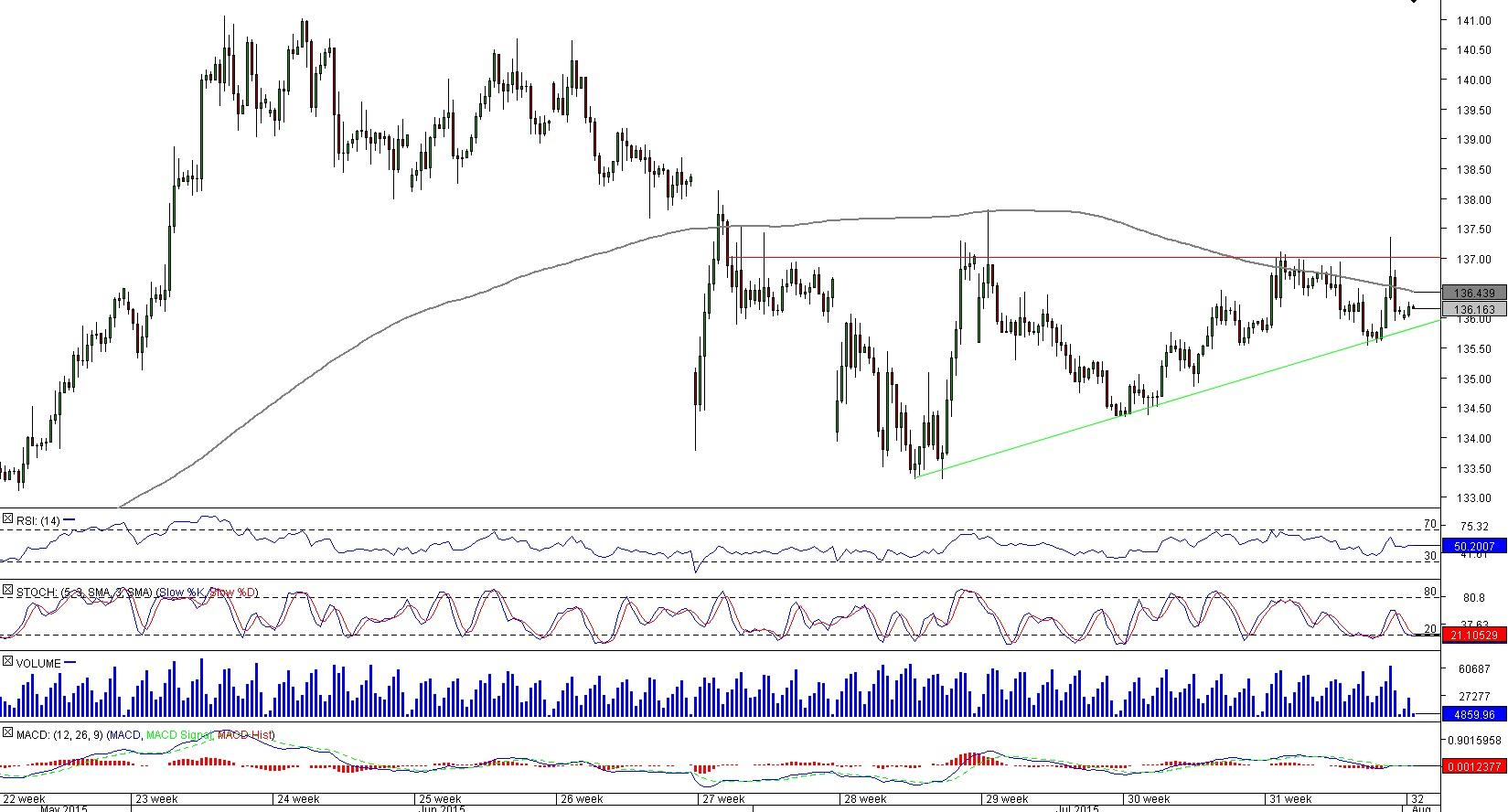

EUR/JPY 4H Chart: Ascending triangle

Comment: A traditional ascending triangle is a continuation pattern within an up-trend; this time around it was preceded by a sell-off, which increases the uncertainty regarding the direction of a break-out. Considering the technical indicators however, the risks are skewed to the upside. Accordingly, the base case scenario is a close above the level of 137 yen and a subsequent development of a rally. The height of the triangle is 370 pips, and this means the ultimate target is between the June high at 141.05 and the monthly R2 at 140.23. Meanwhile, the SWFX traders are undecided: a half of them is long and the other half is short.

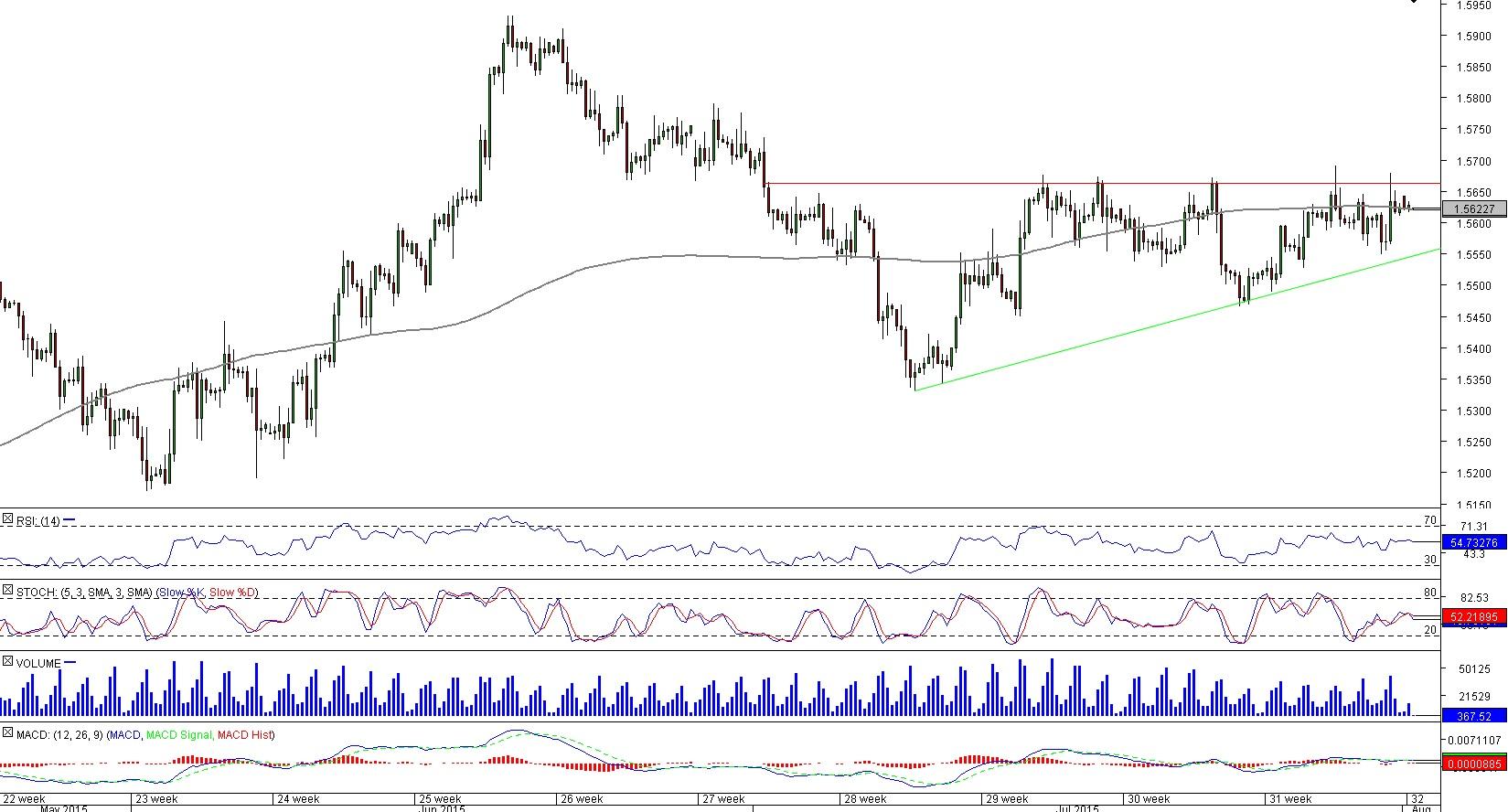

GBP/USD 4H Chart: Ascending triangle

Comment: Ascending triangles formed by EUR/JPY and GBP/USD are similar in nature. Both have emerged after a decline, and in both cases technical studies imply appreciation of a base currency. In case of a bullish break-out the main target will be the June high, even though the distance between the key resistance level and 1.5930 is less than the height of the pattern. This is because the price may have trouble rising past the June high. Alternatively, if the lower trend-line is breached, the first target will be at 1.5468, represented by the July 24 low. Next is the monthly S1 and Jul 8 low at 1.54 and at 1.5330, respectively. Here the market is divided as well: 50% of positions are long and the rest are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.