EUR/TRY 4H Chart: Rising Wedge

Comment: As EUR/TRY formed a rising wedge, a reversal pattern, the risks are heavily skewed to the downside. After the currency pair approaches a dense supply area at 2.87/86, it is expected to violate the support trend-line, which will confirm the bearish intentions of the Euro. The initial destination in this case will be a cluster of supports at 2.75/74, where the monthly PP merges with the 200-period SMA and Jan 22 high. If this zone does not withstand the selling pressure, the Jan 23 low at 2.6060 may well become the next objective. At the same time, an overwhelming majority (73%) of the SWFX market participants are currently holding short positions.

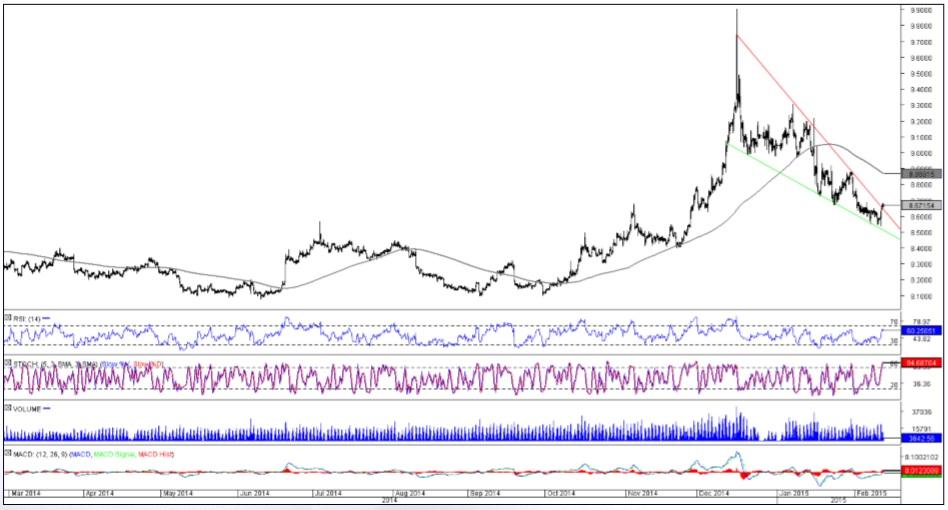

EUR/NOK 4H Chart: Falling Wedge

Comment: A prolonged bearish correction that followed the up-move between September and December seems to have finally come to an end. EUR/NOK has just closed above the resistance trend-line of the falling wedge pattern. If the pair manages to stay above 8.65, the Euro will likely extend the most recent rally to the supply area around 8.80, where the Jan 29 high coincides with the monthly pivot point and the longterm moving average. Should the bulls keep pushing the price even further north, the resistance at 9.23 will be the next potential target. However, the SWFX sentiment is strongly bearish, as 67% of all open positions are presently short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.