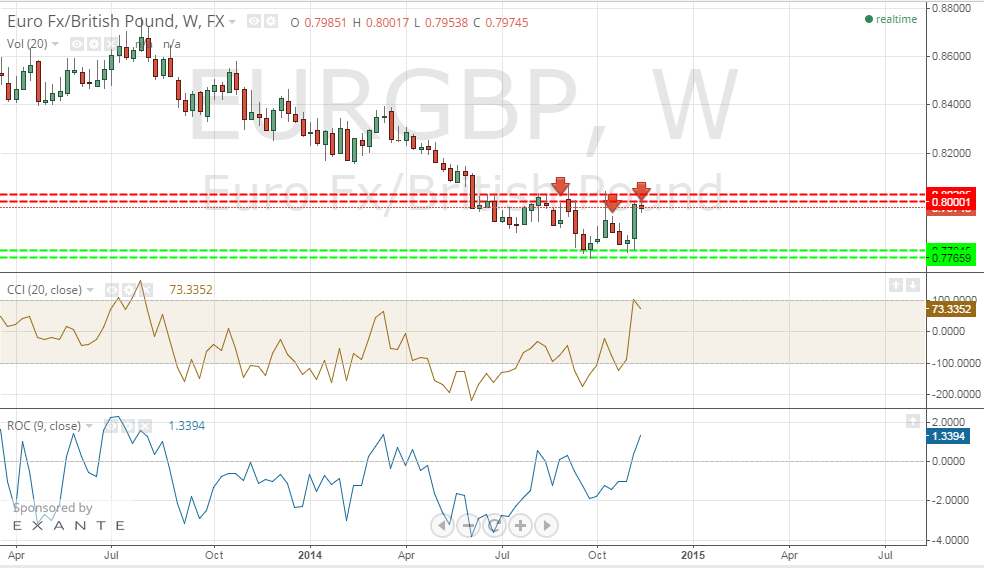

EUR/GBP Is Likely Headed Back Where It Currently Belongs

After last week’s bounce, the EUR/USD looks to be likely going back where it currently belongs; that is below the 0.79 mark and by the look of things, it could even drop further to trade below 0.78 by the end of the week.

The currency pair touched the 0.80 last week triggering a bullish outlook, but since the beginning of this week, the signs are pointing towards a pullback and a return to the more accustomed levels of below 0.79 in exchange rate.

Both the CCI and ROC remain particularly on the bullish side, but there are signs that this could change with the CCI having already turned and heading towards the zero mark.

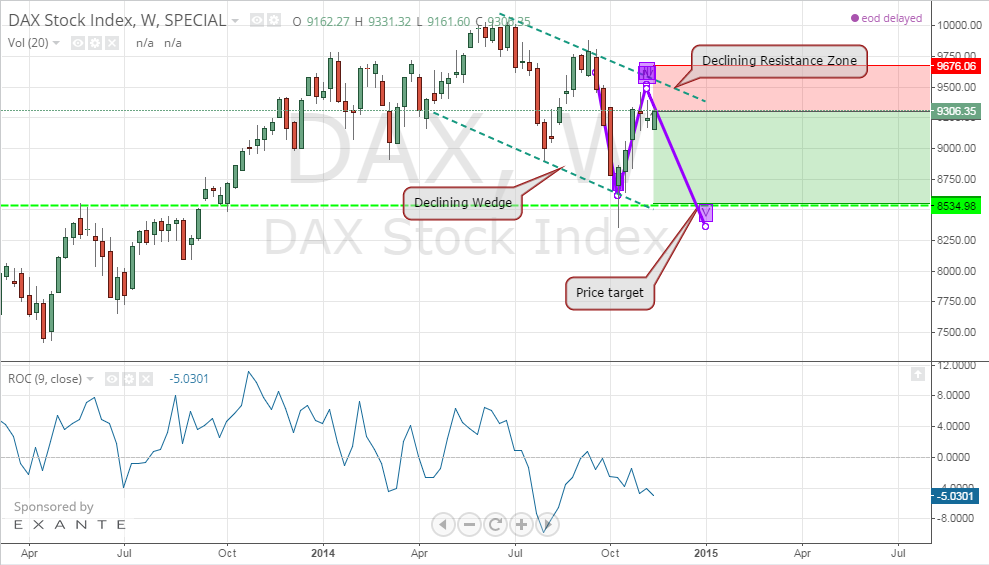

The German DAX 30 Is Looking Like A Short

The German DAX 30 Index seems to have run into a downward trending wedge, where it appears currently trapped. It has recently touched the downward trending resistance level and looks set to nosedive towards the downward trending support within the next few days.

The Rate of Change (ROC) is also on the negative territory, which confirms the recent upward trend. There are no signs that the downward trending wedge is ending soon, and this means that having touched the top side of that trend recently; the German DAX 30 could be an interesting short candidate.

DJ Copper Index On Verge Of A Bearish Breakout

The Dow Jones Copper Index (BIC) daily price has enjoyed a period of unusual prices over the last two weeks as it traded mostly outside of the current trend.

The DJ Copper Index has been trapped in a declining wedge in recent months, but over the last two weeks, it looked as if the BIC was going to break out of that declining wedge into the top side.

However, based on recent developments, a bearish breakout triangle appears to be close to completion with a majority of the shadows of the candles within the triangle already dropping inside the declining wedge.

The 9-day rate of change of the price of the metal has also signaled a possible downward movement, which further confirms the likelihood of a bearish breakout.

Nikkei 225 Index, Time For The Pullback?

The Nikkei 225 Index has been one of the highlights over the last few weeks after it registered a series of bullish candles that lifted it to new levels.

However, this week, things appear likely to change with a possibility of a pullback, albeit limited to the initial resistance level, which has now become the new support level.

The ROC also indicates that a downward movement is likely in the coming days, which makes the Nikkei 225 Index an interesting trade for this week.

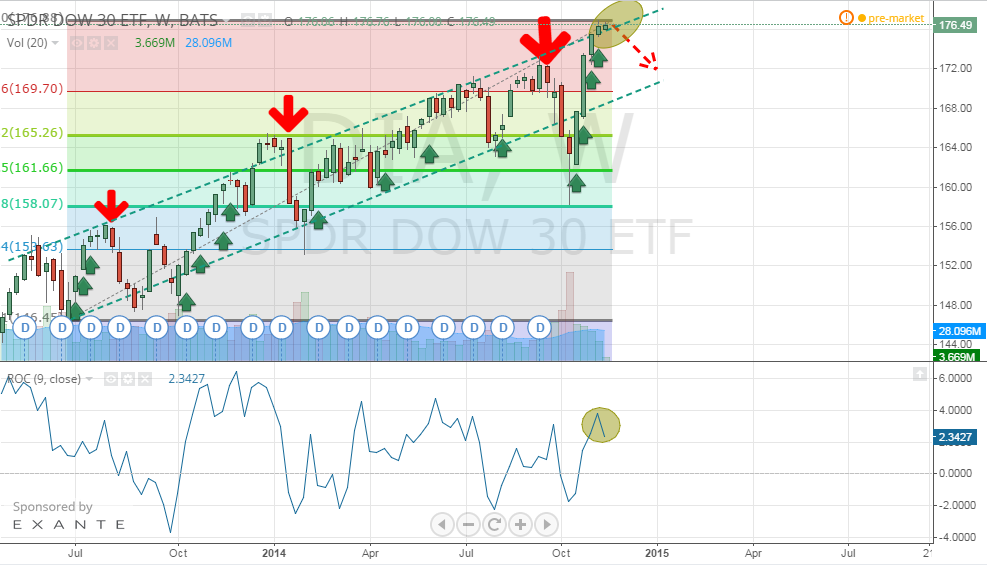

The SPDR Dow 30 ETF (DIA): Expect A Slight Pullback

In most cases, it took more candles for the SPDR Dow 30 ETF (DIA), to rise than it took it to fall. It is currently on its fifth consecutive candle, which represent five weeks on a bull run.

However, over the last two weeks, the bullish state appears to have started dwindling, as investors/traders finally appear to have come into a compromise position.

Now, looking at the upward trending wedge, the Dow 30 ETF looks to have just breached the upward trending resistance level signaling a potential pullback.

While some people might expect a major retreatment of the SPDR Dow 30, I think a majority of the recent rally is down to a bullish price correction.

Swing traders may not be seeing things that way though, as the price level currently represents a potential key reversal opportunity.

Conclusion

There may be factors that could affect my predictions including forthcoming economic data and other geopolitical factors related to instruments mentioned here. Therefore, depending on the nature of news released to the market, these predictions might change.

Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.