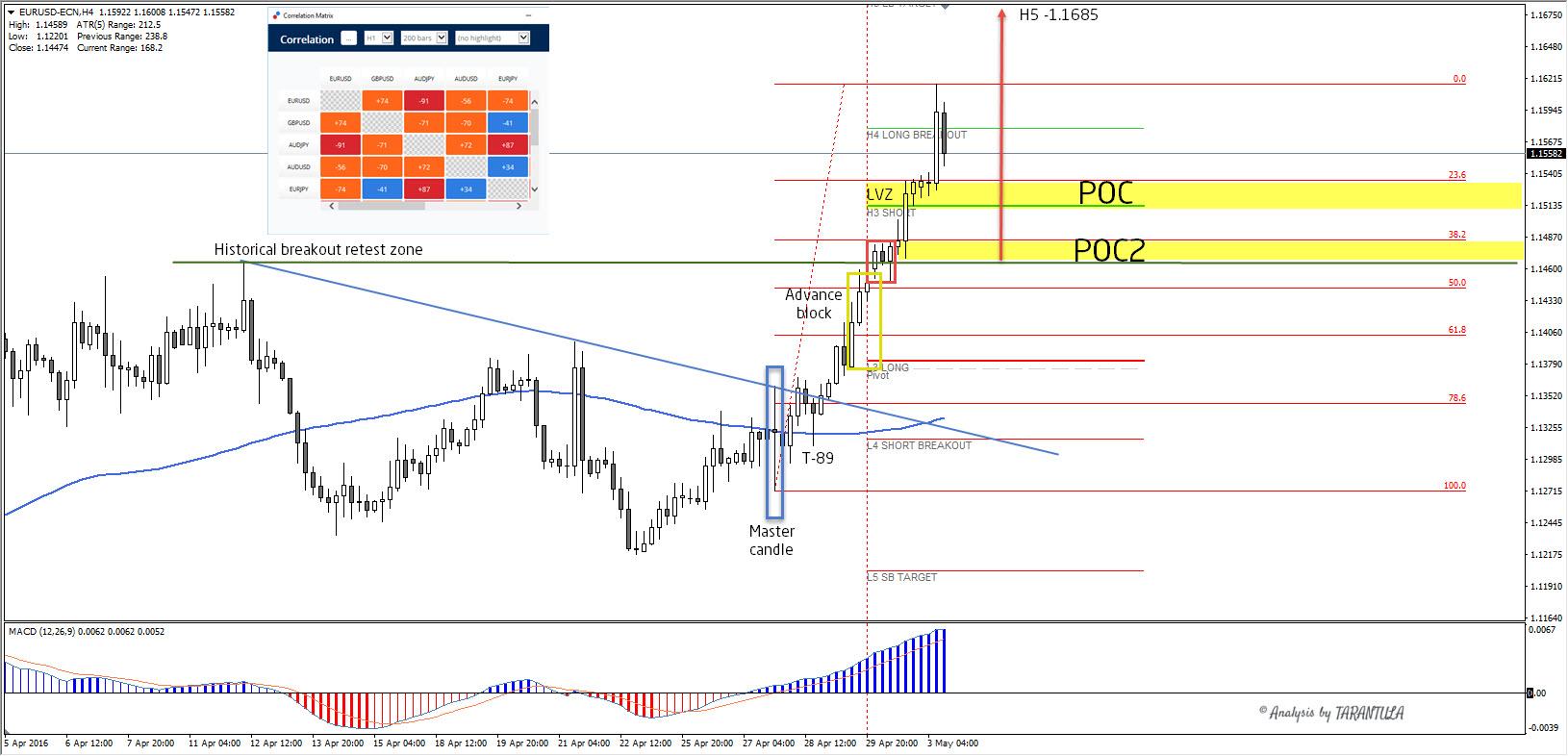

Not surprisingly both EURUSD and GBPUSD have been among the best trade setups this week. Technical and fundamental alignment has placed both pairs in a good correlation (+74) on intraday time frames that extended to intra week correlation.

EURUSD has cleared upward targets but there is still a potential for more bulls. 1.1510-40 is the first POC zone. LVZ – Low Volatility Zone – pattern, H3 and 23.6 make up for a confluence and we could see a rejection that is based on sheer momentum and historical price action.

Below it is another POC 1.1460-85 that has been formed after a bullish Advance block and historical retest zone. 38.2 adds to the confluence. Targets for another potential bullish swing are 1.1616 and if it breaks 1.1685 that is a weekly target.

Traders should pay attention to both POCs and rejections. Don’t forget that tomorrow is ADP and on Friday we will have NFP that will give us the cue for next EURUSD movement.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'