EUR/USD

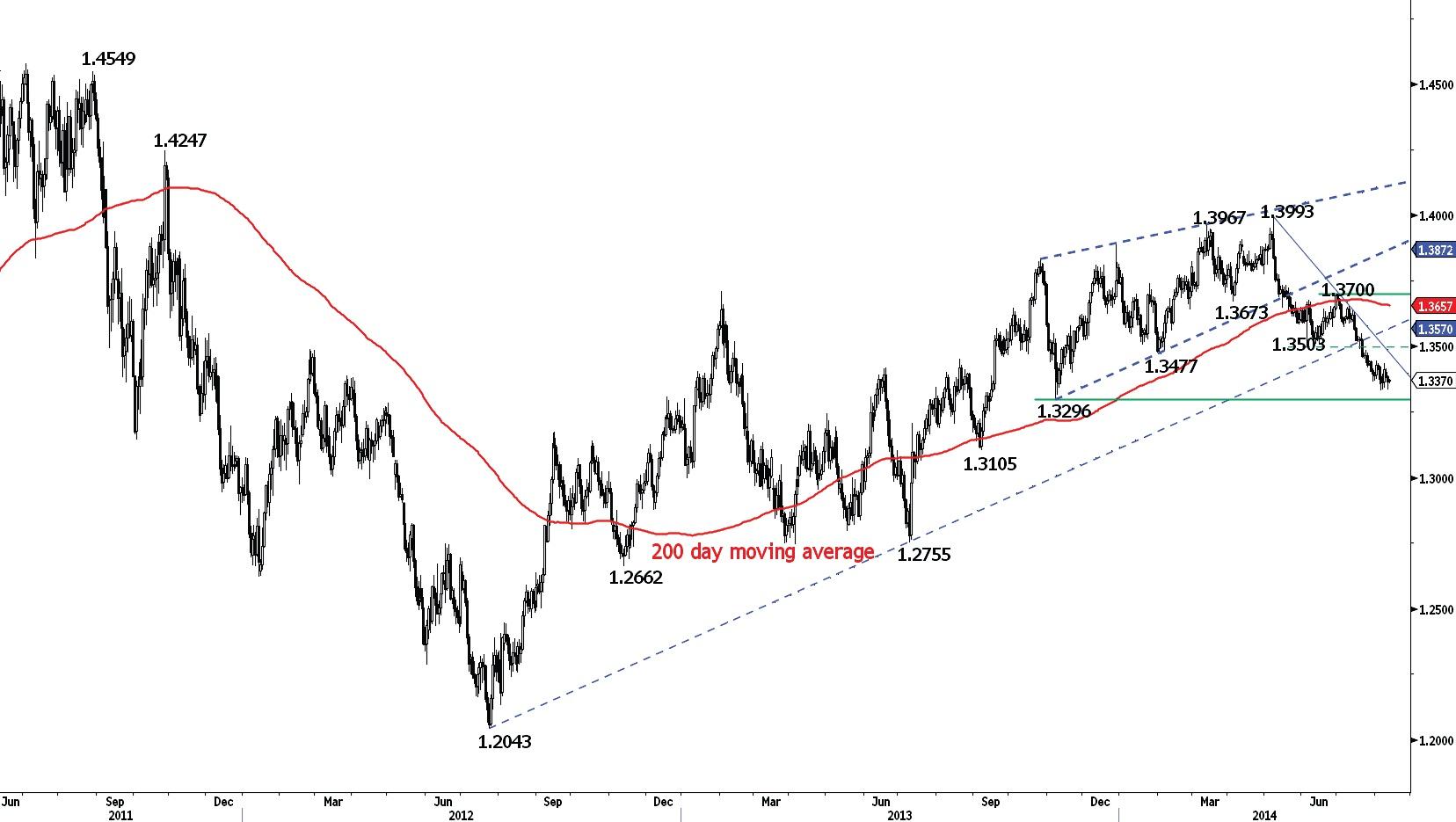

Bouncing near its recent low.

EUR/USD continues to hold at the lows but rallies have lost momentum. The proximity of the key support at 1.3296, a short-term rebounds are likely. Resistances can be found at 1.3444 and 1.3503 (05/06/2014 low). An hourly support stands at 1.3333 (06/08/2014 low).

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The downside risk is given by 1.3210 (second leg lower after the rebound from 1.3503 to 1.3700). A strong support stands at 1.3296 (07/11/2013 low). A key resistance lies at 1.3549 (21/07/2014 high).

Await fresh signal.

GBP/USD

Recovery rally?

GBP/USD traded higher today off the recent lows. In the short-term,the key resistance at 1.6893 will be hard to break given the overextended rise. A break of the resistance at 1.6893 (01/08/2014 high) is needed to suggest exhaustion in short-term selling pressures. Another resistance can be found at 1.6955 (30/07/2014 high).

In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A key support stands at 1.6693 (29/05/2014 low, see also the 200 day moving average).

Buy stop 2 units at 1.6938, Obj: Close 1 unit at 1.7167, remaining at 1.7435, Stop: 1.6865

USD/JPY

Extending higher.

USD/JPY continues to rise and is now challenging the resistance at 102.46 (07/08/2014 high). Hourly support can be found at 102.00 (07/08/2014 low) and key resistance is located 102.66 (06/08/2014 high).

A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. However, a break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. Another resistance can be found at 104.13 (04/04/2014 high), while a major resistance stands at 110.66 (15/08/2008 high).

Buy limit 2 units at 101.10, Obj: Close 1 unit at 102.40, remaining at 103.93, Stop: 100.65

USD/CHF

Remains near the high of its rising channel.

USD/CHF displays many significant daily upper shadows near the resistance at 0.9107, suggesting strong selling pressures close to these levels. Monitor the support at 0.9041 (01/08/2014 low), as a break would invalidate the short-term bullish technical structure. Other supports can be found at 0.9008 (24/07/2014 low) and 08969 (17/07/2014 low).

From a longer term perspective, the recent technical improvements call for the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. Furthermore, the break of the resistance at 0.9037 calls for a second leg higher (echoing the one started on 8 May) with an upside potential at 0.9191. As a result, a test of the strong resistance at 0.9156 (21/01/2014 high) is expected.

Await fresh signal.

USD/CAD

Moving sideways near the support at 1.0905

USD/CAD is further fading near the key resistance at 1.0961 (see also the 50% retracement). Hourly supports stand at 1.0905 (04/08/2014 low) and 1.0845 (intraday low). Another resistance can be found at 1.1053.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Pickup in buying interest.

AUD/USD has broken the resistance at 0.9287but need to clear hourly resistances can be found at 0.9292 (06/08/2014 low) and 0.9374 to reverse bearish pattern. Dominate bearish reversal pattern suggests a downside risk at 0.9206.

In the longer term, prices are consolidating within the range defined by the key support at 0.9206 (see also the 200 day moving average) and the key resistance at 0.9461 (10/04/2014 high)/0.9505. The break of the support at 0.9319 calls for a test of the low of the range.

Await fresh signal.

GBP/JPY

Challenging resistance

GBP/JPY continues to rise, breaking hourly resistance at 171.92 and is now challenging the resistance at 172.63 (07/08/2014 high). Hourly support can be found at 169.51 (see also the rising trendline and the 200 day moving average).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support at 169.51 (11/04/2014 low) holds.

Await fresh signal.

EUR/JPY

Buying interest seems to be stalling.

EUR/JPY continue to move within its declining channel and has breached the key support at 136.23. Another support stands at 134.11. Hourly resistances can be found at 137.12 (07/08/2014 high) and 138.03 (01/08/2014 high).

A decisive break of the key support at 136.23 (04/02/2014 low) would invalidate the long-term succession of higher lows.

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. A strong resistance lies at 140.09 (09/06/2014 high).

Await fresh signal.

EUR/GBP

Extending lower

EUR/GBP is extending its decline. Hourly supports can be found at 0.7904 (28/07/2014 low) and 0.7874.

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

Further consolidation likely.

EUR/CHF continues to rise and is now challenging the resistance at 1.2140 (07/08/2014 low)).The support is located at 1.2122 . A key support stands at 1.2104. Hourly resistances can now be found at 1.2140 (07/08/2014 low) and 1.2155 (01/08/2014 low).

In the longer term, prices are moving in a broad horizontal range between the key support at 1.2104 and the resistance at 1.2261.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23)

GOLD (in USD)

Consolidating.

Gold continues to bounce. The hourly resistance at 1311 has been broken. Resistances stand at 1325 and 1345. Hourly supports can be found at 1302 (07/08/2014 low) and 1279.

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

Range consolidation.

Silver continues to bounce within its declining channel. Hourly support lie at 19.40 (see also the declining channel) and 18.23 (05/23/2014 low).

In the long-term, the trend is negative, as can be seen by the long-term succession of lower highs since the April 2011 peak. However, a strong support area stands between 18.84 (31/12/2013 low) and 18.23 (28/06/2013 low). A key resistance lies at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.