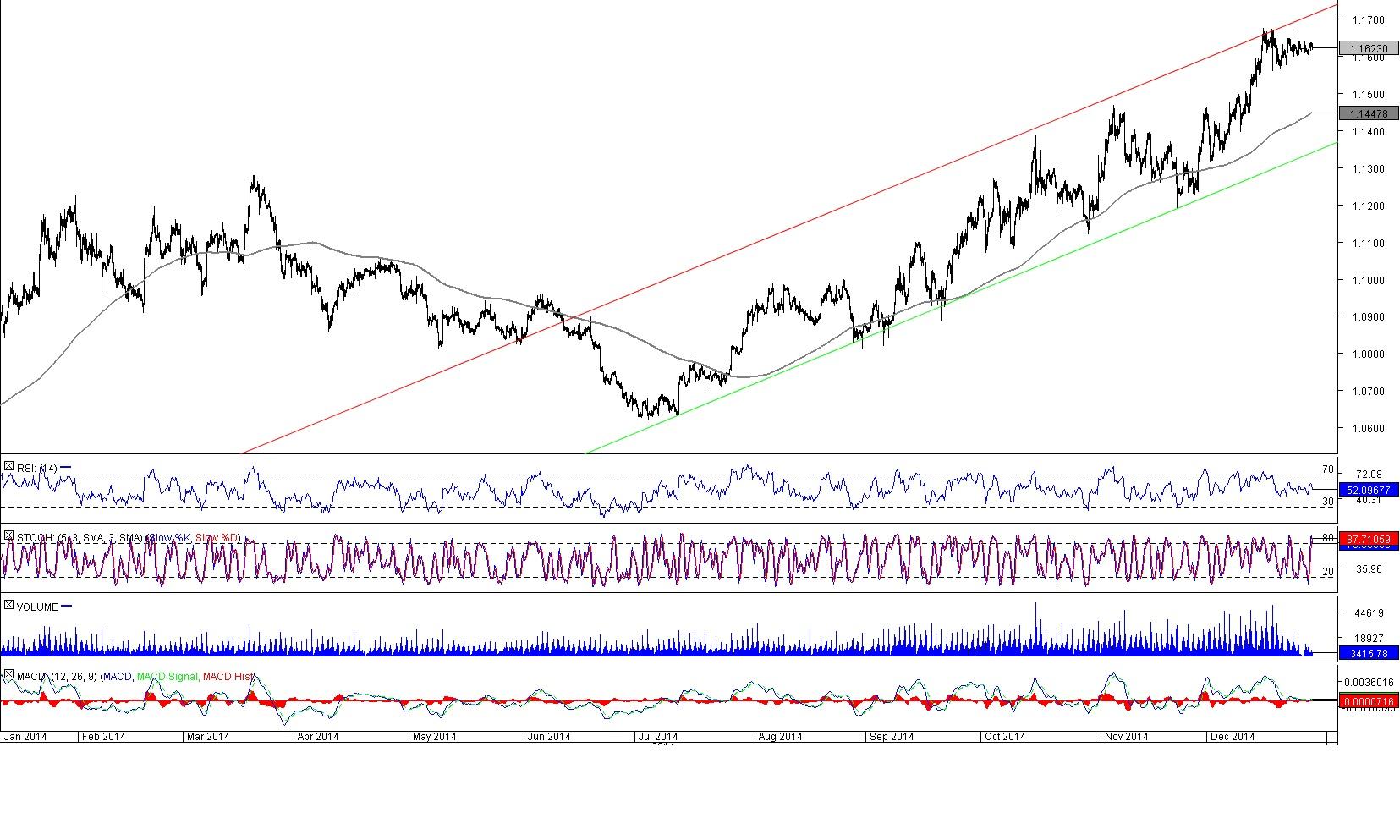

USD/CAD 4H Chart: Channel Up

Comment: After undergoing a bearish correction the fist half of this year USD/CAD managed to stabilise ahead of 1.06 and resume the up-trend that started back in September of 2012. As a result, during the next six months the currency pair formed a bullish channel. Accordingly, the long-term outlook for the US Dollar for now is considered to be positive.

On the other hand, in the short run the greenback is likely to lose some ground against the loonie. The rally is now facing a dense supply area at 1.1670, created by the 2009 Jul high and the up-trend, meaning there should be a decline to the lower edge of the channel before there is another up-move within the boundaries of the pattern.

NZD/CAD 4H Chart: Channel Up

Comment: Having found a strong support near 0.86, the kiwi was able to stop the sell-off (since March) and start outperforming the Canadian Dollar. And while the bullish momentum will probably remain the main force during the next few months, locally the New Zealand Dollar appears to be weak.

Even though the four-hour and daily technical indicators are largely giving ‘buy’ signals, the upside potential should be limited by the rising resistance line at 0.9080 reinforced by the monthly R1. While being capped here NZD/CAD is expected to breach the support at 0.8940 (Dec 23 low and 200-period SMA) and eventually fall down to the up-trend at 0.88.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.