Cable continued to slide against the US dollar last Friday, going from an open of 1.30592 to touch a low of 1.29140. Yesterday saw price recover a little after bouncing off the day’s low also at 1.29140 to close above 1.29500.

The downward pressure for this pair looks set to continue as the Federal Reserve chair made hawkish statements last week at the scheduled monetary policy meeting. However, the wording seemed to leave the possibility of a hike only by December, giving the Sterling some relief.

This week will also see a string of major economic data releases that may create increases in volatility if expectations are not met. This Thursday at 01:30pm we can expect Annualized GDP for the US. The forecast is for an increase of 1.2%, slightly higher than last month’s reading of 1.1%.

If the final number falls short of expectations there should be a rally in Sterling, as the market sees weakness in the US economy.

On Friday we will also see the release of Annualized and Quarterly GDP data for the UK. The markets are eager to see these results as so much has been said as to the effect of a Brexit on the British economy. The general consensus is for GDP for both Annualized and Quarterly to remain unchanged at 2.2% and 0.60% respectively.

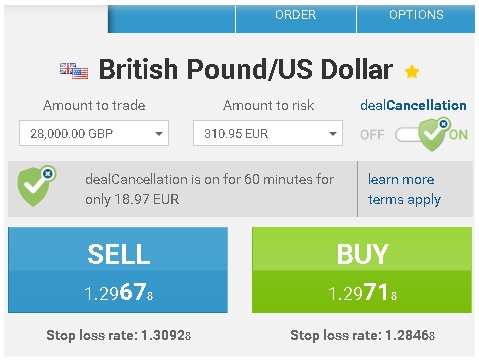

If you feel that the Pound may recover in price upon the release of these two pieces of data, then all you need to do is buy this pair with Deal Cancellation protection. This feature allows you to take a position and set a maximum stop loss, which if hit during the first hour, will only cost you the premium you paid to buy the Deal Cancellation protection.

Deal Cancellation gives you the option to close a trade, during 1 hour, losing no more than the premium you paid, while allowing you to gain from any positive price movement.

The screenshot below, with the trade screen, shows that to buy £28,000, would cost €20.31 to gain Deal Cancellation protection.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.