EUR/USD

Pushing lower.

EUR/USD has broken the key support area defined by 1.3503 (see also the long-term rising trendline from the July 2012 low) and 1.3477 (03/02/2014 low), confirming an underlying downtrend. Yesterday's new lows confirm persistent selling pressures. Hourly resistances can be found at 1.3444 (28/07/2014 high) and 1.3485 (24/07/2014 high).

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. Downside risks are given by 1.3379 (implied by the double-top formation) and 1.3210 (second leg lower after the rebound from 1.3503 to 1.3700). A strong support stands at 1.3296 (07/11/2013 low). A resistance lies at 1.3549 (21/07/2014 high).

Await fresh signal.

GBP/USD

Declining towards the key support at 1.6923.

GBP/USD made new lows yesterday. Prices are now challenging the key support area defined by 1.6953 and 1.6923 (see also the 50% retracement). Coupled with the overextended decline and the underlying uptrend, we favour a rebound in the next few days. Hourly resistances can be found at 1.7001 (see also the declining channel) and 1.7099 (21/07/2014 high).

In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A support lies at 1.6923 (18/06/2014 low).

Buy stop 2 units at 1.7008, Obj: Close 1 unit at 1.7167, remaining at 1.7435, Stop: 1.6943.

USD/JPY

Rising towards the resistance at 102.36.

USD/JPY continues to improve after the break of the resistance at 101.86 (see also the declining channel). Monitor the test of the resistance area defined by 102.27 (03/07/2014 high) and 102.36. Hourly supports can now be found at 101.95 (intraday low) and 101.72 (25/07/2014 low, see also the rising trendline).

A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. However, a break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Making new highs.

USD/CHF has broken the key resistance at 0.9037 (see also the declining channel), opening the way for a move towards the key resistance at 0.9156. A first resistance lies at 0.9082 (03/02/2014 low). Hourly supports can be found at 0.9035 (28/07/2014 low) and 0.9001 (intraday low).

From a longer term perspective, the bullish breakout of the key resistance at 0.8953 (04/04/2014 high) suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. Furthermore, the break of the resistance at 0.9037 calls for a second leg higher (echoing the one started on 8 May) with an upside potential at 0.9191. A strong resistance stands at 0.9156 (21/01/2014 high).

Await fresh signal.

USD/CAD

Bullish breakout at 1.0814.

USD/CAD has broken the key resistance at 1.0814 (previous support, see also the 200 day moving average), suggesting a further rebound towards the key resistance at 1.0961 (see also the 50% retracement). A first resistance can be found at 1.0892 (18/06/2014 high). Hourly supports are given by 1.0797 (29/07/2014 low) and the rising channel (around 1.0756).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Weakening further.

AUD/USD continues to weaken, moving below the support at 0.9380 (intraday low, see also the 61.8% retracement). An hourly resistance lies at 0.9425 (25/07/2014 high). An hourly support can be found at 0.9361 (22/07/2014 low), while a key support stands at 0.9319.

In the longer term, prices are consolidating within the range defined by the key support at 0.9206 and the key resistance at 0.9461 (10/04/2014 high)/0.9505. A break of the support at 0.9319 is needed to suggest significant exhaustion in the buying interest.

Sell stop 2 units at 0.9309, Obj: Close 1 unit at 0.9212, remaining at 0.9007, Stop: 0.9348.

GBP/JPY

Calm before the storm?

GBP/JPY continues to display small daily real bodies (dojis) indicating short-term indecision. A break of the hourly resistance at 173.59 (18/07/2014 high, see also the declining trendline) would suggest exhaustion in selling pressures. Another resistance stands at 174.57. A support stands at 172.38.

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support at 167.78 (18/03/2014 low) holds.

Buy stop 2 units at 173.69, Obj: Close 1 unit at 175.24, remaining at 179.80, Stop: 173.00.

EUR/JPY

Consolidating.

EUR/JPY is consolidating near the key support at 136.23. Hourly resistances are given by 137.34 (22/07/2014 high, see also the declining trendline) and 137.83 (50% retracement).

The bearish breakout of the 200 day moving average confirms a deterioration of the mediumterm technical structure. A key support stands at 136.23 (04/02/2014 low), while a strong resistance lies at 104.09 (09/06/2014 high).

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds.

Await fresh signal.

EUR/GBP

Monitor the declining channel.

EUR/GBP remains close to the resistance implied by the top of the declining channel (around 0.7933). Another resistance lies at 0.7981 (see also the declining trendline). An initial support can be found at 0.7904 (28/07/2014 low), while an hourly support stands at 0.7874.

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

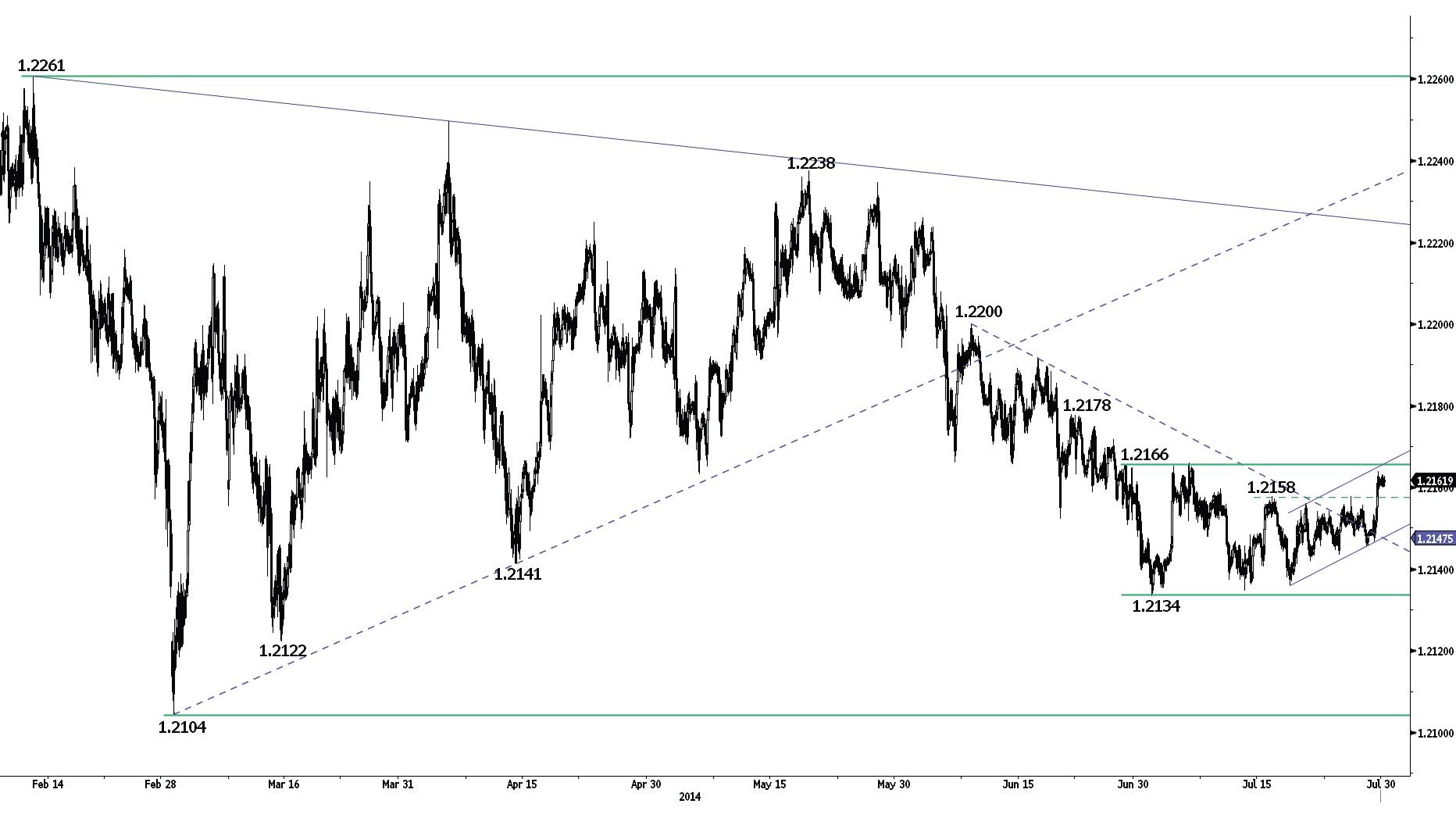

Improving.

EUR/CHF has broken the resistance at 1.2158, confirming an increasing buying interest. The top of the horizontal range defined by the support at 1.2134 and the resistance at 1.2166 is now challenged. A break to the upside out of this range would negate the downside risk at 1.2104 implied by the previous symmetrical triangle. Another resistance lies at 1.2178. An initial support can now be found at 1.2158 (previous resistance).

In the longer term, prices are moving in a broad horizontal range between the key support at 1.2104 and the resistance at 1.2261.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Short-term succession of lower highs remains intact.

Gold remains in a succession of lower highs since the peak at 1345. An hourly resistance can be found at 1311 (23/07/2014 high). Another resistance stands at 1325. The hourly support at 1299 (intraday low) has been broken. Another support lies at 1288 (24/07/2014 low).

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

Remains in its declining channel.

Silver has thus far failed to break its declining channel. An hourly resistance stands at 20.82. Another resistance lies at 21.26. Supports can be found at 20.31 and 20.00.

In the long-term, the trend is negative. However, the successful test of the strong support area between 18.84 and 18.23 (28/06/2013 low) and the break of the resistance at 20.41 (24/02/2014 high) indicate clear exhaustion in the selling pressures. A key resistance stands at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.