EUR/PLN 4H Chart: Channel Down

Comment: The bears are unlikely to remain in control of EUR/PLN for long. Even though there is a downward-sloping channel emerging in the four-hour chart, we hold a bullish bias towards the Euro. The main reason is the pair’s proximity to a major rising support line, which has been successful in underpinning the price since this year’s April. An additional reason to be bullish is the technical indicators, which are mostly sending ‘buy’ signals for the four-hour and weekly time frames. In the short run however, there is likely to be a selloff from 4.2350, but the decline should be limited by 4.19. Nevertheless, the SWFX market is dominated by bears: 73% of open positions are short.

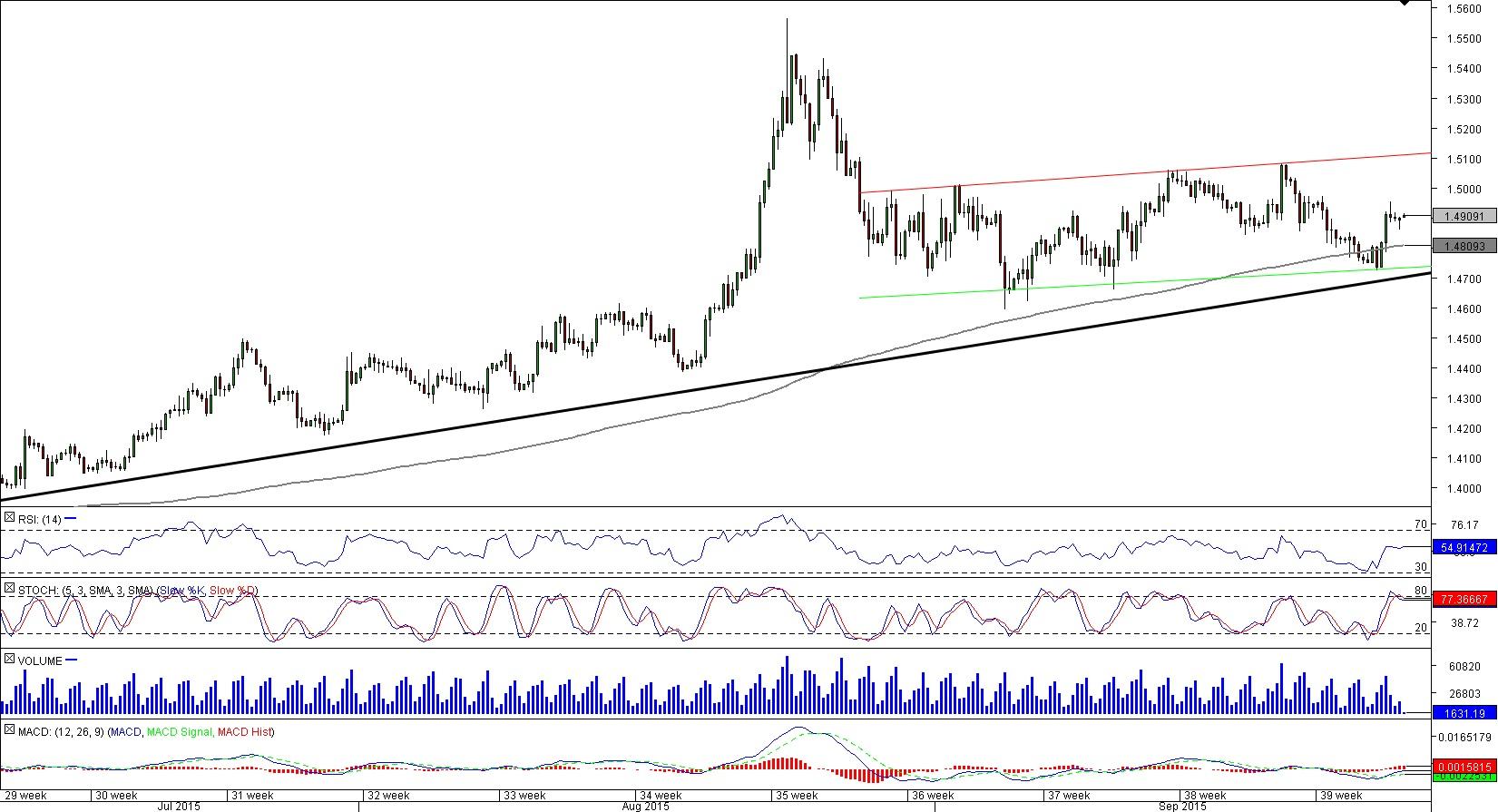

EUR/CAD 4H Chart: Channel Up

Comment: EUR/CAD appears to be bullish in all time frames. During the next few days the currency pair is expected to extend recovery up to 1.51 after it confirmed the green trend-line. The medium-term outlook is bullish due to the channel the Euro is currently forming. Finally, the long-term prospects are positive as well because of the six-month up-trend that is likely to prevent dips beneath 1.47 and because the spot price remains above the long-term moving average. Additionally, a large portion of the technical studies is pointing north. Still, the sentiment in the market towards EUR/CAD is strongly bearish, as 71% of open positions are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.