Hi investors! Here’s your 5-minute overview of the forex, crypto, and stock markets with hot stories that may have an impact on your investment strategy.

Forex Market Overview

Let’s start with the Forex Market. Last week was a bit of a disappointment for those holding onto an American Dollar that was weighed down by trade tensions and an increasingly negative outlook from the Fed. The Fed’s recent interest in cutting interest rates is now an ongoing cause for concern.

While the American Dollar floundered, the Canadian Dollar was able to perform above investor expectations. The New Zealand Dollar was also able to do surprisingly well, largely due to the fact that many of the larger currencies have been struggling.

In Europe, the Pound experienced yet another disappointing performance, hurt by further Brexit uncertainties and a series of disappointing financial reports. On the mainland, the Euro performed marginally better, though the continental currency still had its fair share of ups and downs.

The Yen is yet another currency that has been down and with few Japanese reports on the horizon, it will likely remain down this week as well. The biggest reports to watch this week include American CPI numbers and retail sales figures. If you’re new to forex trading, my book, Invest Divas Guide to Making Money in Forex is the best place to start.

Taking a Closer Look at USD/JPY

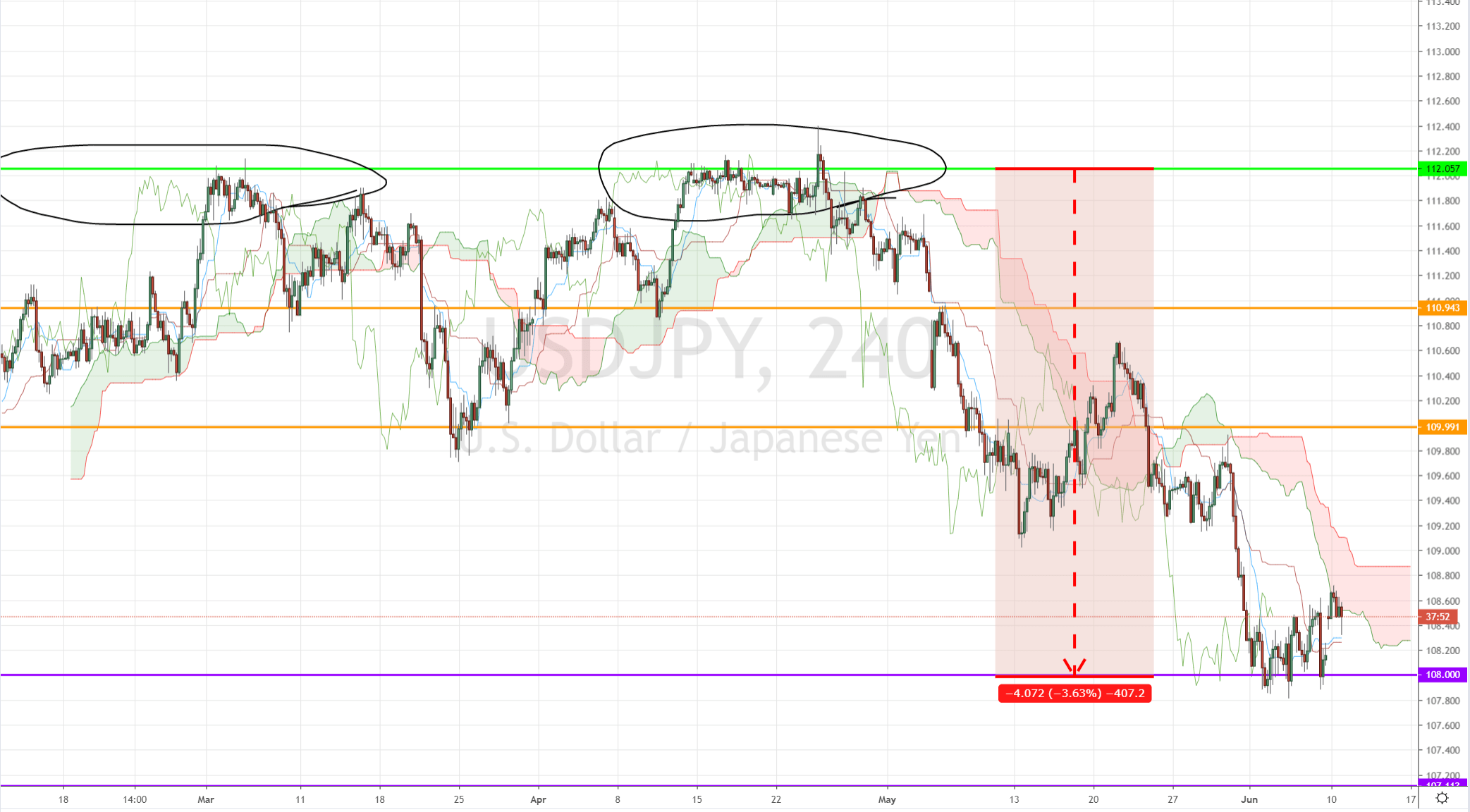

On the charts, the USD/JPY pair appears to have completed a double top chart pattern on and attempting to bottom out at 108. On the 4-hour time frame, it is testing the lower band of the Ichimoku Cloud with the Tenkan line crossing about the Kijun line.

USD/JPY 4-hour chart — Ichimoku Analysis

For my forex trading signals, visit your membership area on the PIG.

Crypto Market Overview

Next is the crypto market. Bitcoin began last week with a bit of a slide, dropping in value from a 2019 peak around $8,800 to a June floor around $7,500. However, things are starting to look up again for the world’s largest cryptocurrency, who opened this week with a $300 rebound.

Holders of Litecoin were greeted with good news to start this week as the coin broke the $125 mark and reached its highest price in over a year. Other alt-coins also opened this week with a rally, suggesting that the crypto industry as a whole may be experiencing a fundamental change in value.

HIGH RISK Investment Trading forex (also known as foreign exchange or currencies) on margin carries a HIGH LEVEL OF RISK, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, risk appetite, and the amount of your expendable income. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should ONLY invest money that you can afford to lose! You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Forex Diva Trading Opinions Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and education, and does not constitute advice. Forex Diva will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.