USD/CHF 1H Chart: Channel Up

Comment: A two-month decline performed by USD/CHF ended late March when the pair entered a bullish channel, within which it is trading at the moment. The formation has average quality and magnitude and is about 195-bar long. According to the SWFX numbers, more than 57% of market participants bet on further appreciation of the pair that means the instrument is likely to prolong the pattern. Additional stimulus may come from disposition of the SMAs, with the short-term SMA being on the verge of jumping above the long one. Moreover, technical indicators are sending ‘buy’ signals for short and lone terms.

CAD/CHF 1H Chart: Channel Up

Comment: Like in the previous case, the Swiss Franc commenced depreciation against its peer, the Canadian Dollar, in the second part of March when a drop to a three-year low of 0.7808 underpinned CAD/CHF. Since then, the pair has been on the rise, being locked between two upward sloping lines for more than 235 hours.

Now the pair is vacillating not far away from the lower boundary of the corridor as heavy downside pressure prevailing after CAD/CHF hit a one-month high of 0.8090 late March is restricting the upswing. However, the pair has some potential for a climb as technical data points to a possible strength in sort and long terms.

EUR/JPY 1H Chart: Channel Up

Comment: A short, only 51-bar long, channel up pattern formed by EUR/JPY represents a part of a sharp rally started on March 28. The advance has already sent the pair from a three-week low of 139.97 to a one-month high of 143.47 in less than a week.

Now the pair is sitting near the lower limit of the pattern and if it manages to bounce off this level, it may re-approach the recent high. Traders neither support bullish scenario nor disagree with it-proportion of long to short positions on the SWFX is almost 1:1. Technical data sheds some light on the obscurity of the future pair’s moves, sending bullish signals for short and medium perspectives.

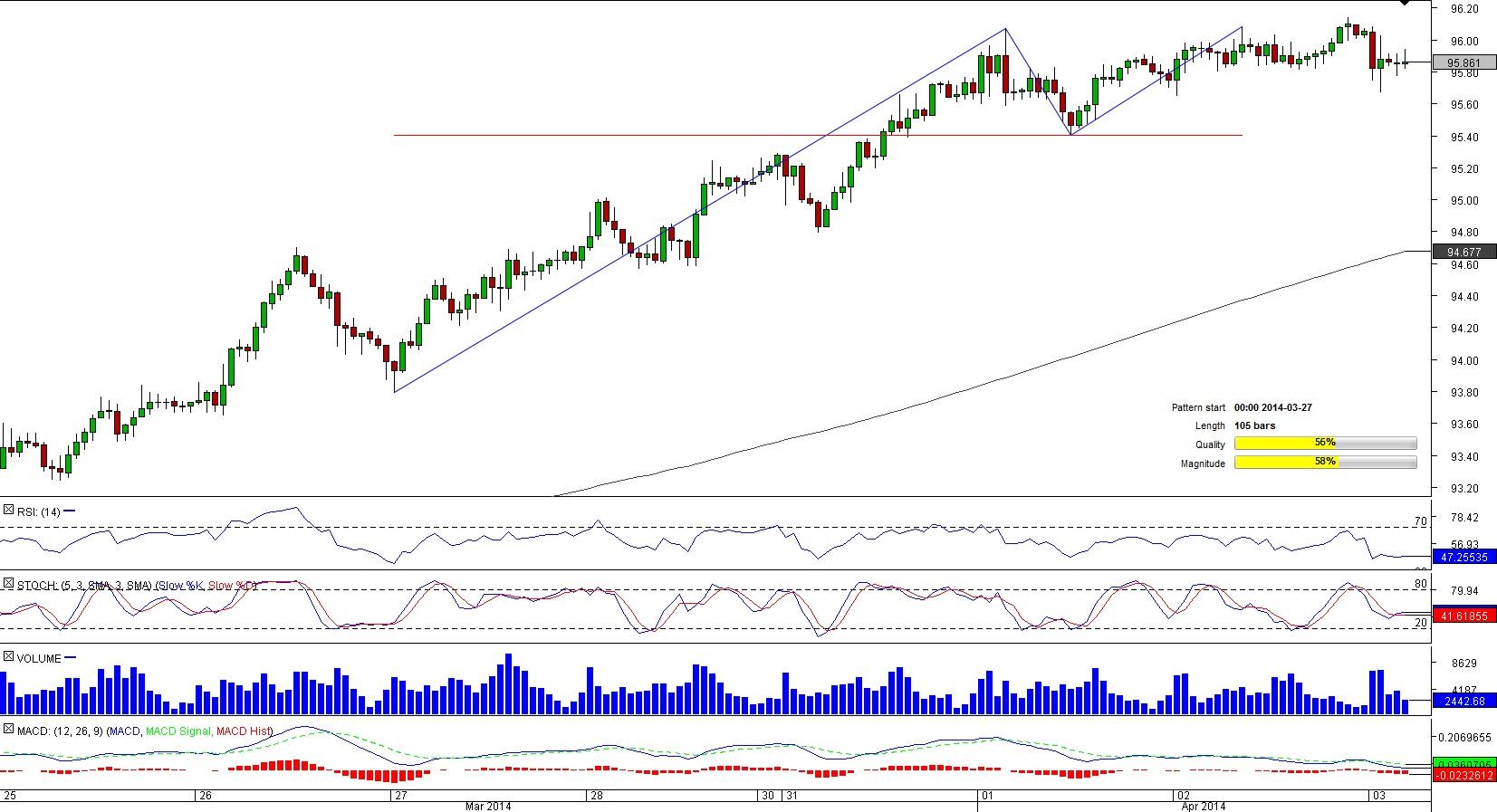

AUD/JPY 1H Chart: Double Top

Comment: Another double top pattern formed by the Australian Dollar cross is worth examining today. The trajectory of AUD/JPY is very similar to AUD/USD moves we described earlier-the Australian Dollar started to gain versus the Yen in mid-March and then peaked at a one-year high of 96.06 early April.

Now the pair is on the brink of falling beneath the 50-hour SMA at 95.84, below which there are only two levels-95.75/65 (daily S1; four-hour S1) and 95.46 (daily S2; four-hour S2) capable to stop the pair from nearing the neck-line at 95.40. If AUD/JPY breaches these support zones and the neck-line, the breakout followed by a massive sell-off is likely to happen.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.