CHINA AFTER THE MINOTAUR

Posted on 27th November 2012In the book’s penultimate chapter, I discussed the Soaring Dragon which, as everyone tells us, is waiting in the wings, purportedly to take over from the Global Minotaur. In my concluding remarks, written back in January 2011, I wrote: “To buy time, the Chinese government is stimulating its growing economy and keeps it shielded from currency revaluations, in the hope that vibrant growth can continue. But they see the omens. And they are not good. On the one hand, China’sconsumption-to-GDP ratio is falling; a sure sign that the domestic market cannot generate enough demand for China’s gigantic factories. On the other hand, their fiscal injections are causing real estate bubbles. If these are unchecked, they may burst and thus cause a catastrophic domestic unwinding. But how do you deflate a bubble without choking off growth? That was the multi-trillion dollar question that Alan Greenspan failed to answer. It is not clear that the Chinese authorities can.”

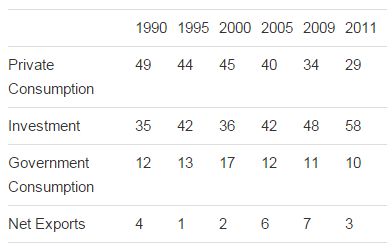

In the eighteen months that followed since those lines were written (in 2011), events have confirmed the projected pattern. The table below reveals that the falling rate of Chinese consumption is continuing unabated. In 2011 of every one dollar of income produced, only 29 cents entered China’s markets. With net exports making a small annual contribution to domestic demand (even though they contribute greatly to the country’s capacity to invest and, thus, boost productivity), the onus falls increasingly on investment to meet the demand shortfall. However, as suggested in the avove paragraph, this emphasis on investment is a double edged sword, as it threatens to let the Giny out of the bottle in real estate markets, where bubbles have been looming threateningly for a while now.

Indeed, in 2011 the Chinese authorities tightened up the administrative conditions for providing new housing loans, in the hope that such a move would leave productive investments unaffected while curtailing the funding of more white elephants and empty apartment blocks (which Chinese middle class professionals buy, having borrowed heavily, but leave empty in the hope of selling them more dearly later on – a standard bubble-in-the-making).

Unfortunately, while demand for housing fell, the tell-tale signs soon appeared that the government’s intervention was about to deflate not just the housing bubble but also industrial output. What tell-tale signs? The level of electicity output which, in early 2012, plataued. The last time that had happened, in 2008/9, the growth rate of industrial production declined sharply soon after, causing Beijing to stimulate the economy at a level that further suppressed the consumption ratio. To avoid this, the government is now relaxing its constraints on mortgage provision, accepting a renewed risk of a bubble in housing.

In summary, just as in Europe’s surplus countries, so too in China, the one fourth reduction in global aggregate demand occasioned by the Global Minotaur’s passing has impeded any meaningful recovery. Indeed, it has made the world we live in more precarious because the remedies attempted (stimulus in China, QE in the United States, and austerity in Europe) increase the probability that the Crisis will spawn nasty little appendages. For until and unless a global recycling mechanism rises from the Minotaur’s ashes to replace him, the world will remain an insecure, depressing place.

Recommended Content

Editors’ Picks

AUD/USD bounces off YTD lows near 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, attempting a tepid bounce from YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold: Buyers take a breather below $2,400 amid easing geopolitical tensions

Gold price is catching a breath below $2,400 in Asian trading on Tuesday, having risen over 1% in the US last session even on a solid US Retail Sales report, which powered the US Dollar through the roof. Easing Middle East geopolitical tensions and strong Chinese data could cap Gold's upside.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.