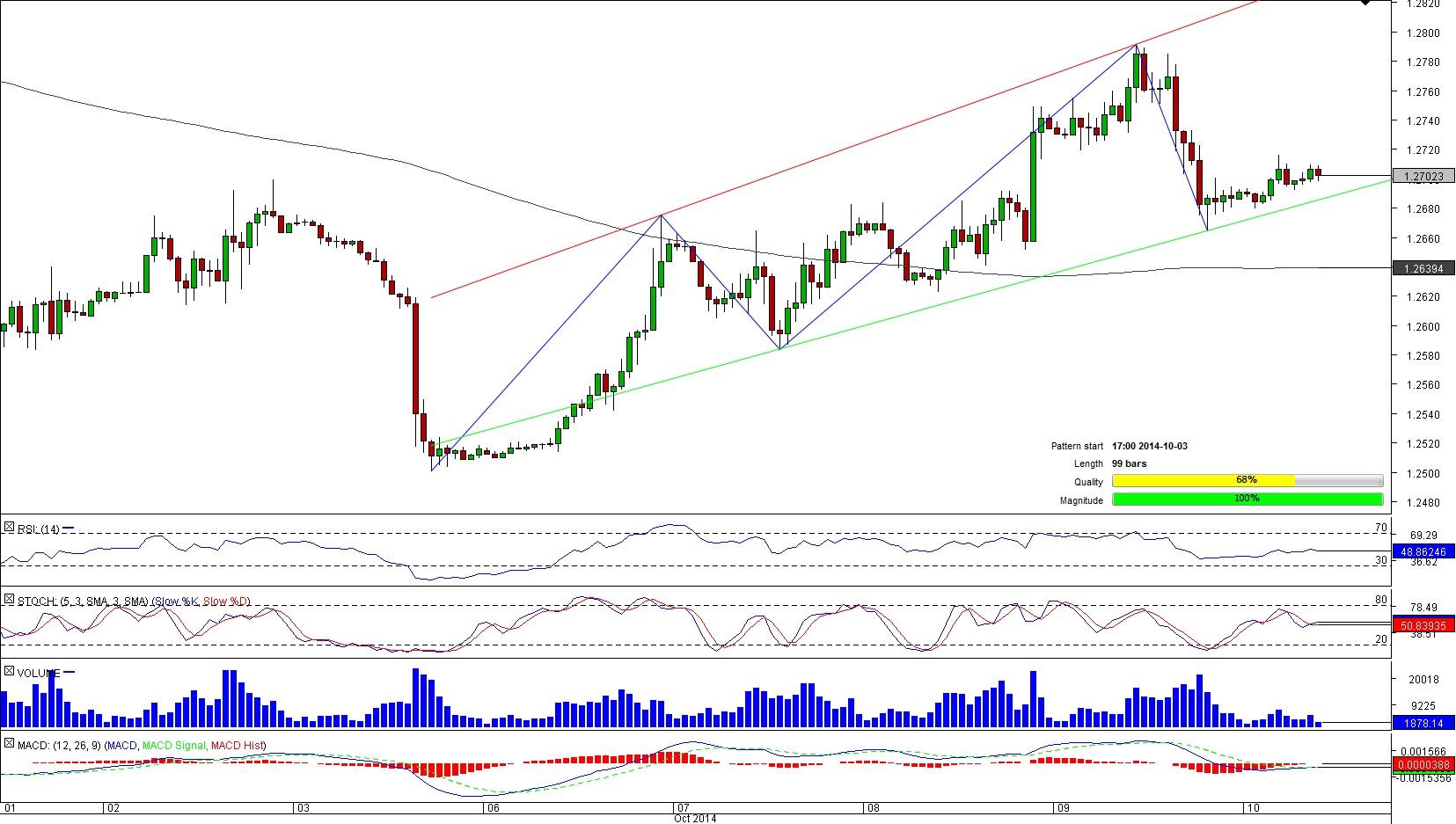

EUR/USD 1H Chart: Broadening Rising Wedge

Comment: After a sharp decline on the 3rd of October, EUR/USD found a support at the major level at 1.25. Since then the pair has formed a broadening rising wedge pattern.

At the moment, the currency pair is trading around the lower boundary of the pattern. If the lower trend-line will hold the pair’s bears back then a repeated test of the 1.28 level is possible. However, there are certainly down-side risks. The hourly and daily technical studies are pointing downwards, therefore increasing the bearish risks. At the same time the traders’ sentiment is more or less neutral with 53.29% of them expecting a rebound. For bullish traders the monthly PP and weekly R2 is the target.

AUD/NZD 1H Chart: Double Top

Comment: At the second part of September AUD/NZD reached the lowest trading level since July at 1.0920. However, at these levels the pair received a bullish impetus that pushed the pair towards the 1.13 level, forming a double top pattern.

Currently, the pair is hovering slightly above the pattern’s neckline at 1.1121. Since this is a bearish pattern in the base scenario, we should see a drop below the neckline towards the 1.10 level. However, the market participants disagree with this argument, as 69.42% of them are bullish on the pair. Very important gauge will be around the weekly S1 and daily S2. If these supports holds then we might see a bullish movements in the near-term.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.