The Euro has had a hard time over the past 20 trading sessions losing ground on a consistent basis. On May 3rd EURUSD reached a most recent high at 1.16159 to then tumble to yesterday’s low at 1.10972. Most the Euro’s decline has been due to weakness in the Euro area economy. Latest GDP growth data showed the economy has expanded at 0.5%, which was less than analysts’ forecasts.

Adding to the Euro’s woes, recentlyrenewed sentiments of multiple interest rate hikes in the US happening during 2016 have taken hold of the market. The possibility of higher interestrates in the US is helping the currency gain against most major currencies. Until recently the most hawkish comments had come from Federal Reserve directors, who do not vote on monetary policy decisions.

However, last Friday Ms. Yellen the Federal Reserve Chair made a speech at Harvard, which was considered by the market as being extremely hawkish. Meaning that more interest rate hikes are to be implemented this year; with the next one possibly taking place at the scheduled Federal Open Market Committee meeting this June 15th at 7:00 pm.

The fate of the Euro also depends a lot on monetary policy from the European Central Bank (ECB), which is due for a scheduled monetary policy meeting this Thursday, at 12:45 pm an initial interest decision announcement will be made. No change in interest rates is expected, however, we could see a large spike in volatility depending on the statements made at the press conference.

Mr. Draghi, the ECB president, is expected to hold a pressconference at 01:30 pm to explain the central bank’s stance on monetary policy. His comments will be read to determine if we can expect any further quantitative easing or liquidity injections. Further intervention should send the EURUSD lower; the market is expecting some sort of easing to encourage growth, any references to inaction could create an increase in volatility.

If you think that the volatility for EURUSD will increase over the next week then you maybuy a Straddle strategy, which consists of simultaneously buying a Call and a Putt option with the same strike, expiry and amount.

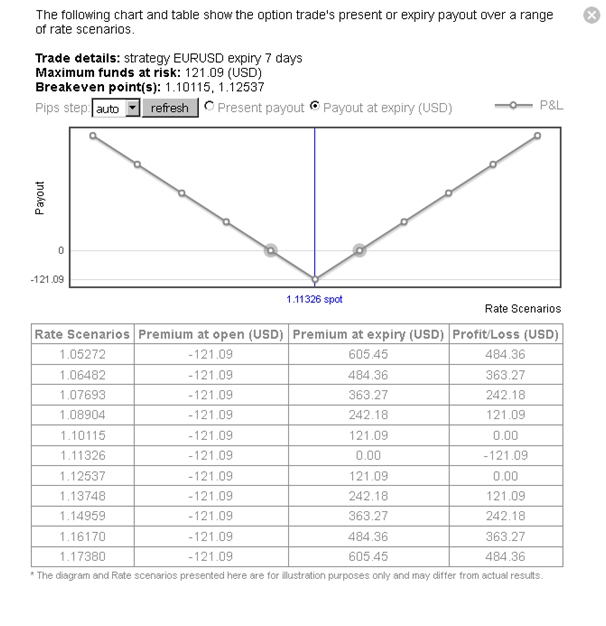

The screenshot below shows a EURUSD Buy Straddle with a 1.11327 strike, 7 day expiry and for €10,000 would cost $121.10, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Buy Straddle strategy, just click on the Scenarios button.

On the other hand, if you feel that volatility for EURUSD will remain flat or decrease over the next week then you maysell a Straddle strategy, which consists of simultaneously selling a Call and a Put option with the same strike, expiry and amount.

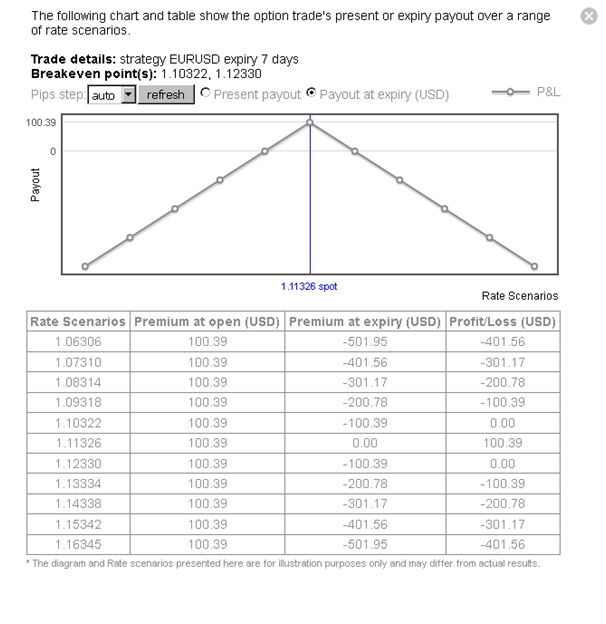

The screenshot below shows a Sell Straddle strategy with a 1.11326 strike, 7 day expiry and for €10,000 would generate $100.40 of revenue, with a total risk of $323.06.

This screenshot shows the profit and loss profile of the above Sell Straddle strategy.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.