EUR/USD

Challenging the key support at 1.3105.

EUR/USD is challenging its key support at 1.3105 (06/09/2013 low). Hourly resistances for a short-term bounce can be found at 1.3221 (28/08/2014 high) and 1.3297 (22/08/2014 high).

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. A long-term decline towards the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) is favoured. However, in the shorter term, monitor the test of the key support at 1.3105 (06/09/2013 low) given the general oversold conditions. A key resistance lies at 1.3444 (28/07/2014 high).

Await fresh signal.

GBP/USD

Fading near its declining trendline.

GBP/USD is fading near the resistance implied by the declining trendline, suggesting persistent short-term selling pressures. Hourly supports stand at 1.6537 and 1.6501 (25/08/2014 low). Hourly resistances can now be found at 1.6644 and 1.6679.

In the longer term, the break of the key support at 1.6693 (29/05/2014 low, see also the 200 day moving average) invalidates the positive outlook caused by the previous 4-year highs. However, the lack of medium-term bearish reversal pattern and the short-term oversold conditions do not call for an outright bearish view. A key support stands at 1.6460 (24/03/2014 low).

Long 2 units at 1.6611, Obj: Close 1 unit at 1.6883, remaining at 1.7165, Stop: 1.6527 (Entered: 2014-08-28).

USD/JPY

Pushing higher towards the strong resistance at 105.44.

USD/JPY is making new highs, opening the way for a test of the strong resistance at 105.44 (see also the 61.8% retracement and the longterm declining trendline). Hourly supports can be found at 104.22 (intraday low) and 103.50 (22/08/2014 low).

A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The break to the upside out of the consolidation phase between 100.76 (04/02/2014 low) and 103.02 favours a resumption of the underlying bullish trend. Strong resistances can be found at 105.44 (02/01/2014 high) and 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Grinding higher.

USD/CHF remains well supported as can be seen by today's new highs. Hourly supports now stand at 0.9177 (01/09/2014 low) and 0.9126 (28/08/2014 low).

From a longer term perspective, the recent technical improvements call for the end of the large corrective phase that started in July 2012. The first upside potential at 0.9207, implied by the March-May double-bottom formation, has been met. Key resistances stand at 0.9250 (07/11/2013 high) and 0.9456 (06/09/2013 high).

Await fresh signal.

USD/CAD

Bouncing.

USD/CAD is bouncing after its successful test of the support area given by 1.0809 (50% retracement) and 1.0797. Hourly resistances can be found at 1.0908 (intraday high) and 1.0928 (22/08/2014 low).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Lack of buying interest.

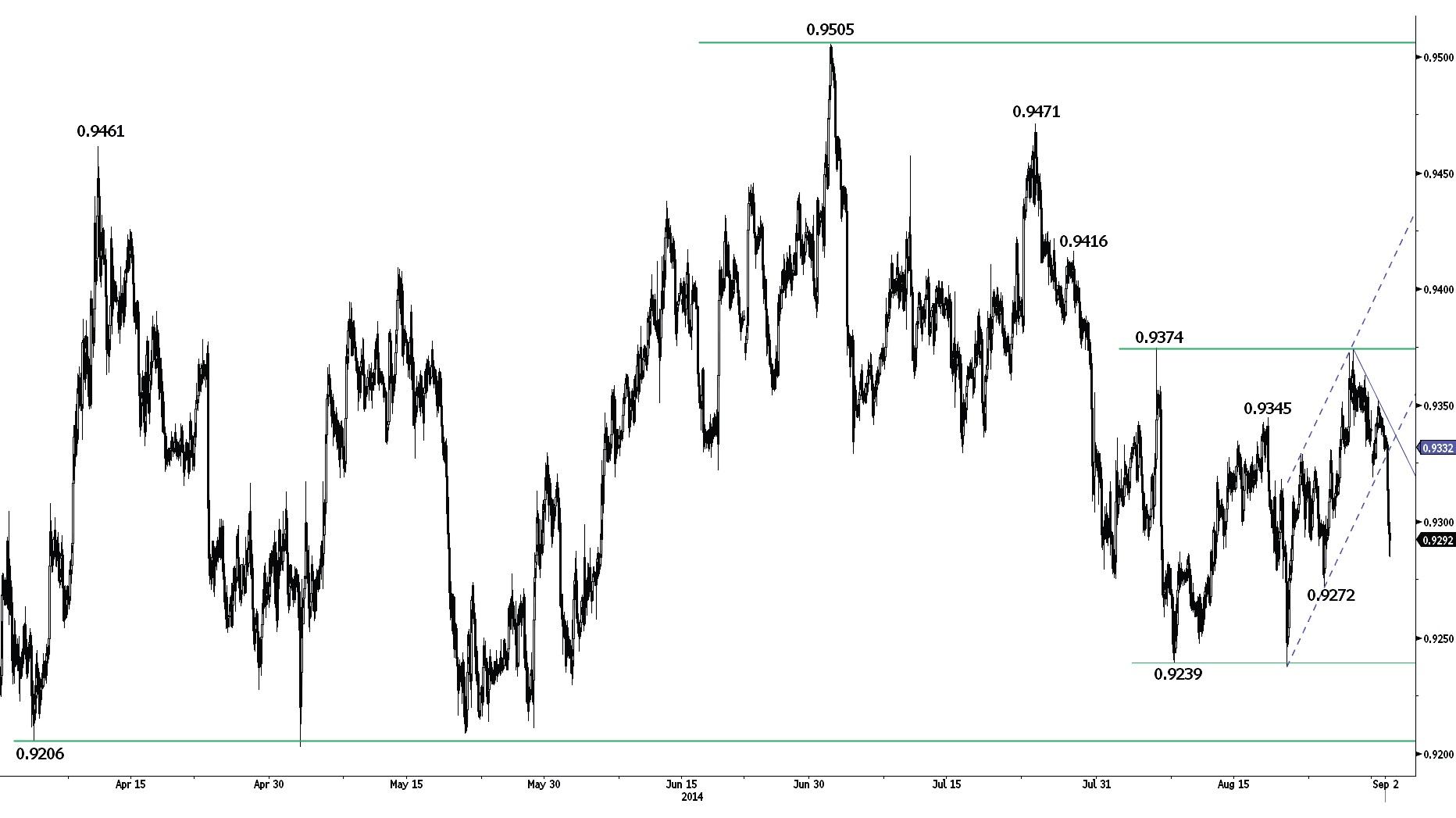

AUD/USD has failed to break the resistance at 0.9374. The subsequent break to the downside out of the rising channel negates a potential short-term double-bottom formation. An hourly support can be found at 0.9272, while a key support stands at 0.9239. An hourly resistance now lies at 0.9319 (01/09/2014 low).

In the longer term, prices are consolidating within the range defined by the key support at 0.9206 (see also the 200 day moving average) and the key resistance at 0.9461 (10/04/2014 high)/0.9505.

Await fresh signal.

GBP/JPY

Pushing higher.

GBP/JPY continues to improve as can be seen by the break of the resistance area given by the declining trendline and 173.51. Other resistances can be found at 174.22 and 174.56. Hourly supports stand at 173.14 (intraday low) and 172.63 (01/09/2014 low).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support at 169.51 (11/04/2014 low) holds.

Await fresh signal.

EUR/JPY

Monitor the strong resistance at 138.03.

EUR/JPY has bounced near its support at 136.37 (12/08/2014 low). The break of the hourly resistance at 137.42 opens the way for a test of the key resistance at 138.03. However, a break of this level is needed to suggest a further sustainable rise (see potential bullish head and shoulders formation). An hourly support now lies at 137.19 (29/08/2014 high).

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. The recent successful test of the key support at 136.23 (04/02/2014 low) favours further sideways moves. A strong resistance lies at 140.09 (09/06/2014 high).

Await fresh signal.

EUR/GBP

Trying to bounce.

EUR/GBP is trying to bounce after the break of the support at 0.7916. The hourly resistance at 0.7931 (intraday high) is challenged. The resistance at 0.7970 (20/08/2014 low) is unlikely to be broken. An hourly support now lies at 0.7892 (01/09/2014 low), while a key support stands at 0.7874.

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

Bouncing.

EUR/CHF is bouncing after having breached the support at 1.2063 (10/12/2012 low). Hourly resistances can be found at 1.2093 (26/08/2014 high) and 1.2121 (15/08/2014 high). An hourly support lies at 1.2049 (28/08/2014 low).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Challenging again its rising trendline.

Gold is weakening and is now challenging the support implied by its recent low at 1273 (21/08/2014 low, see also the symmetrical triangle). Hourly resistances can be found at 1297 (28/08/2014 high) and 1304 (intraday high, see also the declining channel). Another support lies at 1258 (17/06/2014 low).

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

Monitor the support at 19.32.

Silver made a significant bearish intraday reversal on 28 August, favouring a cautious view. Monitor the key support at 19.32, as a break would indicate a resumption of the underlying downtrend. Hourly resistances can be found at 19.64 (29/08/2014 high) and 19.91.

In the long-term, the trend is negative, as can be seen by the long-term succession of lower highs since the April 2011 peak. However, a strong support area stands between 18.84 (31/12/2013 low) and 18.23 (28/06/2013 low). A key resistance lies at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.