- The Inflation rate in the UK is expected to have decelerated to 2.3% y/y in April, confirming the dovish view on inflation from the Bank of England.

- With post-Brexit Sterling depreciation effect on UKL inflation dissipating, domestic price pressures stemming from UK labor market start to stand out.

The Bank of England is set to cheer the inflation in the UK approaching the targeted level of 2% as the Consumer Price Index (CPI) in the UK is expected to decelerate to 2.3% over the year in April, down from 3.1% cyclical inflation peak from December last year. The consumer prices are expected to decelerate further from 2.5% y/y growth rate in March confirming the view of the Bank of England that sees inflation returning to levels near 2% inflation target faster than originally estimated.

“Growth—at 0.1% in the first quarter of this year—was much weaker, and inflation—at 2.5% in March—was notably lower than we had projected in February,” the Bank of England Governor Mark Carney said in the opening remarks at the press conference after publishing May Inflation Report on May 10.

Should the inflation in the UK decelerate more than expected in April, Sterling is expected to fall further as the reasons from the Ban of England to act upon the interest rate hike will become even more distant. And that is the case especially because of the dovish turn the Bank of England made while p[resenting the May Inflation Report.

The reason why inflation in the UK is decelerating relatively quickly after rising by 2.9%-3.1% year-to-year from August last year to January 2018 period is mainly caused by the foreign exchange rate of Sterling is translating to import prices and consumer prices.

The inflation is measured on a monthly as well as on a year-to-year basis. While the post-Brexit slump in Sterling saw import prices rising immediately over the month, the year-to-year measure of inflation actually started to pick up rapidly only one year after the post-Brexit slump of Sterling that peaked in September 2016, about three months after the Brexit referendum. Now, as the Sterling has recovered from lows, the import prices are losing the dynamism over the year and actually are decelerating.

The Bank of England Governor Mark Carney explained at the May Inflation Report press conference that “since sterling’s depreciation, import prices have risen by less than the MPC had been expecting with pass-through from sterling world export prices currently running at around 50% rather than the anticipated 60%.”

So while post-Brexit Sterling depreciation and its negative effect on the UK inflation is dissipating the attention of the policymakers is shifting from external sources of UK inflation to domestic ones. The biggest risk to inflation outlook is stemming from the UK labor market tightness. With the UK unemployment rate at the lowest level since 1973 and Brexit looming, making it harder to import workers from abroad, the UK wages are rising.

“Private sector wages have picked up. Adding to the positives, job-to-job flows are back to their pre-crisis average rate and there is widespread evidence in employment surveys of a tightening labor market,” Mark Carney further said in the opening statement at the press conference after the May Inflation Report was made public.

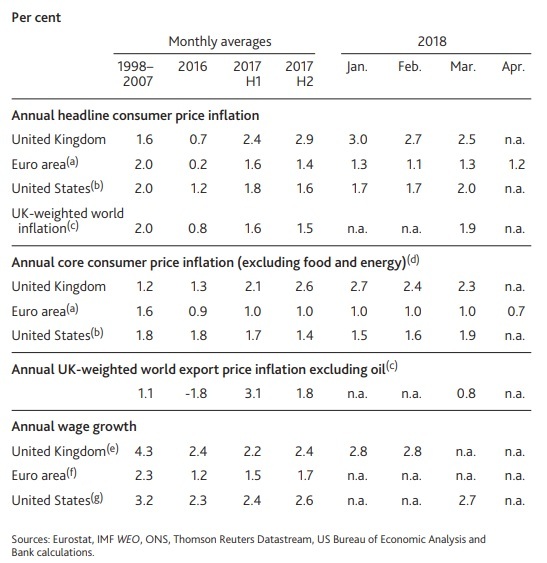

May Inflation Report: Inflation and wage growth forecast in selected economies

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.