AUD/NZD 1H Chart: Channel Up

Comment: The near-term outlook on AUD/NZD is bullish. The currency pair has just formed an ascending triangle, and most of the hourly technical indicators are pointing north. Accordingly, we expect the Aussie to rebound from 1.0650 and re-test last week’s maximum. However, the price lacks the potential to go higher, which is implied by the daily studies. In addition, the Australian Dollar is already overbought, as shown by the SWFX sentiment that is bullish with two thirds of open positions being long. Beneath the weekly pivot point AUD/NZD will have a good chance to stabilise near the 200-hour simple moving average, which at the moment can be found at 1.0632.

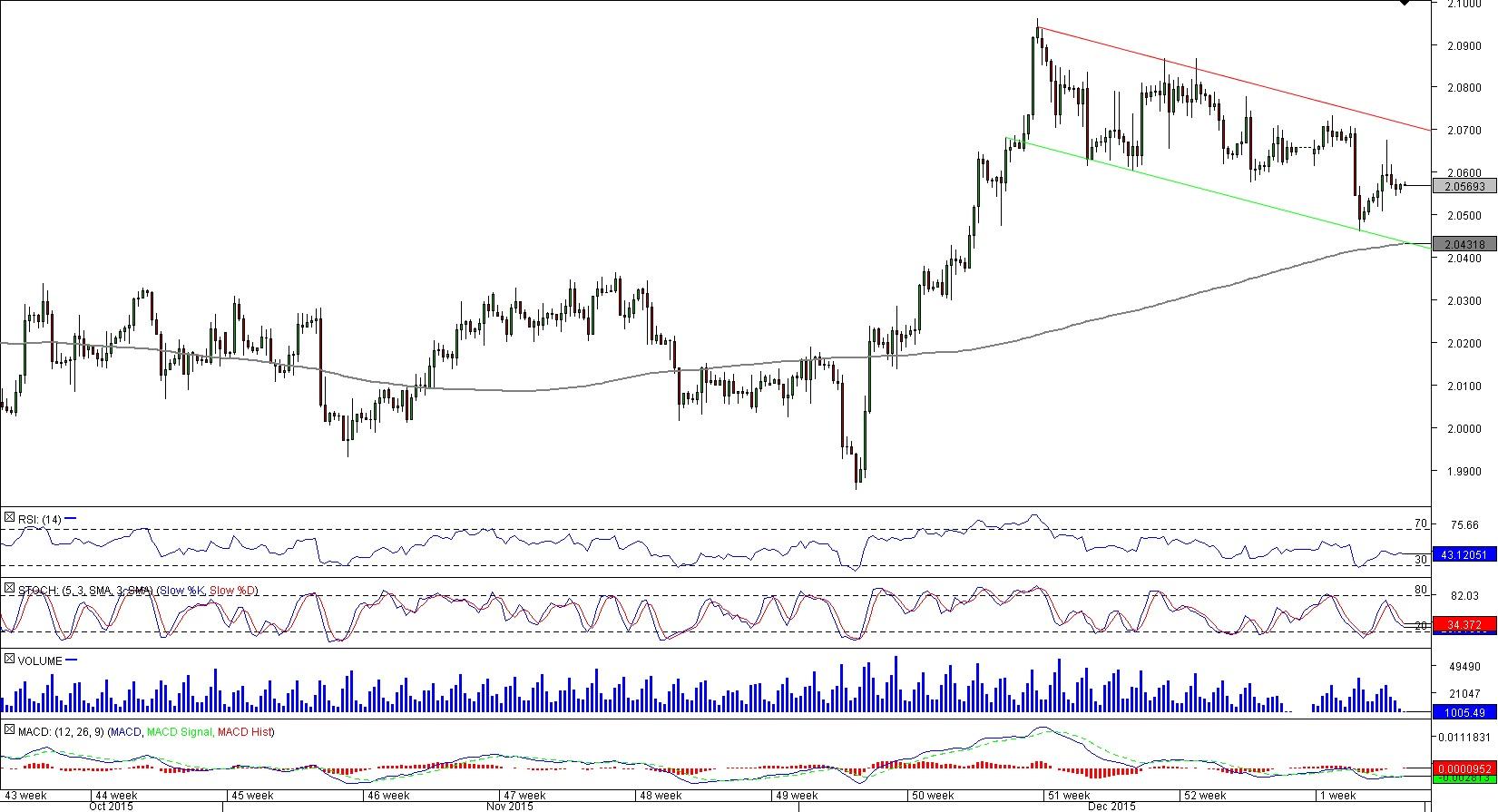

GBP/CAD 4H Chart: Channel Down

Comment: GBP/CAD has recently failed to pass through the resistance at 2.0960, and as a result, the pair entered a down-trend. The perspectives, however, are ambivalent. Even though the four-hour and daily technical indicators are mostly sending ‘sell’ signals, and the SWFX market is overcrowded with bulls (72% of positions are long), we may still be in a correction phase following the Dec 3-11 rally. Moreover, the long-term moving average remains beneath the spot price. Thereafter, if the Sterling breaches the major support at 2.0430/10, the currency’s bearish intentions will be confirmed, and it will likely aim for the December low at 1.9850.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.