EUR/USD

Weak recovery to start the week.

EUR/USD remains capped by the short-term declining trendline and the hourly resistance at 1.2988 (05/09/2014 high). A break of these resistances is needed to suggest exhaustion in selling pressures. An hourly support now lies at 1.2835, while a key support stands at 1.2755.

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The break of the key support at 1.3105 (06/09/2013 low) opens the way for a decline towards the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low). A key resistance lies at 1.3221 (28/08/2014 high).

Await fresh signal.

GBP/USD

Post-Scotland referendum bounce fades.

GBP/USD recovery above the 1.6500 handle has faltered. Failure to rally above key resistance at 1.6644 (see also the 200 day moving average) signals a period of sideways trading. Hourly supports can be found at 1.6345 (intraday low) and 1.6247 (18/09/2014 low).

In the longer term, the collapse in prices after having reached 4-year highs has created a strong resistance at 1.7192, which is unlikely to be broken in the coming months. Monitor the recent rebound as it could signal the start of a medium-term consolidation phase. A support lies at 1.6052, while a strong support stands at 1.5855 (12/11/2013 low).

The first objective at 1.6495 of our long strategy has been reached. We have updated our stop-loss.

Long 1 unit at 1.6368, Obj: Close unit at 1.6640, Stop: 1.6337 (Entered: 2014-09-18).

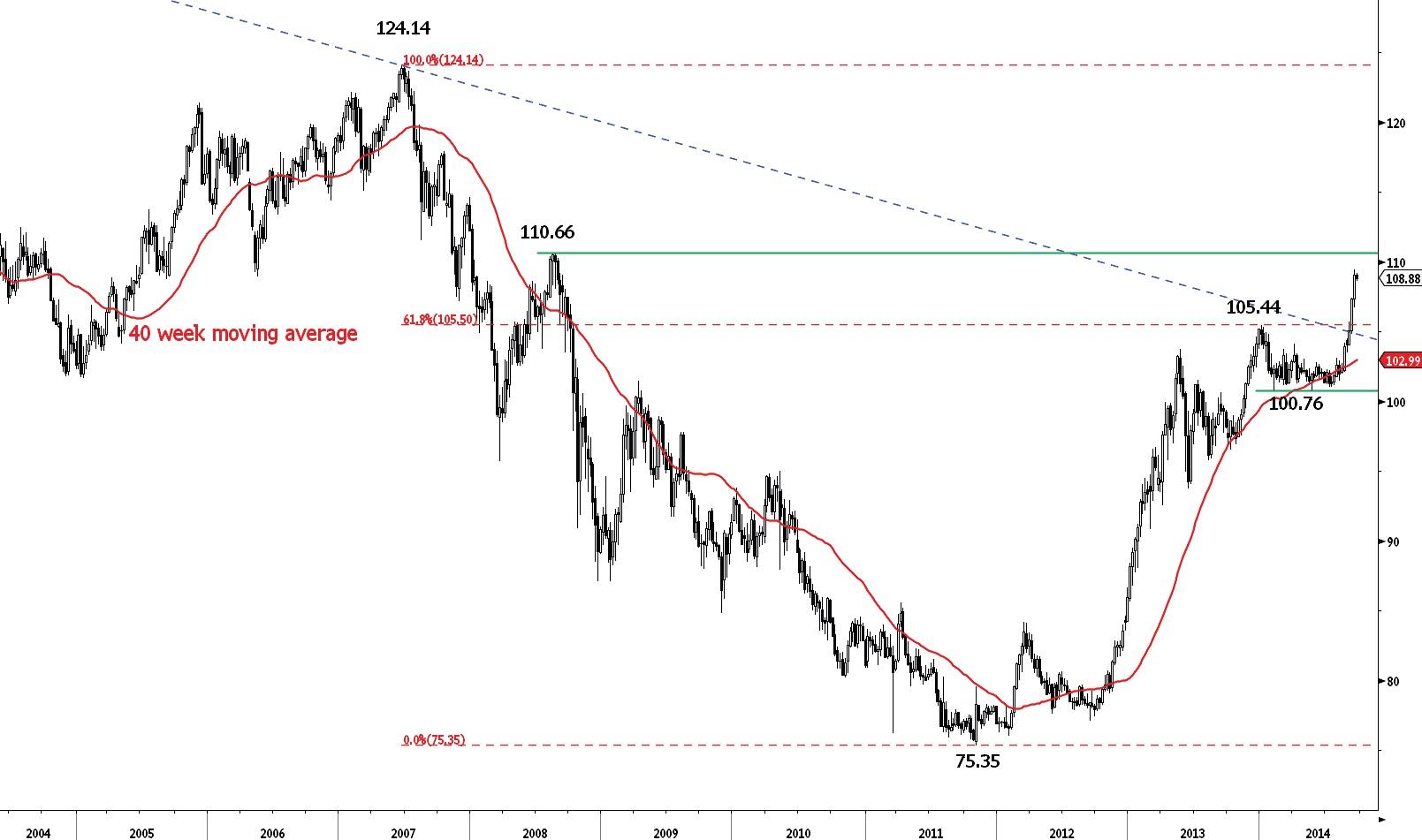

USD/JPY

Minor bullish pause.

USD/JPY continues its steep advance and is now close to the major resistance at 110.66. Given the overextended rise, the odds to see a short-term correction are increasing. Hourly supports can be found at 108.37 (intraday low) and 107.39 (12/09/2014 high).

A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The recent new highs confirm a strong underlying bullish trend. Despite a likely pause near the major resistance at 110.66 (15/08/2008 high), an eventual break to the upside is favoured. Another resistance can be found at 114.66 (27/12/2007 high).

Await fresh signal.

USD/CHF

Fading near the strong resistance at 0.9456.

USD/CHF declined sharply near the strong resistance at 0.9456 yesterday. A break of the hourly support area between 0.9301 (16/09/2014 low, see also the rising trendline) and 0.9287 would signal a corrective phase.

From a longer term perspective, the technical structure calls for the end of the large corrective phase that started in July 2012. The break of the strong resistance at 0.9250 (07/11/2013 high) opens the way for a move towards the next strong resistance at 0.9456 (06/09/2013 high). Supports can be found at 0.9176 (03/09/2014 low) and 0.9104 (22/08/2014 low). A psychological resistance lies at 0.9500.

Await fresh signal.

USD/CAD

Fail to hold below support at 1.0934.

USD/CAD has thus far successfully tested its support at 1.0934. However, monitor this level as a daily break would validate a bearish head and shoulders formation. An hourly resistance can be found at 1.1024 (18/09/2014 high). Another resistance lies at 1.1099, whereas another support stands at 1.0811.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Approaching the support at 0.8891.

AUD/USD is approaching the support at 0.8891. An initial resistance lies at 0.9002 (intraday high), while more significant resistances stand at 0.9112 (16/09/2014 high) and 0.9218 (10/09/2014 high).

In the medium-term, the break to the downside out of the 5 month horizontal range between 0.9206 and 0.9505 (bearish head and shoulders formation) calls for a further decline towards the support at 0.8891 (03/03/2014 low). A strong support stands at 0.8660 (24/01/2014 low).

Await fresh signal.

GBP/JPY

Slight pullback from new highs.

GBP/JPY has broken the key resistance at 175.37 (03/07/2014 low), confirming the underlying bullish trend. Hourly supports now lie at 177.72 (intraday low) and 176.88 (intraday low).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further long-term strength. The resistance at 179.17 (see also psychological threshold at 180.00) is challenged. Other resistances can be found at 183.98 (50% retracement of the 2007-2009 decline) and 197.45. Strong supports lie at 172.99 (16/09/2014 low) and 169.51 (11/04/2014 low).

Await fresh signal.

EUR/JPY

Bullish breakout at 140.09.

EUR/JPY has broken the key resistance area defined by the declining trendline and 140.09 (see also the 200 day moving average). Hourly supports can be found at 139.85 (intraday low) and 139.15 (18/09/2014 low).

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. The break of the strong resistance at 140.09 (09/06/2014 high) confirm exhaustion in selling pressures. Another resistance can be found at 142.47 (29/04/2014 high).

Await fresh signal.

EUR/GBP

Recovers off new lows.

EUR/GBP has broken its support at 0.7874, opening the way for a test of the key support at 0.7755. The short-term technical structure is negative as long as prices remain below the resistance at 0.7915 (18/09/2014 high). Another resistance stands at 0.8010 (16/09/2014 high).

In the longer term, the underlying downtrend favours a test of the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) at minimum. A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

Basing near 1.2070

EUR/CHF has weakened near the resistance at 1.2121 (15/08/2014 high). The support implied by the rising trendline (1.2087) has been broken. Another support stands at 1.2045. An hourly resistance now lies at 1.2091 (intraday high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future. As a result, further sideways moves are expected in the mediumterm.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Remains weak.

Gold has broken the support at 1240, confirming an underlying bearish momentum. The support at 1219 (08/01/2014 low) is challenged. Hourly resistances can be found at 1243 (16/09/2014 high) and 1258 (09/09/2014 high).

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured. The recent break to the downside out of the symmetrical triangle confirms this scenario.

Await fresh signal.

SILVER (in USD)

Heading towards major support area.

Silver has broken key support at 18.13 and is nearing major supply level at 17.06. A break of the hourly resistance at 18.88 is needed to suggest exhaustion in short-term selling pressures. Another hourly resistance can be found at 19.15 (10/09/2014 high).

In the long-term, the underlying downtrend and the potential declining triangle underway since August 2013 favour a bearish bias despite the major support area between 18.64 (30/05/2014 low) and 18.23 (28/06/2013 low). Another support can be found at 14.64 (05/02/2010 low). A key resistance lies at 21.58 (10/07/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.