After a rather flat two days with no main fundamentals to go by, the markets will be looking to a busy day with the European session focusing on the UK's Q2 GDP number while later in the day, the NY session will see the release of the FOMC statement which overshadows the durable goods orders due for release earlier in the day. Most of the major currencies and gold remain flat at key price levels with the news likely to push prices in either direction. Still, the main take away comes from USDJPY, which technically points to a near-term correction to 104 – 103.

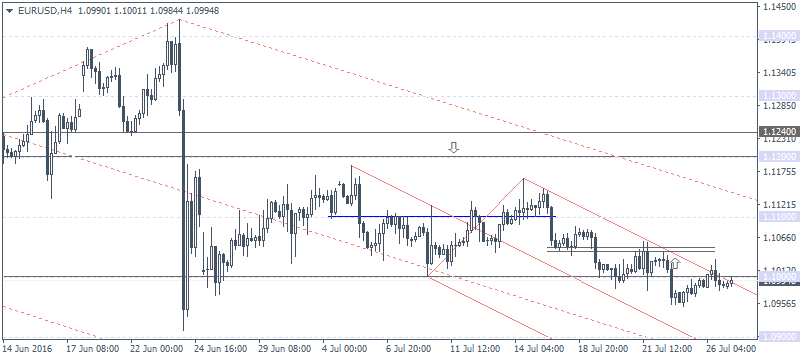

EURUSD Daily Analysis

EURUSD (1.099): The EURUSD is seen hovering near 1.10, for nearly 6 days so far, but that could change heading into today's trading session. 1.10 remains a near term resistance level on the 4-hour chart and subject to a breakout above 1.10; further upside can be expected. Overall, EURUSD remains range bound within 1.110 and 1.10 ahead of the FOMC meeting today. A break above 1.11 will signal further upside towards 1.120 which will mark a completion of the bullish divergence seen on the daily chart and the Stochastics. To the downside, look for initial resistance at 1.10 to hold following a break below the previous low established at 1.0951.

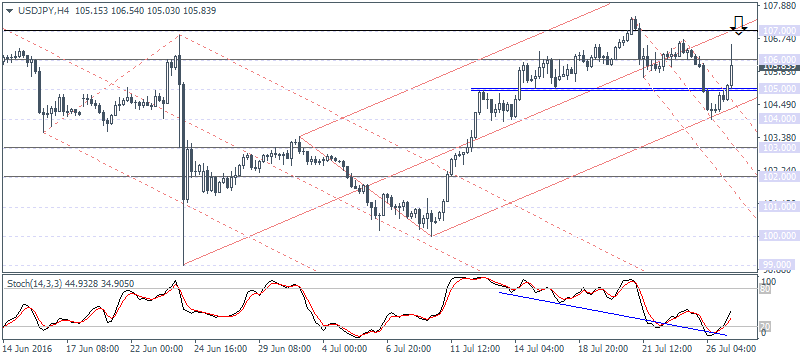

USDJPY Daily Analysis

USDJPY (105.84): USDJPY is seen testing 106 levels this morning, but we expect the declines to resume shortly as the lower support at 103.0 - 103.5 remain untested. Price action also shows the hidden bearish divergence on the daily time frame indicating that USDJPY will be looking weaker in the near term towards 103.0 - 103.5. To the upside, only a breakout above 108 could signal further upside. For the moment, price action will likely remain flat within 106 and 105 levels.

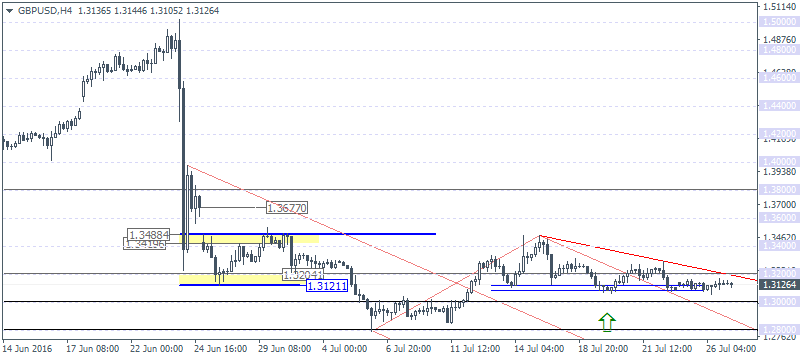

GBPUSD Daily Analysis

GBPUSD (1.312): GBPUSD has been flat for the past two days, trading below 1.320. With the advance Q2 GDP due out today, the Sterling might get the much required push. Price remains flat bouncing off the 1.311 - 1.308 support level which marks the minor head and shoulders on the 4-hour chart. A break below this support could send GBPUSD testing 1.280 - 1.285 lows. Further declines can be expected only on a conclusive break down of prices below 1.28, failing which GBPUSD is likely to remain range bound.

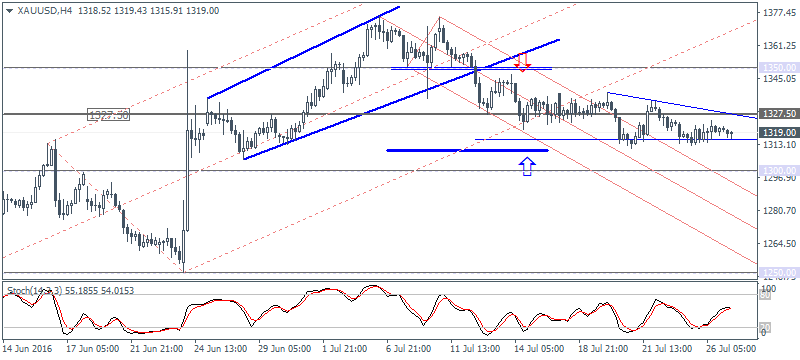

Gold Daily Analysis

XAUUSD (1319.00): Gold is seen testing 1318 - 1315 support level with the daily chart showing a hidden bullish divergence currently near this support level. The upside is, therefore, likely to unfold if gold can breakout above 1327.50 resistance level. On the 4-hour chart, price action is evolving into a descending triangle pattern with the support identified near 1315.30 - 1309.50. A break out below this support could signal a dip to 1300 which could limit the declines initially followed by a move lower towards 1250.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.