EUR/USD

Consolidating.

EUR/USD is consolidating. The recent succession of lower highs needs to be broken to favour further short-term strength. Hourly resistance stand at 1.2495 and 1.2532. Hourly supports can be found at 1.2415 (15/12/2014 low) and 1.2362.

In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) calls for a decline towards the strong support at 1.2043 (24/07/2012 low). A key resistance stands at 1.2600 (19/11/2014 high).

Sell limit 2 units at 1.2522, Obj: Close unit 1 at 1.2305, remaining at 1.2070., Stop: 1.2610.

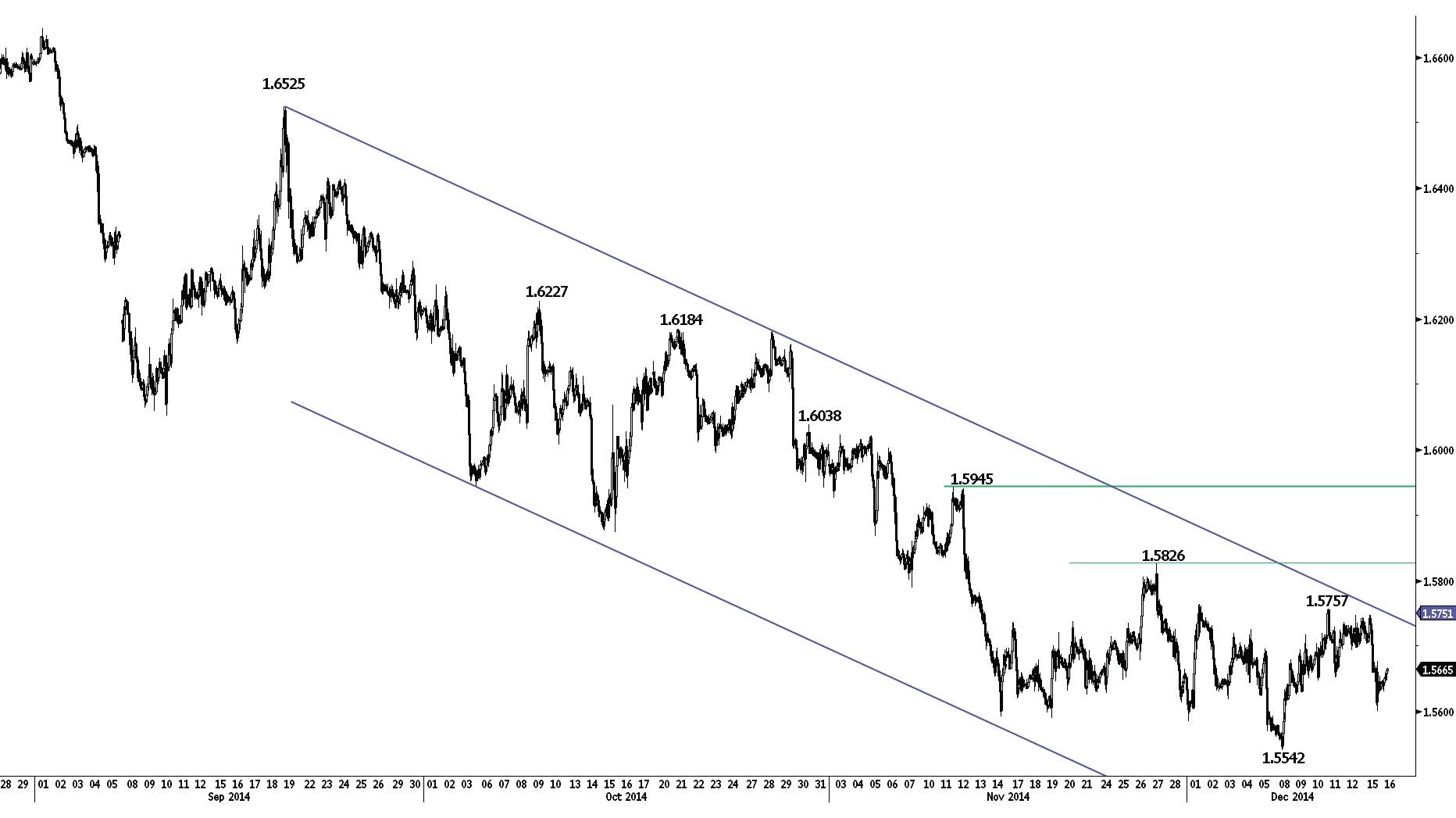

GBP/USD

Fading near the resistance implied by its declining channel.

GBP/USD has weakened near the resistance implied by its declining channel. An hourly resistance lies at 1.5757. Hourly supports can now be found at 1.5602 (15/12/2014 low) and 1.5542. A key horizontal resistance stands at 1.5826.

In the longer term, the technical structure is negative as long as prices remain below the key resistance at 1.5945 (11/11/2014 high). A conservative downside risk is given by a test of the support at 1.5423 (14/08/2013 low). Another support can be found at 1.5102 (02/08/2013 low).

Await fresh signal.

USD/JPY

Weakening.

USD/JPY remains weak, as can be seen by the move below the support at 117.24. Another key support stands at 115.46 (see also the 38.2% retracement). Hourly resistances can now be found at 118.01 (intraday high) and 119.09 (15/12/2014 high, see also the declining trendline).

A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Given the major resistance at 124.14 (22/06/2007 high) and the overextended rise, the odds to see a medium-term consolidation phase are elevated. However, there is no sign to suggest the end of the long-term bullish trend.

Await fresh signal.

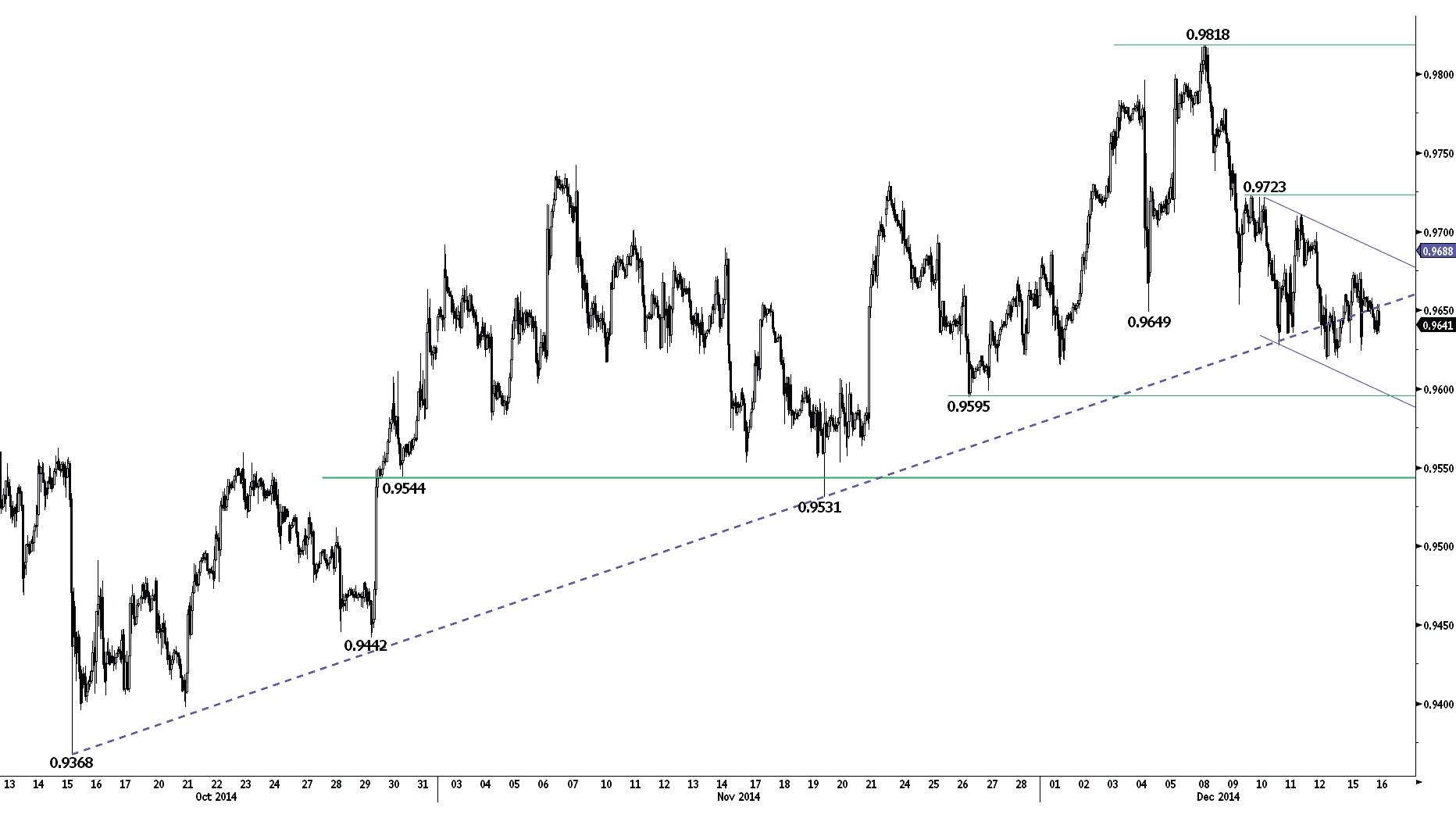

USD/CHF

Remains weak.

USD/CHF has moved below its rising trendline, indicating persistent selling pressures. An hourly support now lies at 0.9595. Hourly resistances are given by the short-term declining channel (around 0.9687) and 0.9723.

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. A major resistance area stands between 0.9972 (24/07/2012 high) and 1.0067 (01/12/2010 high). A key support can be found at 0.9351 (19/11/2014 low).

Await fresh signal.

USD/CAD

Approaching the key resistance at 1.1725.

USD/CAD has recently increased its rate of ascent and is now close to the key resistance at 1.1725. Hourly supports now stand at 1.1605 (intraday high) and 1.1549 (15/12/2014 low).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is given by the strong resistance at 1.1725 (08/07/2009 high). Given the current overbought conditions, the odds to see a consolidation phase are increasing. Key supports stand at 1.1398 (09/12/2014 low) and 1.1192 (21/11/2014 low). Another resistance is given by the psychological threshold at 1.2000.

Await fresh signal.

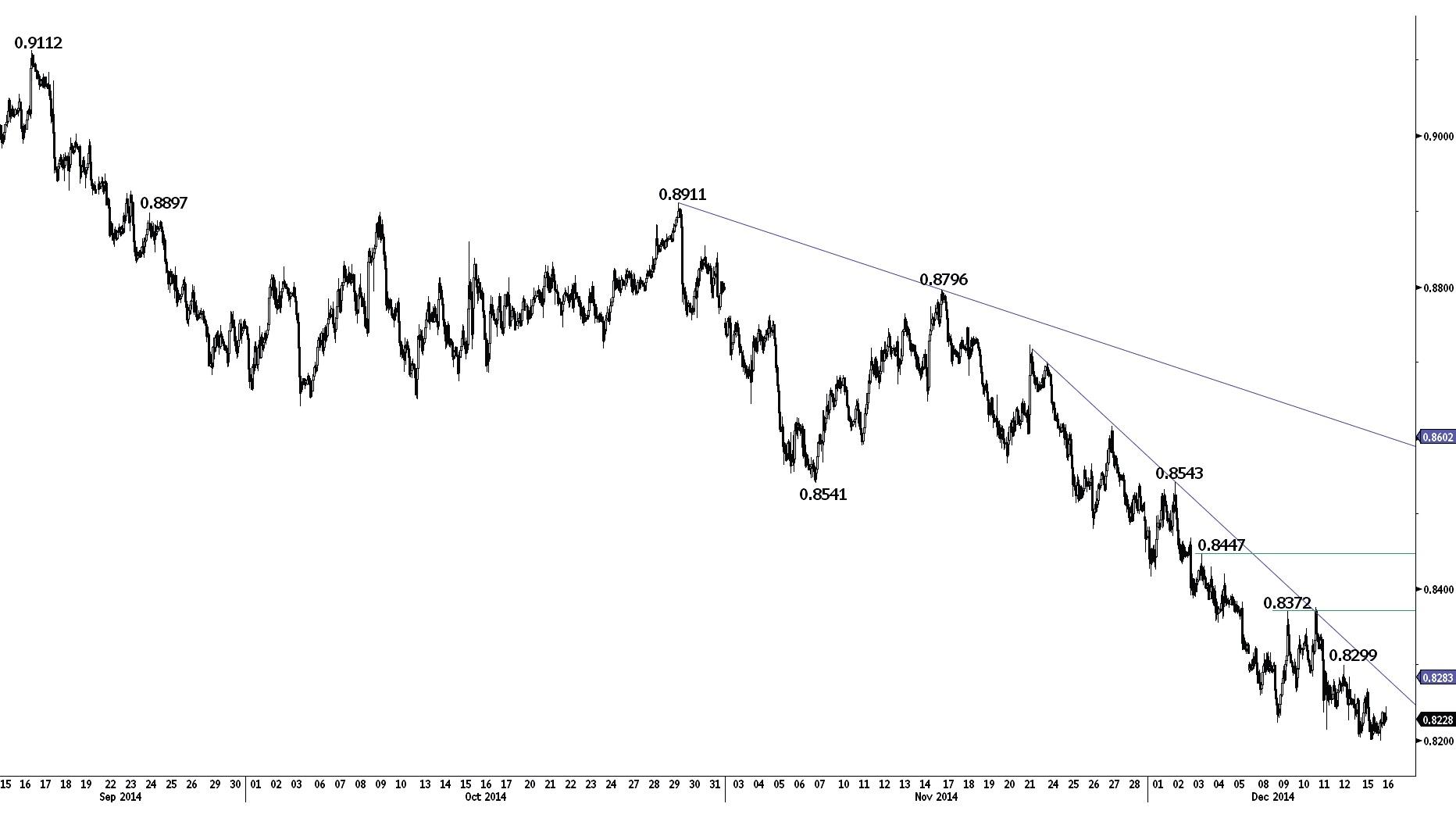

AUD/USD

Making marginal new lows.

AUD/USD is in a succession of lower highs, confirming an underlying bearish trend. The recent marginal new lows suggest a potential lack of sustained short-term selling pressures. Hourly resistances can be found at 0.8299 and 0.8372.

In the long-term, the break of the strong support at 0.8660 (24/01/2014 low) confirms the underlying long-term bearish trend and opens the way for further weakness. A strong support area stands between 0.8067 (25/05/2010 low) and 0.7947 (61.8% retracement of the 2009-2011 rise). A key resistance can be found at 0.8615 (27/11/2014 high).

Await fresh signal.

GBP/JPY

The support at 185.02 has been broken.

GBP/JPY has broken the support at 185.02, confirming a weak short-term technical structure. The support at 183.98 has also been broken, opening the way for a test of the key support at 181.13. An hourly resistance area now stands between 184.62 (intraday high) and 185.02 (previous support).

In the long-term, the trend is positive as long as the key support at 178.74 (23/09/2014 high) holds. The break of the strong resistance at 180.72 (19/09/2014 high) opens the way for further strength. A key resistance stands at 197.45 (24/09/2008 high). A key support lies at 180.72 (19/09/2014 high).

Await fresh signal.

EUR/JPY

Drifting lower.

EUR/JPY has broken the support at 146.43, confirming a weak short-term technical structure. The support at 145.59 is challenged. Other supports lie at 144.79 and 143.35 (12/11/2014 low). Hourly resistances can now be found at 146.79 (intraday high) and 147.90 (intraday high, see also the declining channel).

The long-term technical structure remains positive as long as the key support at 141.23 (19/09/2014 high) holds. Monitor the test of the psychological resistance at 150.00. Another resistance stands at 157.00 (08/09/2008 high). A key support stands at 144.79.

Await fresh signal.

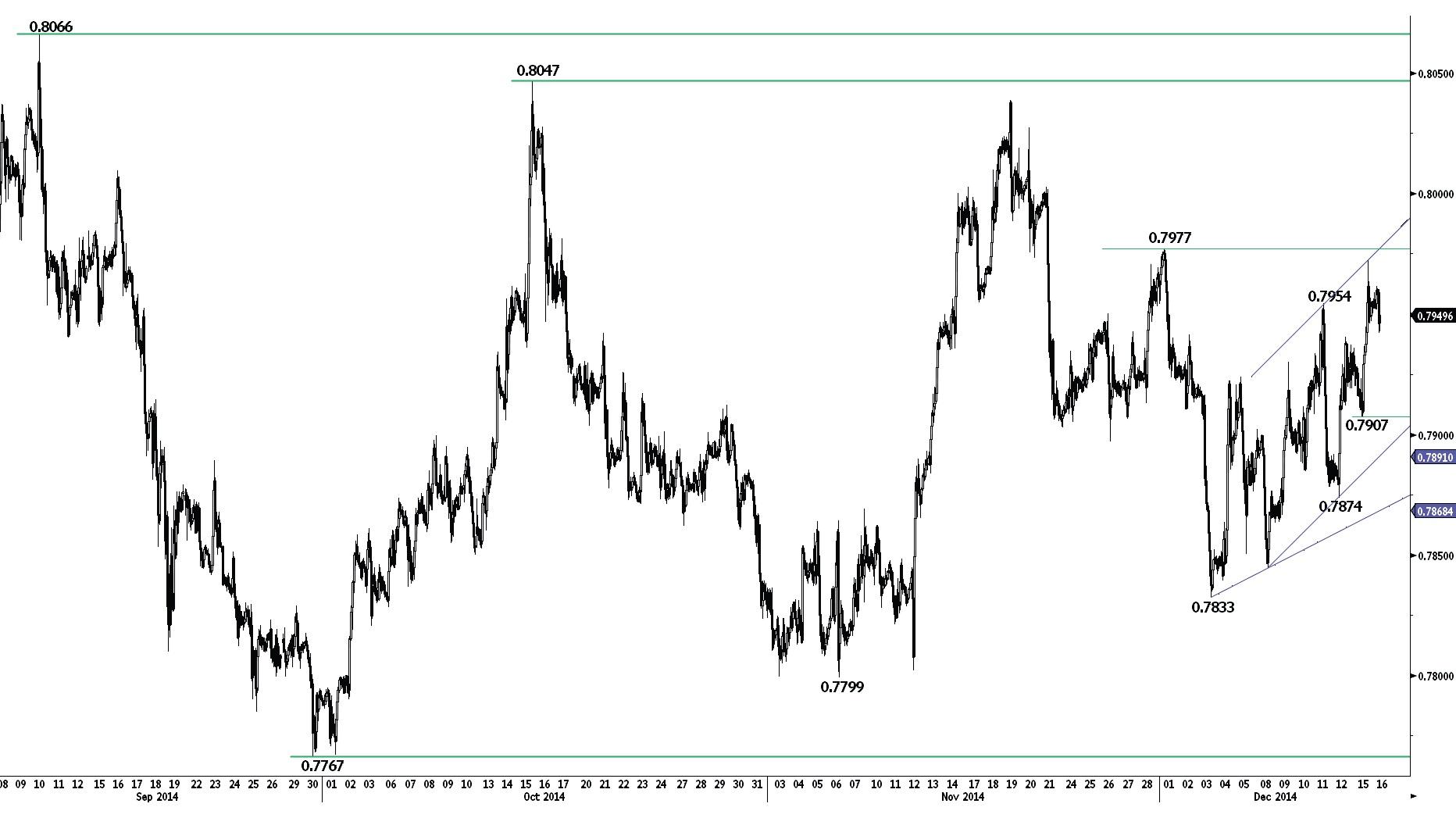

EUR/GBP

Challenging the resistance at 0.7977.

EUR/GBP continues to rebound and is now challenging the resistance at 0.7977. A key resistance stands at 0.8047. Hourly supports can be found at 0.7907 (see the rising channel) and 0.7874.

In the longer term, the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) has held thus far. However, a decisive break of the resistance at 0.8034 (25/06/2014 high, see also the declining channel and the 200-day moving average) is needed to confirm an improving technical structure.

Short 2 units at 0.7939, Obj: Close unit 1 at 0.7833, remaining at 0.7705., Stop: 0.7987 (Entered: 2014-12-11).

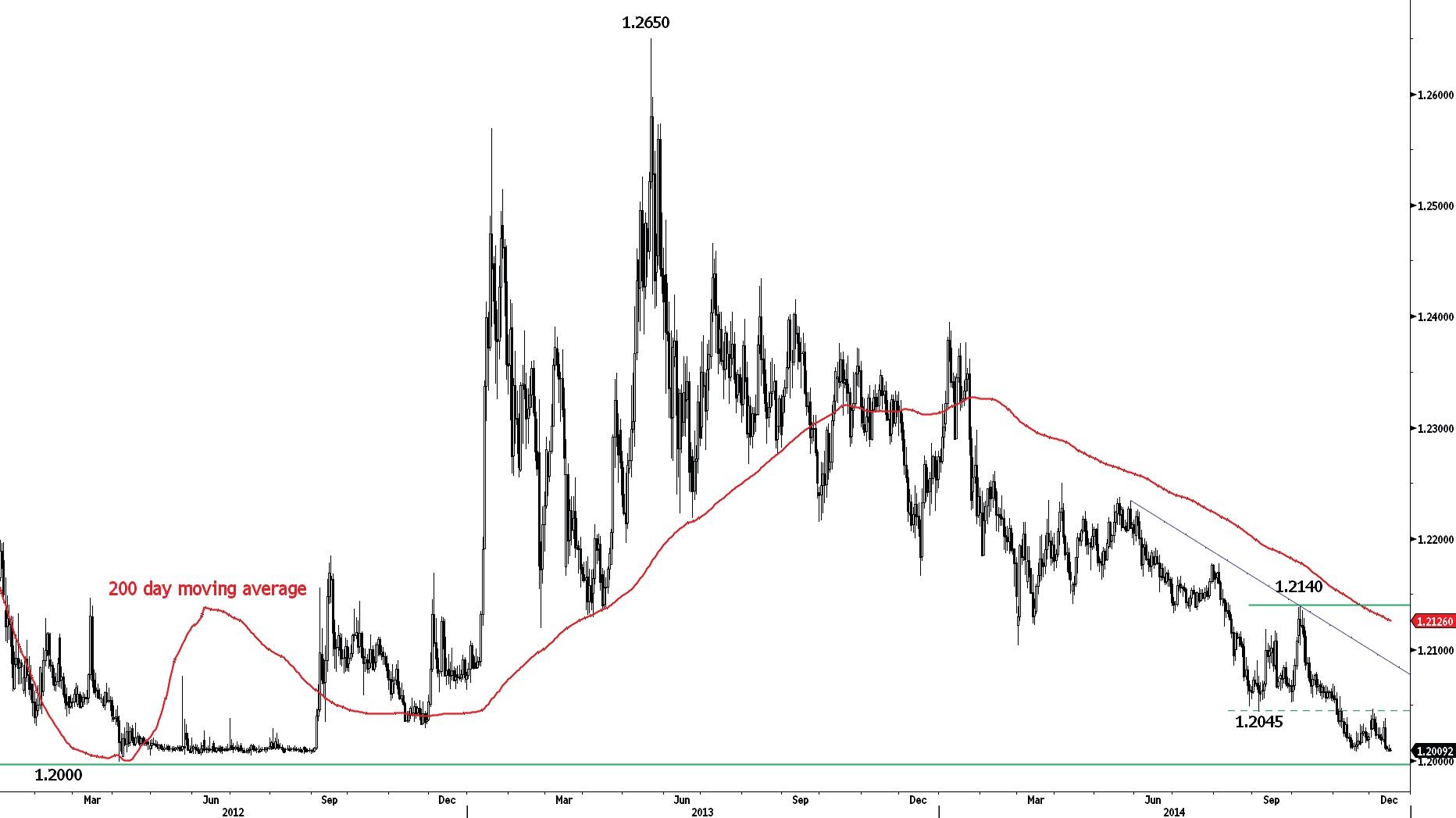

EUR/CHF

Moving sideways near the 1.20 threshold.

EUR/CHF continues to move sideways near the SNB's 1.20 threshold. The lack of any significant bounce highlights persistent selling pressures. An hourly resistance area can be found between 1.2045 (previous support) and 1.2058 (06/11/2014 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which will be enforced with the "utmost determination". For the time being, a break of this threshold is very unlikely. As a result, further tight sideways moves are favoured.

Await fresh signal.

GOLD (in USD)

Monitor the support at 1186.

Gold has declined after having failed to break the resistance at 1236 (see also the declining trendline). Monitor the test of the support at 1186. An hourly resistance now lies at 1217 (intraday high). Other supports stand at 1170 (intraday low) and 1143.

In the long-term, the move below the strong support at 1181 (28/06/2013 low) confirms the underlying downtrend and opens the way for further declines towards the strong support at 1027 (28/10/2009 low). A break of the strong resistance at 1255 (21/10/2014 high) is needed to invalidate this bearish outlook.

Await fresh signal.

SILVER (in USD)

Weakening.

Silver has broken the hourly support at 16.80 (01/12/2014 high), confirming a weakening momentum. Monitor the test of the support at 16.08. An hourly resistance can be found at 16.77 (intraday low). Another support lies at 15.52 (intraday low).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Although the strong support at 14.66 (05/02/2010 low) has held thus far, the lack of any base formation continues to favour a long-term bearish bias. A key resistance lies at 18.00 (23/09/2014 high). Another key support can be found at 11.77 (20/04/2009 low).

Our long position has been stopped.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.