EUR/TRY 4H Chart: Channel Up

Comment: The Euro is well-positioned to keep advancing. From below EUR/TRY is underpinned by 3.35, where the lower boundary of the pattern coincides with the weekly S1 and Sep 22 low. Additional supports are the 200-period SMA and Aug 31 low at 3.31 and 3.25 respectively. The main resistance is at 3.48, represented by this month’s high and monthly R1. A close above this serious obstacle will confirm pair’s long-term bullish intentions, but there is likely to be a selloff from 3.5336, where we have the upper boundary of the channel. Still, even despite the bullish technical indicators, the sentiment in the SWFX market is distinctly bearish: 69% of open positions are short.

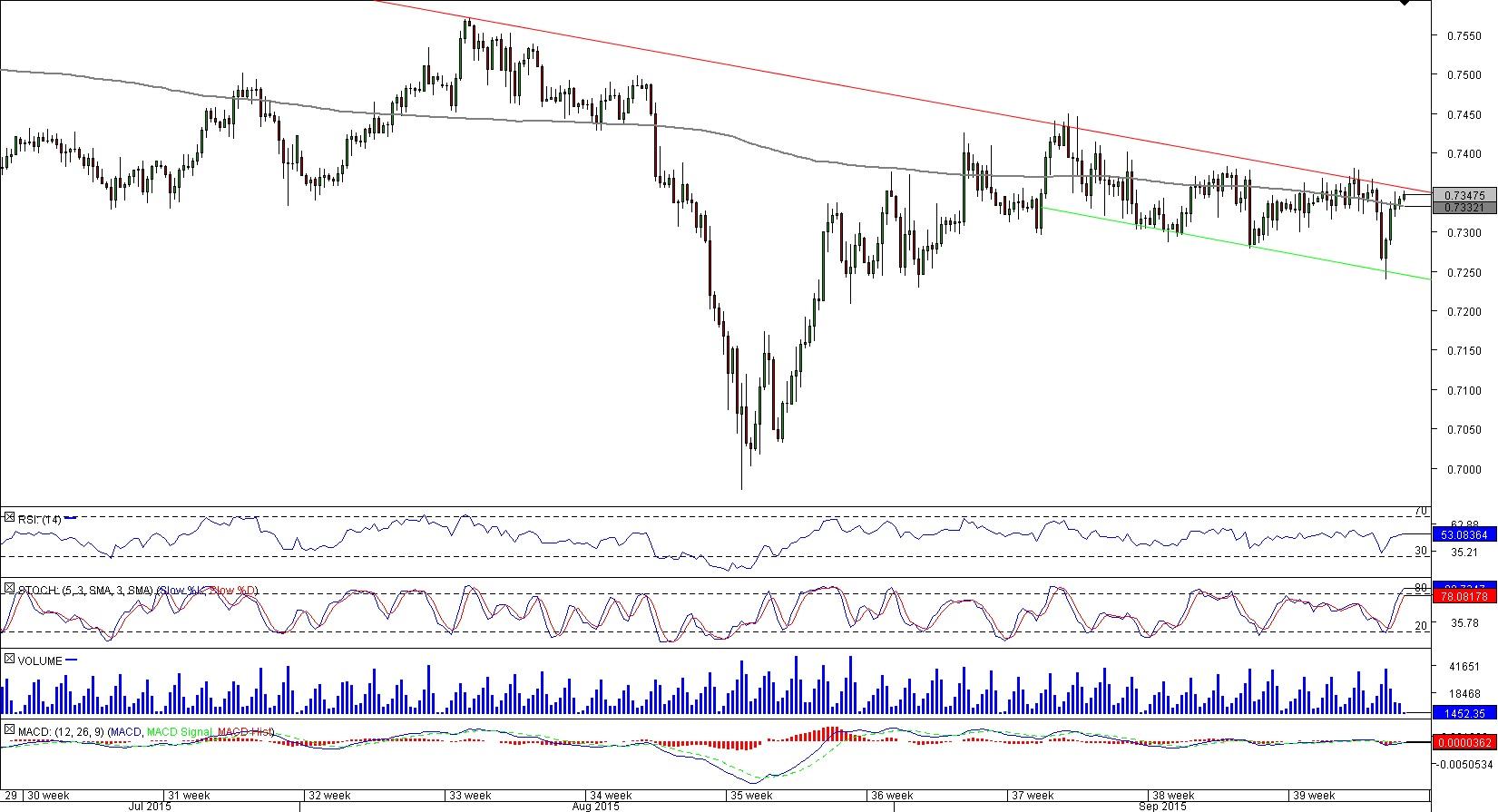

CAD/CHF 4H Chart: Channel Down

Comment: We hold a negative bias with respect to CAD/CHF. The currency pair continues to trade under the falling resistance line, and recently it has entered a bearish channel. Accordingly, we expect the current rally to be rejected by 0.7350, which should be followed by a decline to 0.7240, where the support line coincides with the Sep 24 low and weekly S2. Additional reason to be bearish the Canadian Dollar is the technical studies, a majority of which is pointing south. A breach of 0.7350 however, will invalidate the negative outlook, and the rate will be expected to test September high at 0.7450. Meanwhile, the SWFX market participants are equally divided between the bulls and bears.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.