EUR/USD

Bullish Pause

EUR/USD short-term bullish momentum is dominate despite pause, after breaking out of its short-term declining channel and pushing above near term resistance. Monitor the resistance at 1.3820 (see also 50% retracement). Hourly supports now lie at 1.3820 (old resistance) and 1.3673. Another resistance can be found at 1.3876.

In the longer term, EUR/USD is still in a succession of higher highs and higher lows, suggesting additional upside can be anticipated. A significant resistance now lies at 1.3876 (24/03/2014 high).

Await fresh signal.

GBP/USD

Bullish Rally Stalls at 1.6823

GBP/USD strong bullish run was halted at key resistance 1.6823. The short-term bullish momentum is intact as long as the hourly support at 1.6684 (previous resistance) holds. Another support lies at 1.6556.

In the longer term, prices continue to move in a rising channel. As a result, a bullish bias remains favoured as long as the support at 1.6460 holds. A major resistance stands at 1.7043 (05/08/2009 high).

Await fresh signal.

USD/JPY

Declining sharply towards its key support area.

USD/JPY has broken the support at 102.68 (19/03/2014 high), leading to a sharp decline. Even though the support at 101.72 has been breached, prices are now close to a key support between 101.56 (see the rising trendline from 100.76 (04/02/2014 low)) and 100.76 (see also the 200 day moving average). A resistance now stands at 102.68 (previous support).

A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.80) and 99.57 (see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Pointing to Further Downside

USD/CHF sell-off continues and is now challenging near term support. The weakening momentum has been confirmed by the break of the support implied by the rising trendline. Other hourly horizontal supports stand at 0.8787. Hourly resistances can be found at 0.8887 (intraday high) and 0.8953.

From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. The recent technical improvements suggest weakening selling pressures and a potential base formation. A decisive break of the key resistance at 0.8930 would open the way for further medium-term strength.

Await fresh signal.

USD/CAD

Short-Term Correction

USD/CAD failure to break Fibo support at 1.0860, hurt short-term momentum. Resistances for a short-term bounce are given by 1.1010 (07/04/2014 high) and 1.1048 (02/04/2014 high). Other supports are given by 1.0860 (see 38.2% retracement) and 1.0738 (20/12/2013 high).

In the longer term, the decisive break of the major resistance at 1.0870 validates a multi-year basing formation whose minimum upside potential is around 1.1910. The key resistance given by the 50% retracement (around 1.1236) of the decline from the September 2009 peak at 1.3065 remains thus far intact. A key support stands at 1.0911 (19/02/2014 low).

Await fresh signal.

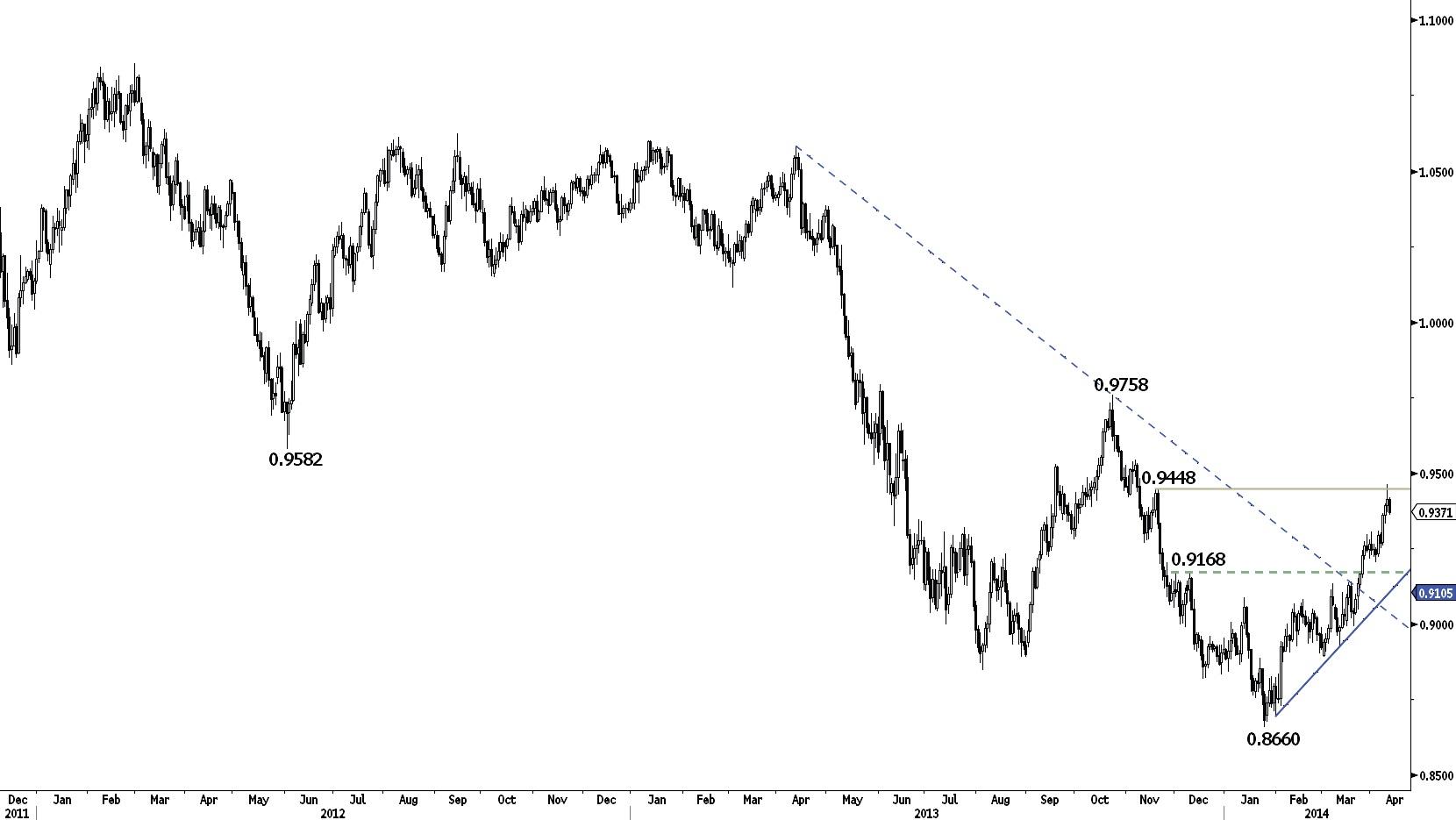

AUD/USD

Challenging Resistance .

AUD/USD has broken the key resistance at 0.9168, validating a 3 month bullish reversal pattern. The break to the upside out of the hourly horizontal range between 0.9214 and 0.9295 confirms a persistent buying interest. A key resistance still stands at 0.9448. Hourly supports can be found at 0.9295 (previous resistance, see also the short-term rising trendline) and 0.9254 (07/04/2014 low).

In the medium-term, the decisive break of the strong resistance at 0.9168 (02/12/2013 high, see also the 200 day moving average) favours a further rise towards the key resistance at 0.9448.

Longer term, the underlying downtrend still favours a bearish bias.

We have raised the stop-loss of our strategy.

Long 2 units at 0.9175, Obj: Close unit 1 at 0.9429, remaining at 0.9691, Stop: 0.9278 (Entered: 2014-03-26).

GBP/JPY

Sideways Consolidation

GBP/JPY has shifted into a sideways range after making new lows earlier in the week, confirming a weak price momentum. Developing symmetrical triangle should be monitored. A break of the hourly resistance at 171.61 (07/04/2014 high) is needed to negate the current short-term bearish momentum. A support can be found at 169.54. A key resistance stands at 173.66, whereas a key support lies at 169.40.

The break of the major resistance at 163.09 (07/08/2009 high) calls for further long-term strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support area defined by 163.89 (04/02/2014 low) and the 200 day moving average (see also the long-term rising trendline from the February 2013 low) holds.

Await fresh signal.

EUR/JPY

Monitor the support at 139.97.

EUR/JPY has significantly weakened recently. However, the medium-term trend is neutral and a significant support is at 139.97. A resistance lies at 141.90, while a key resistance area can be found between 143.38 (13/03/2014 high) and 143.79. A key support stands at 138.68.

Despite the key support at 136.23 (04/02/2014 low, see also the 200 day moving average), the long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. A strong resistance can be found at 147.04 (16/09/2008 low).

Await fresh signal.

EUR/GBP

Drifting lower.

EUR/GBP recovery rally has temproarily move price of the monthly lows. However, bearish momentum still dominates reinfored by the break of support at 0.8246,. Other supports can be found at 0.8204 (05/03/2014 low) and 0.8191 (28/02/2014 low). Key resistance stands at 0.8322.

In the longer term, the failure to make any follow-through after the break of the resistance at 0.8350 (06/02/2014 high) calls for caution as prices remain below the declining 200 day moving average. A key support area stands at between 0.8168 and 0.8158.

Await fresh signal.

EUR/CHF

Drifting lower towards the low of its rising channel.

EUR/CHF has lost some bearish momentum and lingers above local support. The hourly support at 1.2194 has been broken, opening the way for a test of the support at 1.2163 (see the rising channel from 28/02/2014 low).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the medium-term.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Retraces off resistance at 1321.

Gold continues to bounce after its test of the support at 1276. A resistance for a temporary rebound is given by 1321 (see also the 38.2% retracement). Another resistance lies at 1343. An hourly support now lies at 1296 (08/04/2014 low).

Longer term, we are skeptical of a long-term bullish reversal pattern. A move back to the previous lows at 1181 (28/06/2013 low) is eventually favoured. A major resistance stands at 1434 (30/08/2013 high).

Await fresh signal.

SILVER (in USD)

Unchanged - Drifting Sideways

Silver continues to exhibit a short-term succession of higher lows. However, a break of the resistance at 20.22 is needed to improve the technical structure. An hourly support lies at 19.79 (07/04/2014 low). Another support stands at 19.58. A key resistance remains at 20.58 (21/03/2014 high).

In the long-term, the trend is negative. However, the potential higher low at 18.84 (31/12/2013 low) and the break of the resistance at 20.52 suggest a phase of stabilisation. A key resistance stands at 23.09.

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.