Last Friday Swiss GDP unexpectedly rose 0.20 % while yesterday Swiss KOF eco barometer also jumped to 100.70, 0.30 points after a revision (100.40). Equities are main driving forces of the market at this point. USDCHF is safe heaven vs safe heaven so it is also exposed to European stocks and Chinese stocks vs US index futures. Adding to that correlation to EURUSD is strongly negative (opposite moving pairs).

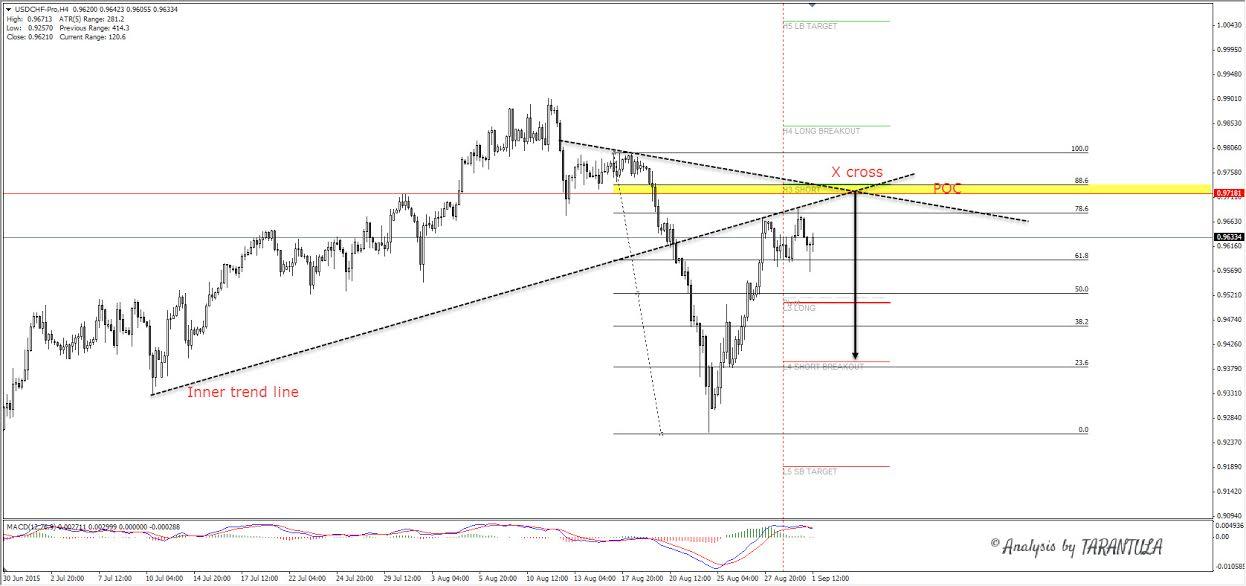

Technically I can spot V shaped reversal which has lead to forming of inner trend line. Inner trend line is making the X CROSS with top descending trend line around 0.9710-0.9730 zone. X cross signifies strong resistance and this time it adds to confluence with H3 and 88.6 deep fib. Don’t forget that 88.6 is VERY strong turning point so I will be watching the zone for potential rejections towards 0.9520-00 (L3, DPP/weekly cam) and 0.9390 (L4/weekly cam). For this scenario 0.9810 should hold the price and previous triple top should not be broken.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.