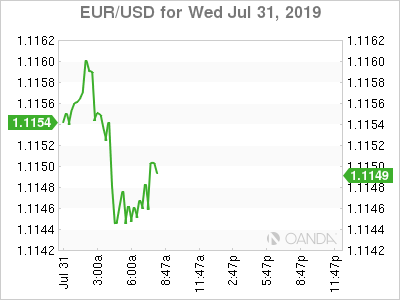

The Fed is widely expected to deliver its first rate cut in over a decade. The case for the Fed to commit to additional rate cuts to avoid end up becoming Japan or Europe and stuck in negative rates is good enough reason for them to commit to at least a couple more by year end. Markets remain cautious as Powell and company have been no stranger to policy mistakes. The long-term trend with little inflation despite how hot the economy is running should have them worried monetary policy is losing its effectiveness. If the Fed delivers only an insurance cut, markets will be extremely disappointed as equities will tumble and the dollar will surge.

Trade

The conclusion of the first face-to-face meeting between the US and China yielded a meeting in the US in September. Details on the overall meeting were limited and so far the main headlines came from Xinhua which noted that both sides discussed China’s promise of increasing farm good purchases. This was a critical update with the trade war that will see financial markets have a mixed reaction as talks seem poised to drag on much longer and expectations for a deal done by the Fall seems like a stretch now.

Apple

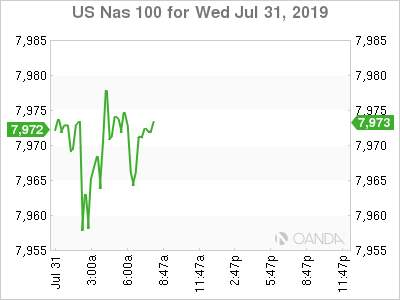

Apple delivered a solid earnings report that saw decent beats with both the top and bottom line and a strong forecast for revenue in the current quarter. Sales to China are falling but growth in other segments are continue to trend in the direction. A record quarter for services and improved demand with wearables will likely see many analysts raise their price targets for the rest of the year. The Nasdaq is set to open slightly higher as markets remain on hold until the Fed at 2pm.

Oil

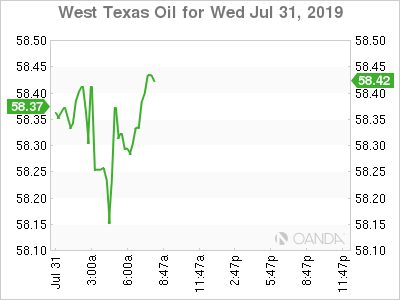

Crude continues to be supported on an almost seven-week streak of declines with American inventories, along with Persian Gulf escalations that now see Iran and Russia set to hold military drills in the Indian Ocean by March 2020. The onset of the Fed easing cycle should be supportive for commodities as the last non-recessionary rate cut saw oil nearly double in the mid-90s.

Gold

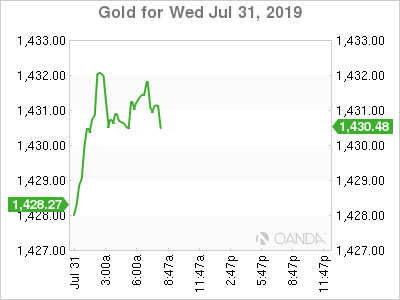

Gold could become the favorite trade for the rest of the year after Fed day is likely to see investors struggle for long-term bearish dollar positions as currency wars will see dovish central bank policies globally keep the interest rate differential fluid. With negative rates in Japan and Europe, a lower trajectory with US rates, global growth concerns and hard Brexit risks, gold seems set for a major rally. Today’s FOMC decision could be the spark plug that could help gold rally above the ascending triangle pattern that has been forming this summer.

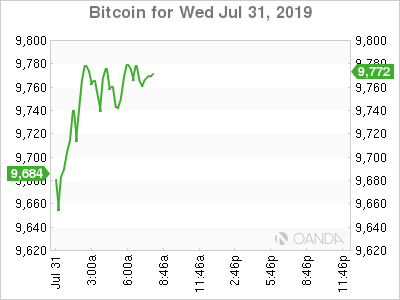

Legitimate crypto investments are needed to help continue to support the overall digital coin world. Canaan Inc, China’s second largest maker of Bitcoin mining hardware, has filed confidentiality for IPO in the US. Canaan gave up on a $1 billion Hong Kong listing earlier in the year and now seeks only around $200 million. Bitcoin is slowly recovering the weekend gap and seems to be poised to test the $10,000 mark again.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.