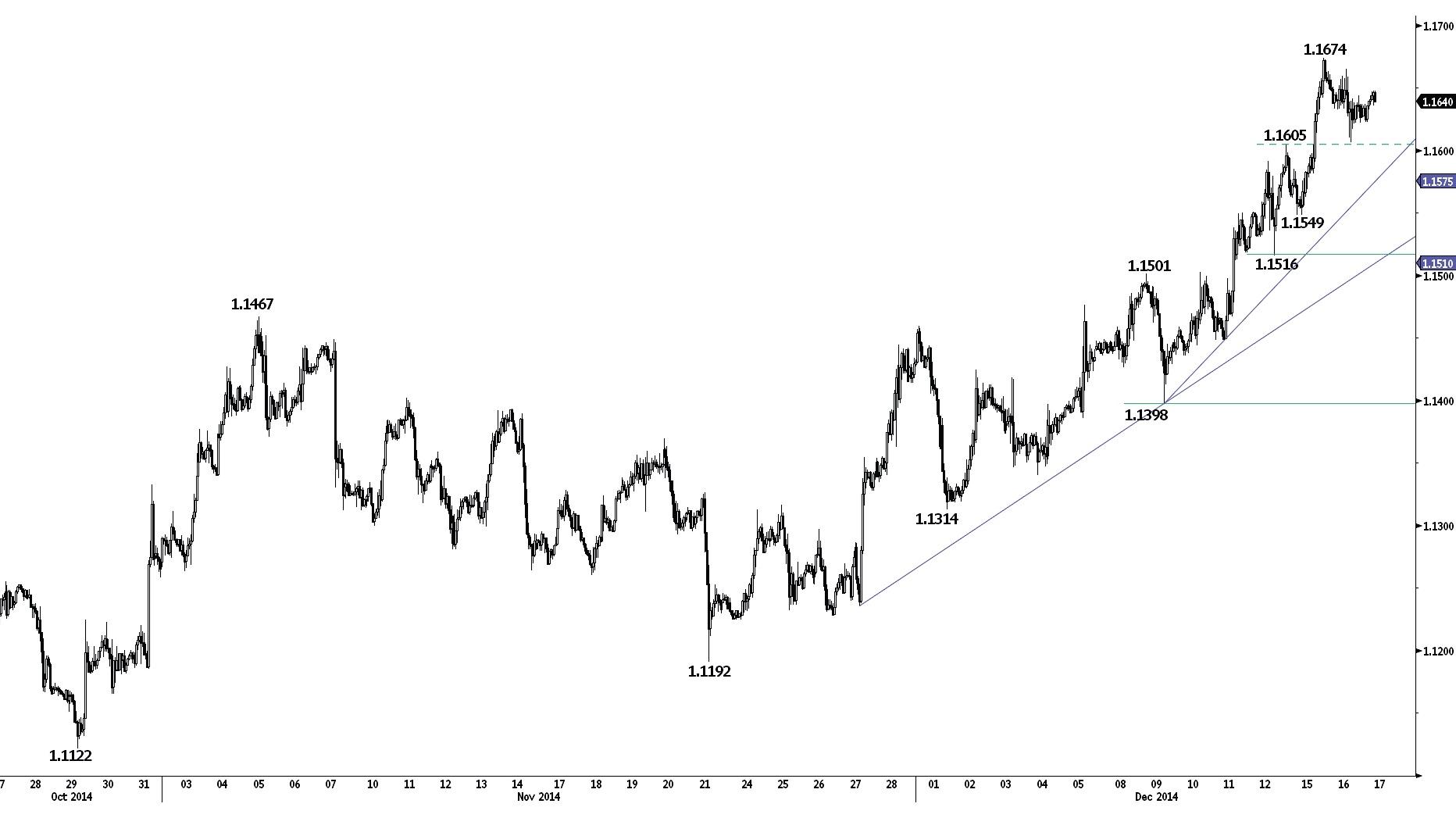

USD/CAD

Approaching the strong resistance at 1.1725.

USD/CAD is getting increasingly overbought. With prices close to the strong resistance at 1.1725, the short-term upside potential seems limited. Hourly supports stand at 1.1605 and 1.1549. An hourly resistance now lies at 1.1674.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is given by the strong resistance at 1.1725 (08/07/2009 high). Given the current overbought conditions, the odds to see a consolidation phase are increasing. Key supports stand at 1.1398 (09/12/2014 low) and 1.1192 (21/11/2014 low). Another resistance is given by the psychological threshold at 1.2000.

Await fresh signal.

AUD/USD

Pushing lower.

AUD/USD is moving lower confirming persistent selling pressures. Hourly resistances can be found at 0.8299 and 0.8372. A strong support lies at 0.8067.

In the long-term, the break of the strong support at 0.8660 (24/01/2014 low) confirms the underlying long-term bearish trend and opens the way for further weakness. A strong support area stands between 0.8067 (25/05/2010 low) and 0.7947 (61.8% retracement of the 2009-2011 rise). A key resistance can be found at 0.8615 (27/11/2014 high).

Await fresh signal.

GBP/JPY

Bouncing close to the key support at 181.13.

GBP/JPY has thus far successfully tested the key support at 181.13. A break of the hourly resistance at 185.02 (previous support) would improve the short-term technical structure. Another resistance can be found at 187.21 (15/12/2014 high).

In the long-term, the trend is positive as long as the key support at 178.74 (23/09/2014 high) holds. The break of the strong resistance at 180.72 (19/09/2014 high) opens the way for further strength. A key resistance stands at 197.45 (24/09/2008 high). A key support lies at 180.72 (19/09/2014 high).

Await fresh signal.

EUR/JPY

Bouncing near the support at 144.79.

EUR/JPY has thus far successfully tested the support at 144.79. Hourly resistances for a shortterm bounce can be found at 147.03 (16/12/2014 high) and 147.90 (intraday high, see also the declining trendline). Another support lies at 143.35 (12/11/2014 low).

The long-term technical structure remains positive as long as the key support at 141.23 (19/09/2014 high) holds. Monitor the test of the psychological resistance at 150.00. Another resistance stands at 157.00 (08/09/2008 high). A key support stands at 144.79.

Await fresh signal.

EUR/GBP

Bearish intraday reversal near the resistance at 0.7977.

EUR/GBP made a significant bearish intraday reversal near the resistance at 0.7977 (01/12/2014 high) yesterday, suggesting exhaustion in buying interest. Hourly supports can be found at 0.7907 (15/12/2014 low, see also the rising trendline) and 0.7874 (12/12/2014 low). A resistance now stands at 0.8007 (16/12/2014 high).

In the longer term, the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) has held thus far. However, a decisive break of the resistance at 0.8034 (25/06/2014 high, see also the declining channel and the 200-day moving average) is needed to confirm an improving technical structure.

Yesterday's whipsaw above the resistance at 0.7977 has stopped our short position.

Our short position has been stopped.

EUR/CHF

Intraday price volatility is decreasing.

EUR/CHF continues to move sideways near the SNB's 1.20 threshold. The lack of any significant bounce highlights persistent selling pressures. An hourly resistance area can be found between 1.2045 (previous support) and 1.2058 (06/11/2014 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which will be enforced with the "utmost determination". For the time being, a break of this threshold is very unlikely. As a result, further tight sideways moves are favoured.

Await fresh signal.

GOLD (in USD)

Monitor the support at 1186.Gold made a sharp bounce yesterday near the support at 1186. However, the resulting large daily upper shadow favours a short-term bearish bias. An hourly resistance now lies at 1224 (16/12/2014 high). Other supports stand at 1170 (intraday low) and 1143.

In the long-term, the move below the strong support at 1181 (28/06/2013 low) confirms the underlying downtrend and opens the way for further declines towards the strong support at 1027 (28/10/2009 low). A break of the strong resistance at 1255 (21/10/2014 high) is needed to invalidate this bearish outlook.

Await fresh signal.

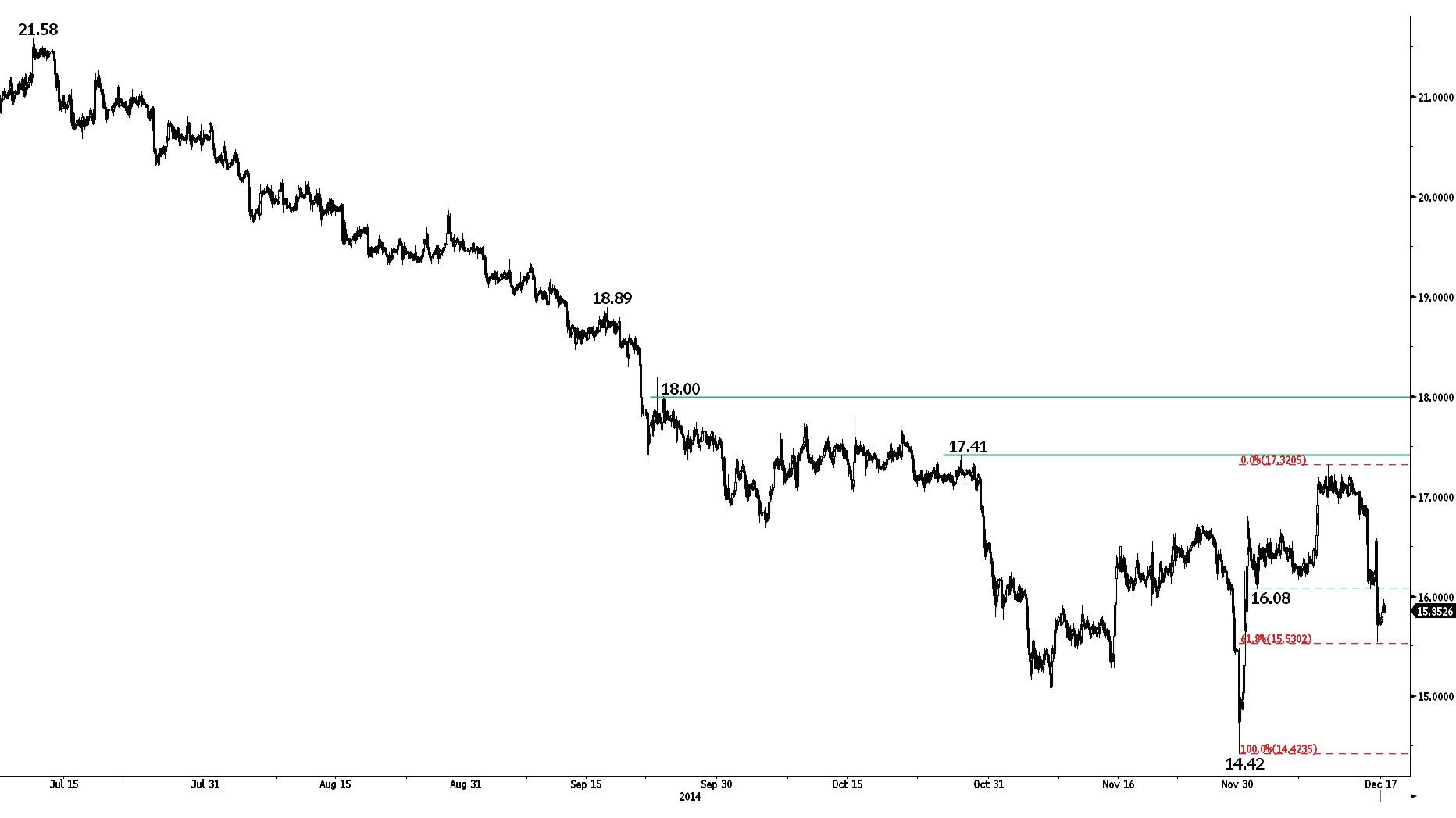

SILVER (in USD)

The support at 16.08 has been broken.

Silver has broken the support at 16.08, confirming increasing selling pressures. The support at 15.52 (intraday low, see also the 61.8% retracement) is challenged. Another support lies at 14.42. Hourly resistances can now be found at 16.08 (previous support) and 16.64 (16/12/2014 high).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Although the strong support at 14.66 (05/02/2010 low) has held thus far, the lack of any base formation continues to favour a long-term bearish bias. A key resistance lies at 18.00 (23/09/2014 high). Another key support can be found at 11.77 (20/04/2009 low).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.